Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

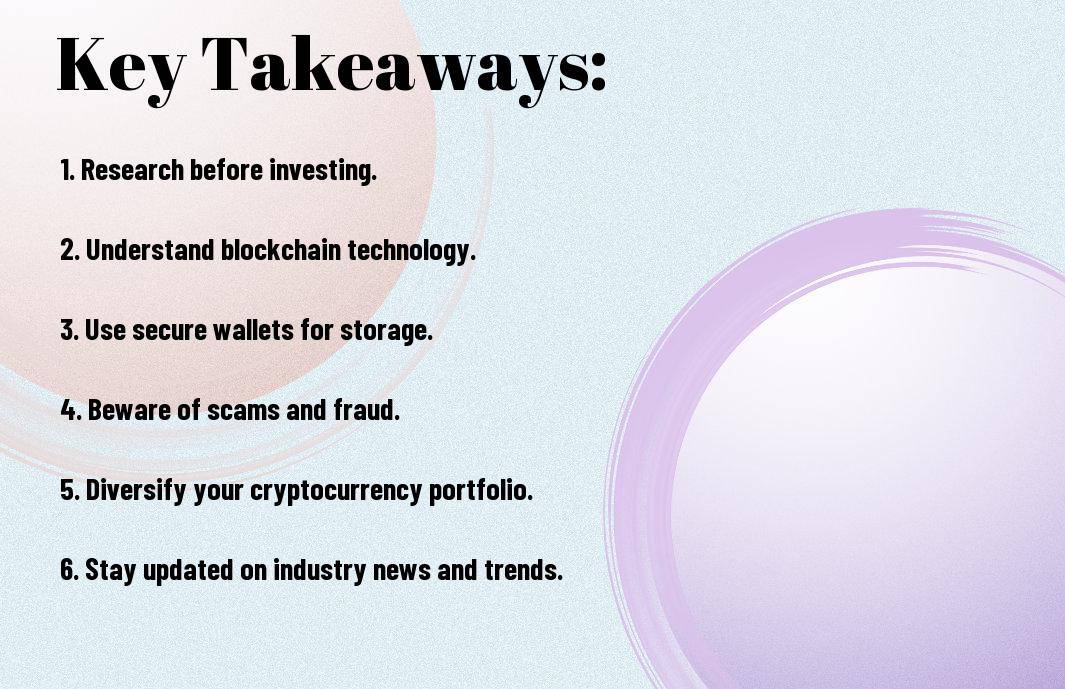

Navigating the Crypto World! A beginner’s guide. With the booming popularity of cryptocurrencies, it’s necessary for newcomers to understand the ins and outs of this intricate financial world. Navigating the World of Crypto – A Newcomer’s Handbook serves as a comprehensive guide to help you navigate through the complexities of digital currencies. From understanding the basics of blockchain technology to safeguarding your investments from potential scams, this handbook covers all the necessary information to empower you in cryptocurrencies.

While delving into the world of cryptocurrency, it’s important to grasp the fundamental concepts that underpin this digital financial revolution. From the intricacies of what cryptocurrency is to how it operates and the various types available, building a foundational understanding is crucial for newcomers looking to navigate this complex landscape with confidence.

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. This means that they are not controlled by any central authority, offering users greater autonomy and privacy in their financial transactions.

The technology behind cryptocurrencies works on a distributed ledger known as a blockchain. This transparent and secure system records all transactions across a network of computers, ensuring immutability and preventing fraud. Cryptocurrency transactions are verified by a process called mining, where powerful computers solve complex mathematical puzzles to add a new block to the chain.

Does the myriad of cryptocurrencies available can be overwhelming, it’s helpful to understand the main categories they fall into. Here are some of the most common types:

Assume that each type of cryptocurrency serves a unique purpose within the digital economy, catering to different needs and preferences. Understanding these distinctions can help investors make informed decisions when entering the market.

After deciding to venture into the world of cryptocurrency trading, the first step involves setting up the necessary tools to store and exchange digital assets efficiently. This chapter will investigate into the imperative components required for an individual to kickstart their crypto journey successfully.

Choosing a cryptocurrency wallet is the initial step towards securing your digital assets. It is crucial to select a wallet that offers robust security features to safeguard your holdings from potential cyber threats. There are various types of wallets available, including hardware wallets, software wallets, and online wallets. Hardware wallets are considered one of the safest options as they store your cryptocurrencies offline, minimizing the risk of hacking.

To begin trading cryptocurrencies, selecting a reliable cryptocurrency exchange is imperative. Ensure the exchange is user-friendly, has a good reputation in the market, and offers a wide range of cryptocurrencies for trading. It is imperative to conduct thorough research on different exchanges, compare their fees and security measures, before making a decision.

For instance, some popular cryptocurrency exchanges include Coinbase, Binance, and Kraken, known for their user-friendly interfaces and robust security protocols. It is advisable to choose an exchange that aligns with your trading needs and provides adequate liquidity for the cryptocurrencies you intend to trade.

Cryptocurrency exchange rates are influenced by various factors such as market demand, supply, regulatory news, and investor sentiment. It is imperative for traders to keep track of these factors to make informed trading decisions. Market fluctuations in cryptocurrency prices can be substantial, leading to both opportunities and risks for traders. Understanding these fluctuations and having a strategy in place is crucial for a successful trading experience.

Another crucial point to consider is the impact of external events such as global economic developments and regulatory changes on cryptocurrency prices. Traders must stay informed about these factors to anticipate market movements and adjust their trading strategies accordingly. Staying informed and being prepared for market fluctuations is key to navigating the volatile world of cryptocurrency trading.

To The Ultimate Guide to Cryptocurrency – Barnes & Noble, investing in cryptocurrencies can be both thrilling and intimidating for newcomers. Understanding the fundamentals of investing in the crypto world is crucial to make informed decisions and mitigate risks. One important aspect of successful crypto investment is conducting thorough Fundamental Analysis of Cryptocurrencies.

Crypto investors need to examine deep into the core aspects of a blockchain project before investing. This includes evaluating the team behind the project, technological innovation, real-world use cases, market demand, and overall potential for growth. By conducting diligent research and analysis, investors can make more informed decisions and identify valuable long-term investment opportunities in the ever-evolving crypto market.

Pertaining to trading cryptocurrencies, Technical Analysis plays a vital role in predicting price movements and optimizing trading decisions. By studying historical price charts, volume trends, and market indicators, traders can identify patterns and trends to make strategic buy or sell decisions. Utilizing technical analysis tools and indicators such as moving averages, RSI, and Fibonacci retracement can give traders a competitive edge in the volatile crypto market.

The Analysis in Technical Analysis for Trading Decisions involves interpreting price charts, analyzing market trends, and utilizing various indicators to forecast potential price movements. Traders who master technical analysis can develop effective trading strategies and enhance their overall profitability in the dynamic world of cryptocurrencies.

Diversification Strategies are important for managing risk and maximizing returns in crypto investment portfolios. By spreading investments across different cryptocurrencies, sectors, and asset classes, investors can reduce the impact of market volatility on their overall portfolio. Diversification also allows investors to capitalize on multiple opportunities and hedge against potential losses in specific assets.

Analysis in Diversification Strategies in Crypto Investment involves assessing risk tolerance, investment goals, and market conditions to construct a well-balanced portfolio. Effective diversification can help investors achieve more stable returns and navigate the unpredictable nature of the crypto market with greater confidence.

Despite the immense potential and opportunities presented by the world of cryptocurrency, it is crucial to prioritize security to safeguard your digital assets and personal information. As a newcomer navigating this complex landscape, understanding and implementing best practices for digital security, recognizing and avoiding scams, and maintaining privacy measures are crucial.

Security should be your top priority when engaging in the world of cryptocurrency. Utilize strong, unique passwords for each of your accounts and enable two-factor authentication whenever possible. Be wary of phishing attempts or suspicious links that may compromise your security.

Recognizing and avoiding scams is paramount in the crypto space. Scammers often use sophisticated tactics to deceive newcomers, such as fake ICOs, Ponzi schemes, and fake exchange websites. If an investment opportunity seems too good to be true, it likely is.

It is important to conduct thorough research and verify the legitimacy of any project or platform before investing. Additionally, never share your private keys or sensitive information with anyone, as this could lead to theft of your digital assets.

Practices that enhance your privacy and anonymity in the crypto world can help protect your identity and transactions. Consider using privacy-focused cryptocurrencies like Monero or Zcash for increased confidentiality. Furthermore, utilizing secure wallets and encrypted communication tools can add layers of protection to your interactions.

Another important aspect of privacy is to minimize the personal information you share online and avoid linking your cryptocurrency addresses to your real identity. By exercising caution and implementing privacy measures, you can mitigate risks associated with potential data breaches or hacks.

Keep in mind that the legal and regulatory landscape surrounding cryptocurrencies can vary significantly from one country to another. It is crucial for anyone entering the world of crypto to understand and adhere to the laws and regulations in their jurisdiction to avoid potential legal issues.

On a global scale, some countries have embraced cryptocurrencies and have established clear regulations to govern their use, while others have taken a more cautious approach or even banned them outright. It is crucial for newcomers to research and understand the regulatory environment in their region to ensure compliance with the law.

Cryptocurrency trading can have significant tax implications, and it is important for traders to be aware of their tax obligations. In many countries, cryptocurrencies are treated as property for tax purposes, which means that capital gains tax may apply to any profits realized from trading. It is advisable for traders to keep detailed records of their transactions and consult with a tax professional to ensure compliance with tax laws.

Cryptocurrency trading can be subject to capital gains tax, which should be carefully considered by traders to avoid any potential legal issues.

Understanding the compliance and reporting requirements related to cryptocurrency transactions is crucial for traders to avoid falling afoul of regulatory authorities. Some jurisdictions require individuals and businesses involved in cryptocurrency trading to register with regulatory bodies, report transactions above a certain threshold, and adhere to anti-money laundering (AML) and know your customer (KYC) regulations.

Trading cryptocurrencies comes with a set of compliance and reporting requirements that traders must follow to ensure they are operating within the legal boundaries.

Many newcomers to the world of cryptocurrency may find themselves overwhelmed by the vast array of tools and services available. To navigate this landscape effectively, it is imperative to educate oneself on the various options and how they can enhance your crypto journey. For a comprehensive guide to smart investing in the crypto space, I recommend checking out Navigating the Crypto Landscape: A Guide to Smart Investing by Evan Carmichael.

| Using Crypto Bots and Automated Trading | Decentralized Finance (DeFi) Ecosystem |

| Crypto bots and automated trading tools can help streamline your trading strategies and execute trades on your behalf. These tools utilize algorithms to analyze market trends and make informed decisions based on predefined parameters. | Decentralized Finance (DeFi) is revolutionizing the traditional financial system by offering decentralized alternatives to banking, lending, and borrowing. Participants can engage in various financial activities without the need for intermediaries, allowing for greater financial freedom and control. |

Many traders in the crypto space leverage the power of crypto bots and automated trading platforms to execute trades efficiently and effectively. By setting up specific criteria and parameters, these tools can help traders capitalize on market opportunities 24/7 without the need for constant monitoring. However, it is crucial to exercise caution and thoroughly understand how these tools operate to mitigate the risks associated with automated trading.

Decentralized Finance (DeFi) encompasses a broad ecosystem of decentralized applications (dApps) and protocols built on blockchain technology. These platforms offer a wide range of financial services, including decentralized exchanges, lending protocols, and yield farming opportunities. Participants can access these services directly from their wallets, interact with smart contracts, and earn rewards through various DeFi protocols.

Leveraging the DeFi ecosystem allows individuals to access innovative financial services without relying on traditional financial institutions. However, it is imperative to conduct thorough research and understand the risks involved in utilizing these platforms, such as smart contract vulnerabilities and market volatility.

Crypto enthusiasts have witnessed the rise of Non-Fungible Tokens (NFTs) as unique digital assets that represent ownership of digital art, collectibles, and virtual real estate. These tokens are indivisible and verifiable on the blockchain, creating scarcity and provenance for digital content. NFTs have garnered significant attention for their potential to revolutionize ownership and distribution of digital assets.

Exploring NFTs opens up new avenues for creators and collectors to participate in the burgeoning digital economy. The unique characteristics of NFTs allow for authentication and ownership of digital assets, opening up opportunities for creators to monetize their work and collectors to own exclusive digital collectibles.

Plus: It is crucial to stay informed and exercise caution when navigating the world of advanced crypto tools and services. While these tools offer convenience and access to innovative financial opportunities, they also come with inherent risks such as hacking, fraud, and market volatility. Always conduct thorough research, seek advice from experienced traders, and stay vigilant to protect your investments.

All newcomers to the world of cryptocurrency must stay informed about the ever-evolving landscape to make informed decisions. With the rapid pace of innovation and market changes, staying up-to-date is crucial.

An necessary resource for understanding these developments is The Crypto Handbook: The ultimate guide to…. This comprehensive guide provides valuable insights and perspectives on emerging trends, technological advancements, and potential future scenarios in the crypto space.

Market dynamics in cryptocurrency are highly volatile, influenced by factors such as regulation changes, technological advancements, and investor sentiment. Staying adaptable and proactive in response to these shifts is crucial for long-term success in the crypto market.

Upon reflecting on the crucial concepts and guidelines outlined in “Navigating the World of Crypto – A Newcomer’s Handbook,” it becomes evident that gaining a solid understanding of the cryptocurrency landscape is crucial for anyone looking to enter this dynamic market. From understanding the basics of blockchain technology to grasping the importance of security protocols, this handbook serves as a comprehensive guide for newcomers seeking to navigate the world of crypto with confidence.

Conclusively, armed with the knowledge and insights provided in this handbook, newcomers can feel empowered to make informed decisions and avoid common pitfalls in the cryptocurrency space. By following the advice and recommendations laid out in this guide, new entrants can initiate on their crypto journey equipped with the tools and strategies necessary to succeed in this rapidly evolving environment.

A: Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of a central authority, such as a government or bank.

A: You can buy cryptocurrency through online exchanges using traditional currency or by accepting it as payment for goods and services. You will need to set up a digital wallet to store your cryptocurrency.

A: A blockchain is a decentralized and distributed digital ledger that records transactions across multiple computers in a secure and transparent way. It is the technology that underlies cryptocurrency.

A: Investing in cryptocurrency carries risks like any other investment. It is important to research and understand the market before investing. Use reputable exchanges and secure your digital wallet to minimize risks.

A: Bitcoin is the most well-known and widely used cryptocurrency. It was the first cryptocurrency created and remains the most valuable in terms of market capitalization.

A: You can store your cryptocurrency in a digital wallet, which can be hardware-based (like a USB drive) or software-based (an app). Make sure to use secure passwords and backup your wallet to protect your assets.

A: Tax laws regarding cryptocurrency vary by country. In many places, cryptocurrency transactions are subject to capital gains taxes. It is important to consult with a tax professional to understand your obligations.