Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

Investing in the stock market can be both exciting and daunting, especially for beginners. One way to navigate this world with more confidence and success is by incorporating Atomic Habits into your investment strategy. By focusing on small, consistent actions, you can gradually build strong investment habits that will pave the way for long-term financial growth and stability.

Little do many realize, but investing is not just about putting your money into the stock market and hoping for the best. It requires a deep understanding of the principles, types of investments available, and the risks involved. As an investor, you must educate yourself on the basics before diving in headfirst.

If you’re new to investing, there are a few key principles that you should familiarize yourself with. Diversification, asset allocation, and risk management are crucial concepts that can help you make informed decisions and build a resilient investment portfolio. By spreading your investments across different asset classes and industries, you can reduce the impact of market volatility and minimize potential losses.

Every investor should have a basic understanding of common investment types and how they work. Some investment types include stocks, bonds, real estate, mutual funds, and exchange-traded funds (ETFs). Each investment type carries its own set of risks and potential returns, so it’s important to do your research and understand the basics before investing. Assume that you have a clear understanding of the different investment options available before making any decisions.

| Investment Type | Explanation |

| Stocks | Ownership in a company, with potential for capital appreciation and dividends |

| Bonds | Debt securities issued by governments or corporations, offering fixed interest payments |

| Real Estate | Investing in physical properties for rental income or capital appreciation |

| Mutual Funds | Pools of money from multiple investors invested in a diversified portfolio of securities |

| Exchange-Traded Funds (ETFs) | Traded on stock exchanges, offering diversification similar to mutual funds |

After reading the Atomic Habits by James Clear – Book Summary, you can apply the principles of atomic habits to your investing journey. By focusing on small, consistent changes over time, you can build a solid foundation for a successful investment strategy.

There’s a reason why atomic habits are so powerful – they are small changes that compound over time to yield significant results. Concerning investing, these small habits can make a big difference in reaching your financial goals. By setting specific, achievable goals, breaking them down into manageable steps, and creating a routine around your investing activities, you can make consistent progress towards building wealth.

To craft an investment habits plan that works for you, start by identifying your financial objectives and risk tolerance. Develop a personalized investment strategy that aligns with your goals and values. It’s important to consider your time horizon, financial resources, and level of comfort with market fluctuations when creating your plan. By establishing a routine for monitoring your investments, making adjustments as needed, and staying disciplined during market volatility, you can build strong investment habits that will serve you well in the long run.

Works like a charm! By consistently sticking to your investment habits plan, you can increase your chances of achieving financial success. Be mindful of, it’s the small, consistent actions that you take today that will lead to significant results tomorrow.

Now is the perfect time to kickstart your journey towards building consistent investment habits. Investing is not just about picking the right stocks or funds; it’s also about developing smart routines and behaviors that will help you achieve your financial goals over time. In this chapter, we will explore how you can establish a strong foundation for your investment journey.

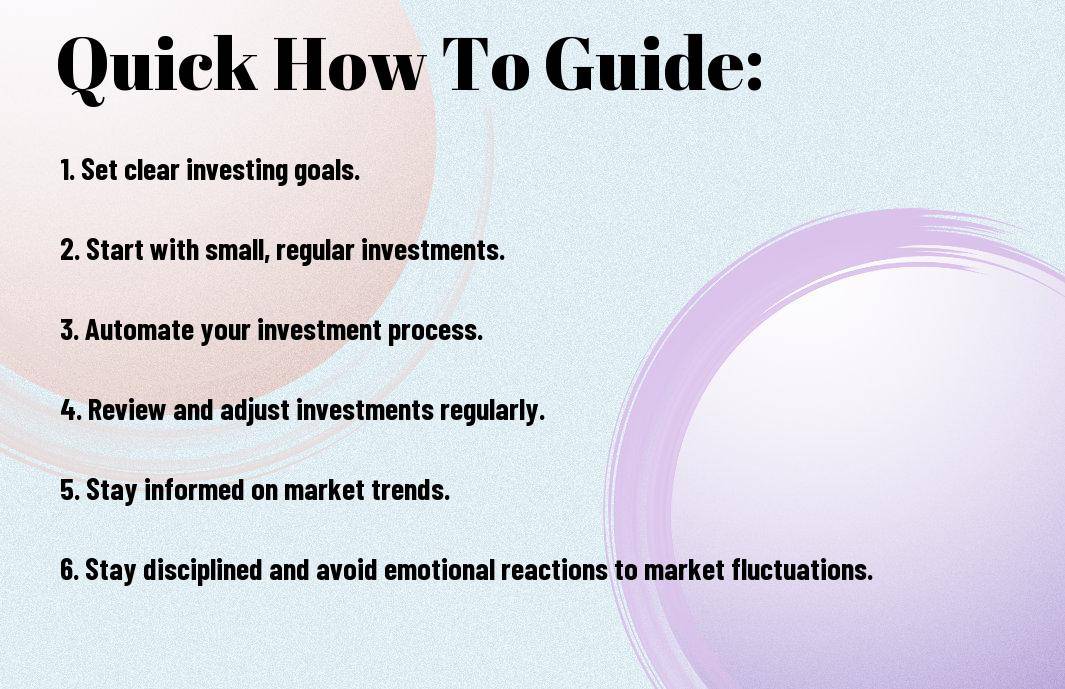

One of the first steps in building consistent investment habits is setting clear and achievable investment goals. Start by identifying what you want to achieve with your investments, whether it’s saving for retirement, buying a home, or building wealth over the long term. Make sure your goals are specific, measurable, and time-bound to keep you motivated and on track. Keep in mind, your investment goals will serve as the roadmap for your financial future, so take the time to define them carefully.

Some investors make the mistake of jumping into investing without fully understanding their current financial situation. It’s important to establish your investment baseline by taking stock of your income, expenses, assets, and debts. This will give you a clear picture of where you stand financially and help you make informed decisions about how much you can afford to invest. By knowing your baseline, you can set realistic investment goals and create a personalized investment plan that aligns with your current financial situation.

Your investment baseline will help you gauge your progress over time and make adjustments as needed to stay on track towards achieving your financial goals. Regularly revisiting your baseline can also help you identify areas for improvement and uncover opportunities to grow your investment portfolio. So, take the time to establish your investment baseline and use it as a springboard for your investing journey.

Despite the complexities of the financial markets, savvy investors have mastered the art of wealth-building through consistent habits. In my blog post, Atomic Habits for Wealth Building: Turbocharge Your Journey with These Money-Savvy Moves, I explore into the core habits that successful investors practice to achieve their financial goals.

Habits play a crucial role in the way savvy investors approach researching and analyzing investment opportunities. They make it a routine to stay informed about market trends, company performances, and economic indicators. By dedicating time each day to review financial news and company reports, they are able to make well-informed decisions when it comes to investing their money.

Any seasoned investor will tell you that one of the key habits to master is diversification. Diversifying your investment portfolio across different asset classes, industries, and geographical regions is a strategy that helps mitigate risks and maximize returns over the long term.

With diversification, you are not putting all your eggs in one basket. By spreading your investments across various assets, you reduce the impact of any single investment underperforming. This approach is imperative for building a resilient and successful investment portfolio.

Keep consistency at the forefront of your mind when it comes to your investment habits. Consistency is key in achieving your financial goals. To help you stay on track, here are some valuable tips to keep in mind:

The key to building lasting investment habits is to make consistency a priority in your financial routine.

Assuming you have set up your investment plan, it can be challenging to stick to it consistently. To help you stay on track, consider implementing techniques such as setting reminders, creating a visual tracking system, or using a rewards system for reaching milestones. Find strategies that work best for you to ensure that you maintain your investment habits over the long term.

Plan for market fluctuations by diversifying your portfolio and focusing on long-term goals rather than short-term market movements. Remember that market fluctuations are a normal part of investing, and it’s necessary to stay calm and avoid making impulsive decisions based on temporary market conditions.

Plus, consider talking to a financial advisor for guidance on how to navigate market volatility while staying true to your investment plan. With a solid support system in place, you can weather market fluctuations without derailing your investment habits.

For individuals looking to build consistent investment habits, it is crucial to understand the various factors that can influence your approach to investing. By recognizing these influences, you can make informed decisions that align with your investment goals and values.

Investment habits are closely tied to how you manage your personal finances. Effective personal finance management can provide you with a solid foundation for successful investing. By creating a budget, tracking your expenses, and saving regularly, you can better allocate funds towards your investment goals. Having a clear understanding of your financial situation will also help you make informed decisions about where to invest your money for the best returns. Thou it is important to regularly review and adjust your financial plan to ensure it remains aligned with your long-term objectives.

There’s a psychological component to investing that can greatly impact your habits and decisions. Understanding how emotions such as fear, greed, and overconfidence can influence your investment choices is crucial for building healthy habits. By recognizing these behavioral aspects, you can develop strategies to overcome impulsive decisions and stick to your long-term investment plan. Note, staying disciplined and keeping emotions in check are key components of successful investing.

Once again, let’s investigate into the world of investing and how you can scale your investments with the power of atomic habits. Building consistent investment habits is necessary for long-term success in the financial markets.

Your investment journey might reach a point where you start considering scaling up your investments. It’s crucial to evaluate your financial goals, risk tolerance, and current market conditions before deciding to scale up. Consider diversifying your portfolio and gradually increasing your investment amounts to minimize risks associated with scaling your investments.

One way to ensure consistent growth in your investments is to regularly monitor and tweak your investment strategy. Regularly review your portfolio performance, assess market trends, and make adjustments as needed to capitalize on new opportunities and mitigate risks. Monitoring and tweaking your investment strategy can help you stay aligned with your financial goals and adapt to changing market conditions.

Strategy: Be proactive in tracking your investments and seek guidance from financial advisors or investment professionals to make informed decisions that support your long-term financial growth.

Not everyone finds it easy to stay consistent with their investment habits, but with the help of technology and tools, you can make it a lot simpler. These resources can not only streamline your investment process but also keep you accountable and on track towards your financial goals.

The key to successful investing is forming a routine and sticking to it, and apps and platforms can play a crucial role in helping you achieve that. Robo-advisors like Betterment and Wealthfront can automate your investments, make suggestions based on your risk tolerance, and rebalance your portfolio as needed. These platforms can also provide regular updates and insights into your investment performance, keeping you informed and engaged.

Investment automation is an excellent way to ensure that you stay consistent with your saving and investing habits. By setting up automatic transfers from your checking account to your investment accounts, you can remove the temptation to spend that money elsewhere. Automating your investments can help you avoid emotional decisions and market fluctuations, as well as ensure that you prioritize saving and investing in the long run.

Drawing together the key principles from Atomic Habits and applying them to investing can help build consistent and successful investment habits. By focusing on the small changes that can lead to significant results over time, investors can create a framework that leads to long-term financial success. By implementing strategies such as setting clear goals, staying consistent with routines, and continually improving one’s investment approach, individuals can build habits that will ultimately lead to financial stability and growth.

A: Building consistent investment habits helps to achieve long-term financial goals, minimizes emotional decision-making, and creates discipline in managing investments.

A: Atomic Habits principles, such as making small changes, setting specific goals, and tracking progress, can be applied to investing by establishing a routine, setting investment targets, and reviewing performance regularly.

A: Consistent investment habits include setting aside a fixed amount of money for investing each month, diversifying investments, reviewing portfolio performance quarterly, and continuously educating oneself about financial markets.

A: You can make investing a daily habit by setting a specific time each day to check on your investments, reading financial news, or learning about new investment opportunities. Consistency is key in forming a habit.

A: Discipline is crucial in building consistent investment habits as it helps in sticking to your investment strategy, avoiding impulsive decisions, and staying focused on long-term goals despite short-term market fluctuations.

A: You can stay motivated by setting clear and achievable investment goals, celebrating small wins along the way, seeking support from like-minded individuals or financial advisors, and reminding yourself of the financial freedom and security that comes with consistent investing.

A: The benefits of building consistent investment habits include wealth accumulation over time, reduced stress about financial security, increased confidence in managing investments, and the potential for achieving financial independence in the future.