Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

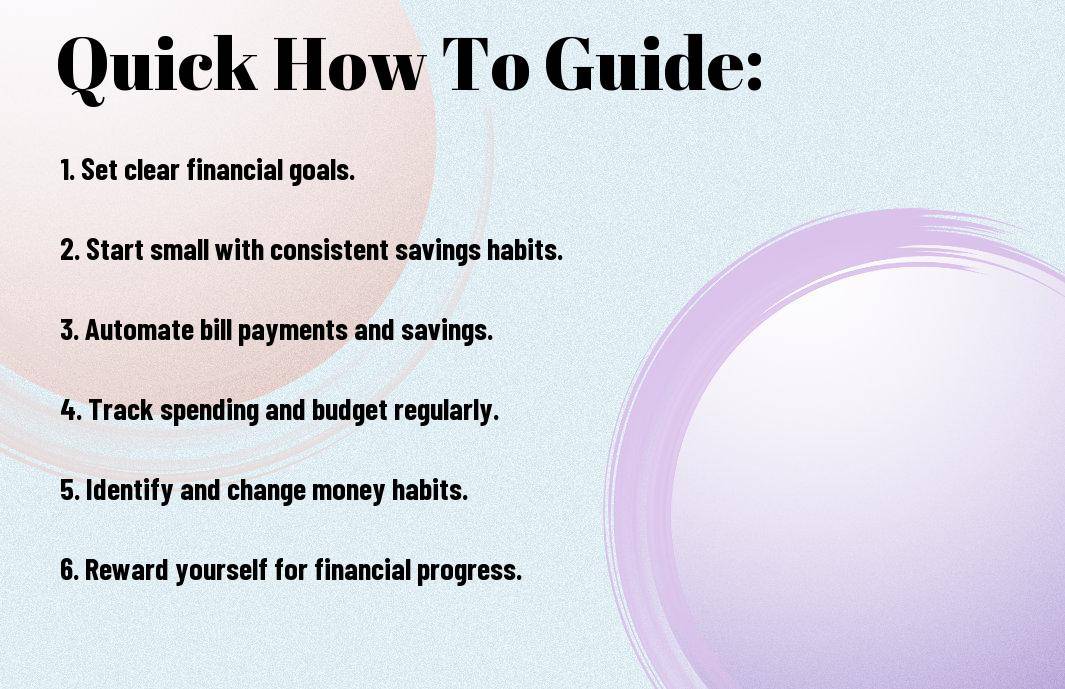

Personal finance management! Most of us want to improve our financial situation, but often struggle to maintain good money habits. By incorporating the principles of Atomic Habits into our approach to personal finance, we can create lasting changes that lead to financial success. Small changes in our daily habits can have a significant impact on our long-term financial well-being.

Imagine this: You’re standing in line at your favorite coffee shop, eagerly awaiting your morning caffeine fix. As you reach for your wallet, a sudden realization hits you like a bolt of lightning – your daily coffee habit might be costing you more than you think. This moment of self-awareness was a turning point for me in my own personal finance journey. It made me reassess my spending habits and take a closer look at the seemingly insignificant expenses that were adding up over time. That’s when I discovered the power of small changes, or what James Clear calls ‘Atomic Habits,’ in transforming my financial landscape. By swapping my daily latte for homemade coffee, I not only saved money but also gained a newfound sense of control over my finances. It’s these small victories, born from conscious choices and incremental changes, that pave the way for lasting financial success. So, next time you’re tempted to splurge on a luxury item or indulge in an unnecessary expense, pause and consider the long-term impact. Sometimes, the smallest adjustments can lead to the biggest rewards.

Even the most disciplined individuals can struggle with personal finance management. Developing atomic habits can transform your financial situation and set you on the path to success.

Assuming control over your financial habits requires a deep understanding of your psychological triggers. These triggers are the subconscious cues that lead to certain financial behaviors. By identifying and acknowledging these triggers, you can start to make intentional choices that align with your financial goals.

Foundation is crucial when it comes to establishing successful financial habits. By setting clear and specific financial goals, you give yourself a roadmap to follow and a target to aim for. Whether your goal is to save for a comfortable retirement, purchase a new home, or simply to build an emergency fund, having a clear objective in mind provides motivation and direction.

Plus, setting clear financial goals allows you to track your progress and celebrate your successes along the way. This positive reinforcement can help keep you motivated and on track, even when faced with challenges or setbacks.

Now, let’s examine how you can develop atomic habits for spending wisely.

Clearly identifying where your money goes is the first step in managing your spending habits. Take some time to review your expenses and highlight areas where you are overspending. Look for patterns and habits that contribute to unnecessary expenses. Once you have identified these needless spending habits, start eliminating them one by one.

The key is to be mindful of your spending habits and make intentional choices about where your money goes. The sooner you can eliminate needless spending, the sooner you can start building wealth for your future. The.

Tips for implementing the envelope system include setting up envelopes for different spending categories such as groceries, entertainment, and transportation. Label each envelope and allocate a specific amount of cash for each category. When the envelope is empty, you’re done spending in that category for the month.

Eliminating the temptation to overspend by using cash-only transactions helps you stay within your budget. This habit-forming technique forces you to be more conscious of your spending and teaches you the value of budgeting and prioritizing your expenses. The.

Once again, we research into the world of personal finance management with a focus on the art of saving. One of the most effective ways to ensure a healthy financial future is by making saving money automatic. By setting up systems that work in the background, you can effortlessly build up your savings over time.

Any small changes in these factors can have a big impact on your savings habits in the long run. By being aware of these influences, you can make adjustments to improve your saving strategies.

An crucial step in setting up an invisible savings system is to automate your savings. This involves setting up automatic transfers from your checking account to your savings account on a regular schedule. By doing this, you ensure that a portion of your income goes directly into savings without any effort on your part.

Another way to make saving automatic is to utilize apps or financial tools that round up your purchases to the nearest dollar and deposit the spare change into your savings account. This simple trick can add up over time and boost your savings without you even realizing it.

Your investing habits play a crucial role in determining your financial success in the long run. It’s important to cultivate healthy habits that will help you grow your wealth steadily over time.

One of the most important habits to develop is consistency in investing. Regularly investing a fixed amount of money, whether it’s into stocks, bonds, mutual funds, or other investment vehicles, can help you take advantage of compound interest and dollar-cost averaging.

Another key habit is diversification. By spreading your investments across different asset classes, industries, and geographical regions, you can reduce the overall risk in your portfolio. This can help protect your investments from market volatility and economic downturns.

It’s also vital to stay informed about your investments and the market. Regularly review your portfolio, stay updated on market trends, and consider seeking advice from financial professionals to ensure that your investments align with your financial goals.

Lastly, patience is key when it comes to investing. The most successful investors understand that achieving significant returns takes time. Avoid making emotional decisions based on short-term market fluctuations, and stick to your long-term investment plan.

By cultivating these positive investing habits, you can position yourself for long-term financial success and grow your wealth steadily over time.

A: Atomic habits are crucial for personal finance management as they help in establishing small, consistent actions that lead to significant long-term financial growth.

A: Atomic habits can be applied to personal finance management by breaking down financial goals into small, manageable tasks and consistently working towards them each day.

A: Examples of atomic habits for personal finance management include tracking daily expenses, setting a budget, automating savings, and reviewing financial goals regularly.

A: Atomic habits help in achieving financial freedom by instilling discipline, building good financial habits, and making incremental progress towards financial goals over time.

A: The benefits of incorporating atomic habits into personal finance management include increased financial discipline, better money management skills, and a greater likelihood of achieving long-term financial success.

A: It typically takes around 21 days to 2 months to form a new atomic habit for personal finance management, depending on the individual and the complexity of the habit.

A: If you slip up on your atomic habits for personal finance management, don’t be too hard on yourself. Instead, acknowledge the setback, learn from it, and recommit to your goals by getting back on track with your habits.

Master Your Knowledge – Strategies for Personal Knowledge Management

Unlocking the Potential of Grid Trading Bot for Automated Profits

Atomic Habits for improving mental health and wellbeing