Happy Money mindset for financial freedom! Begin a journey to transform your relationship with money by cultivating a positive and empowered mindset. In this guide, we will explore practical tips and strategies to help you shift your perspective on money, overcome limiting beliefs, and pave the way towards financial freedom. By adopting a happy money mindset, you can attract abundance, make sound financial decisions, and ultimately achieve your goals with confidence. Let’s dive in and unlock the keys to a prosperous financial future.

Key Takeaways:

- Shift Your Mindset: Cultivating a happy money mindset starts with changing your perspective on money from scarcity to abundance.

- Practice Gratitude: Being grateful for what you have can lead to contentment and reduce the urge for excessive spending.

- Set Meaningful Goals: Define your financial goals based on your values and priorities to ensure that your money is aligned with your happiness.

- Focus on Experiences: Invest in experiences over material possessions as they tend to bring more long-term joy and fulfillment.

- Embrace Financial Wellness: Prioritize your financial well-being by establishing healthy money habits, such as budgeting and saving.

- Avoid Comparison: Comparing your financial situation to others can lead to dissatisfaction; focus on your own journey and progress instead.

- Practice Mindful Spending: Be intentional about how you spend your money, making sure it aligns with your values and brings you true happiness.

Assessing Your Current Financial Mindset

Assuming you are ready to commence on a journey towards financial freedom, the first step is to assess your current financial mindset. This involves understanding your beliefs and attitudes towards money, as they play a crucial role in shaping your financial decisions and habits. By gaining clarity on your current mindset, you can identify areas that may be holding you back from achieving your financial goals.

Identifying Limiting Beliefs About Money

About identifying limiting beliefs about money, it is crucial to recognize any negative or restrictive beliefs you hold about wealth, abundance, or your own financial capabilities. These beliefs can stem from past experiences, upbringing, or societal conditioning. Common limiting beliefs include “money is the root of all evil,” “I will never be good with money,” or “rich people are greedy.” By acknowledging and challenging these beliefs, you can start to shift your mindset towards a more positive and empowering perspective on money.

Mindset is a powerful force that influences how you perceive and interact with the world, including your financial decisions and behaviors. For instance, if you believe that you will always struggle to make ends meet, you may unintentionally sabotage opportunities for growth and wealth accumulation. On the other hand, adopting a mindset of abundance and financial empowerment can lead to making more informed and strategic choices that align with your financial goals.

Strategies for Cultivating a Happy Money Mindset

Tips for Shifting Your Attitude Towards Money

To cultivate a happy money mindset, it is imperative to start by shifting your attitude towards money. Begin by acknowledging any negative beliefs or emotions you have about money and replacing them with positive affirmations. Practice gratitude for the money you have and focus on abundance rather than scarcity. Surround yourself with positive financial influences and limit exposure to negative or fear-based financial news. Do not forget, money is a tool that can bring joy and opportunities into your life.

- Challenge yourself to view money as a source of freedom and fulfillment rather than stress

- Practice mindfulness when making financial decisions to ensure they align with your values and goals

- Set aside time each day to visualize your financial goals and affirm your ability to achieve them

After implementing these tips, you will gradually notice a shift in your mindset towards money. By consistently reinforcing positive beliefs and behaviors, you can create a healthier relationship with money and pave the way for financial freedom.

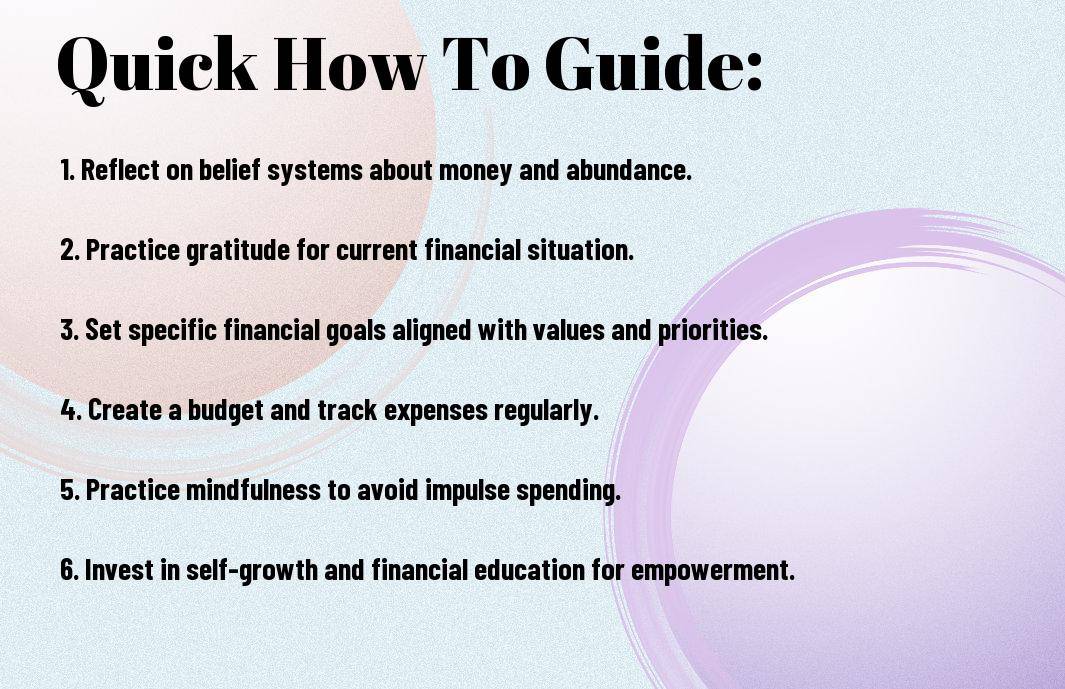

How-To Implement a Positive Financial Routine

One of the most effective ways to cultivate a happy money mindset is by implementing a positive financial routine. Start by creating a budget that reflects your financial goals and priorities. Track your expenses regularly to stay on top of your finances and make adjustments as needed. Set aside time each week to review your financial progress and celebrate your successes. By incorporating positive money habits into your routine, you can build a strong financial foundation for the future.

One key aspect of implementing a positive financial routine is consistency. Make sure to stick to your budget and savings goals, even when faced with financial challenges. By establishing a routine that aligns with your values and priorities, you will set yourself up for long-term financial success.

Critical Factors in Achieving Financial Freedom

Many individuals aspire to achieve financial freedom, where they have the ability to make choices that align with their values and passions without being hindered by financial constraints. However, reaching this goal requires a combination of strategic planning, disciplined saving, and smart investment decisions. In this chapter, we will explore the critical factors that play a pivotal role in helping individuals attain financial freedom.

- Setting clear financial goals

- Creating a sustainable budget

- Developing smart investment and saving practices

How-To Create a Sustainable Budget

Create a detailed plan outlining your monthly income and expenses. Be sure to include categories such as housing, food, transportation, and entertainment. Tracking your spending habits can help identify areas where you can cut back and save more effectively. Additionally, allocate a portion of your income towards savings and investments to build towards your financial goals.

After establishing a budget, periodically review and adjust it as needed to reflect any changes in your financial situation or goals. It’s important to be flexible and willing to make necessary revisions to ensure you stay on track towards achieving financial freedom.

Tips for Smart Investment and Saving Practices

Freedom In order to maximize your savings and investments, consider automating contributions to your retirement accounts or investment portfolios. This can help you stay consistent with your financial goals and prevent the temptation to spend money impulsively. Diversifying your investments across different asset classes can also help reduce risk and increase potential returns over time.

- Start early and take advantage of compound interest

- Consult with a financial advisor to develop a long-term investment strategy

- Regularly review and rebalance your investment portfolio

Perceiving the value of your investments as long-term assets can help shape a mindset that focuses on the bigger picture rather than short-term gains. By embracing patience and staying committed to your financial plan, you can position yourself for long-lasting financial success.

This chapter emphasizes the importance of creating a sustainable budget and implementing smart investment and saving practices as key components in achieving financial freedom. By adopting a strategic approach to managing your finances and staying disciplined in your financial decisions, you can pave the way towards a future where financial constraints no longer dictate your choices.

Maintaining Your Happy Money Mindset

Keep your Happy Money mindset strong and resilient by practicing positive financial habits and mindset shifts. Cultivating a mindset of abundance, gratitude, and intentionality can help you navigate through various financial challenges with grace and confidence.

How-To Overcome Common Financial Setbacks

An important aspect of maintaining a Happy Money mindset is knowing how to overcome common financial setbacks. Whether it’s unexpected expenses, a job loss, or a market downturn, these challenges can test your financial resilience. To overcome setbacks, focus on adapting your budget, finding alternative income sources, and seeking support from financial advisors or mentors who can provide guidance and perspective.

Tips for Long-Term Financial Mindset Health

In terms of long-term financial mindset health, consistency is key. Develop a routine that includes regular check-ins on your financial goals, reviewing your budget, and tracking your progress. Setting achievable milestones and celebrating small wins along the way can help you stay motivated and committed to your financial journey.

- Practice gratitude for your financial progress

- Visualize your long-term financial goals regularly

Money mindset plays a crucial role in shaping your financial habits and behaviors. By cultivating a positive relationship with money and practicing healthy financial habits, you can set yourself up for long-term financial success and security. Any setbacks or challenges along the way can be viewed as learning opportunities to further strengthen your financial mindset.

Conclusion

On the whole, cultivating a Happy Money mindset is vital for attaining financial freedom. By shifting our perspective towards money, focusing on gratitude, generosity, and mindfulness, we can create a positive relationship with our finances and pave the way for a more prosperous future. To learn more about changing your money mindset, visit Money Mindset: Get Financial Freedom by not Eyeing ….

FAQ

Q: What is a Happy Money mindset?

A: A Happy Money mindset is a way of thinking and approaching finances that prioritizes joy, fulfillment, and well-being over material accumulation or status. It focuses on using money as a tool to create a meaningful and fulfilling life.

Q: How can cultivating a Happy Money mindset lead to financial freedom?

A: Cultivating a Happy Money mindset can lead to financial freedom by helping you make intentional financial decisions, prioritize what truly matters to you, and avoid unnecessary spending. By focusing on the value and impact of your spending, you can build a healthier relationship with money and work towards your financial goals.

Q: What are some strategies for cultivating a Happy Money mindset?

A: Some strategies for cultivating a Happy Money mindset include practicing gratitude for what you have, setting clear financial goals aligned with your values, creating a budget that reflects your priorities, and regularly reassessing your spending habits to ensure they align with your values and goals.

Q: How can gratitude impact our financial well-being?

A: Gratitude can impact our financial well-being by shifting our focus from what we lack to what we have. When we appreciate what we already possess, we are less likely to engage in impulsive or unnecessary spending. Gratitude can also help us feel more content with our current financial situation, reducing stress and increasing our overall well-being.

Q: What role does mindset play in financial success?

A: Mindset plays a crucial role in financial success as it influences our beliefs, attitudes, and behaviors around money. A positive and empowering mindset can help us make sound financial decisions, stay motivated during challenging times, and bounce back from setbacks. By cultivating a mindset focused on growth, abundance, and resilience, we can increase our chances of achieving financial success.

Q: How can mindfulness practice contribute to a Happy Money mindset?

A: Mindfulness practice can contribute to a Happy Money mindset by increasing our awareness of our thoughts, emotions, and behaviors related to money. By being present in the moment and observing our financial choices without judgment, we can make more conscious decisions, avoid impulsive spending, and cultivate a sense of contentment and peace with our financial situation.

Q: What are the benefits of developing a Happy Money mindset for overall well-being?

A: Developing a Happy Money mindset can bring a wide range of benefits for overall well-being, including reduced stress and anxiety related to finances, improved relationships with money and others, increased contentment and fulfillment, and a greater sense of control and empowerment over your financial life. By aligning your spending with your values and priorities, you can create a more harmonious and fulfilling relationship with money.