Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

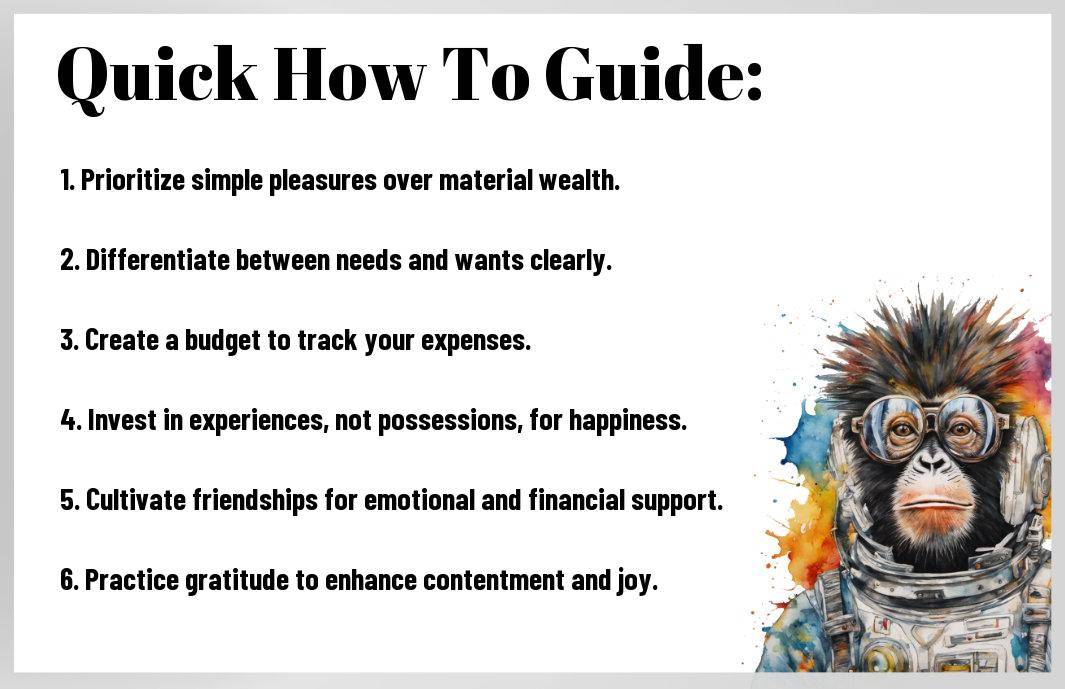

Managing your money wisely can lead to a more fulfilling life, just as the ancient philosopher Epicurus taught us. In this post, I’ll share some practical tips, inspired by his teachings, that will help you find joy and tranquility in your financial decisions. By focusing on what truly matters, you can create a budget that aligns with your values and desires. Let’s investigate how you can cultivate a happier relationship with your finances in a way that Epicurus would surely appreciate!

A deep look into Epicurean philosophy transforms how I view happiness, wealth, and the essence of living a fulfilling life. This ancient school of thought encourages finding joy not in material possessions but in the simple pleasures of everyday living. Epicurus, the founder of this philosophy, believed that pursuing pleasure is imperative but that true happiness stems from moderation and understanding what brings genuine joy.

Even though it’s often misunderstood as hedonism, Epicureanism emphasizes the pursuit of a balanced life filled with meaningful pleasures rather than the chaotic chase of instantaneous gratification. I’ve learned that it’s about appreciating depth over quantity, seeking fulfillment from experiences and connections that enrich my existence. Epicureans advocate reducing desires to find peace in what I have, rather than striving for more possessions or status.

Little moments, like enjoying a warm cup of tea on a rainy day or sharing laughter with friends, hold immense value in Epicurean thought. I’ve come to cherish these simple pleasures, as they cultivate contentment and lead me to a more enlightened state of mind. Instead of dreaming of luxury and excess, focusing on the little joys brings me a lasting happiness that far outweighs the temporary thrill of acquiring more.

To embrace these simple pleasures, I’ve started to be more mindful of my daily experiences. Whether it’s immersing myself in a good book, savoring every bite of a home-cooked meal, or spending quality time with loved ones, I recognize that these moments fill my life with joy and gratitude. Incorporating this mindset into my financial management allows me to prioritize experiences that truly matter, making my life richer far beyond any monetary value.

Clearly, creating a budget is more than just crunching numbers; it’s about aligning your financial resources with what truly brings you joy. Inspired by the philosophy of Epicurus, I focus on identifying the experiences and items that enhance my life the most. Rather than inflating my spending with unnecessary expenses, I take a step back and evaluate what activities or purchases genuinely contribute to my happiness. By being intentional in this process, I ensure that my budget reflects my values and allows me to enjoy life to the fullest without feeling deprived.

Clearly, the first step in budgeting is identifying what truly brings me joy. Some people find pleasure in dining out and socializing with friends, while others might find happiness in investing in hobbies such as painting or gardening. I take my time to reflect on the moments that have made me feel fulfilled and happy. This helps me shift my focus away from materialistic gains and towards experiences that foster genuine joy in my life. By doing this, I can prioritize spending in a way that enhances my well-being.

Any successful budgeting process needs clearly defined, realistic financial goals. I don’t set myself up for failure by aiming for astronomical savings rates or immediate financial independence. Instead, I assess my current situation and the economic landscape I’m in, allowing me to create achievable milestones that keep me motivated throughout the year. Whether it’s saving for a special trip or building a safety net for unexpected expenses, I make sure each goal is specific, measurable, and tailored to my unique lifestyle.

The beauty of setting realistic financial goals is that it gives me a sense of direction while making budgeting feel less daunting. I break larger goals into smaller, actionable steps, which makes tracking my progress much more satisfying. Plus, when I reach these milestones, I can enjoy small rewards that contribute to my happiness. Ultimately, aligning my financial goals with my personal values not only assists me in managing money effectively but also enriches my life experience.

Once again, it’s imperative to consider how I manage my money in a way that aligns with my values and brings me genuine happiness. Mindful spending can be a transformative practice, allowing me to enjoy life more fully while being intentional about my purchases. Here are some tips that help me embrace a more thoughtful approach to my finances:

The goal here is to create a lifestyle where every dollar spent contributes to my overall well-being and happiness.

You might find that prioritizing experiences over material possessions invites more joy and fulfillment into your life. I’ve come to realize that the memories created during shared experiences—like traveling with friends or taking a cooking class—hold much more significance than the latest gadget or wardrobe item. This perspective shift not only alters my spending habits but helps me cultivate richer, more meaningful moments in my life.

Some of my best moments with money come from practicing gratitude in my spending. When I approach my purchases with appreciation, I tend to make choices that reflect my core values. For instance, rather than simply buying a coffee out of habit, I take a moment to appreciate the craftsmanship that went into it, fostering a deeper connection to my experience. This habit encourages me to be more selective about what I spend my money on, leading to more satisfying purchases.

Mindful spending also involves taking the time to reflect on how my purchases align with my values and how they contribute to my overall sense of happiness. With gratitude at the forefront of my spending, I feel more satisfied with my choices and less inclined to chase after fleeting trends that don’t bring me lasting joy. This practice not only enriches my relationship with money but also enhances my life through deeper connections and memorable experiences.

After spending some time reflecting on how Epicurus viewed life, I’ve realized that the bonds we create with others are not just nice to have; they are fundamental to our happiness and well-being. Epicurus believed in nurturing friendships, as they offer support, joy, and a sense of belonging. In my own life, I’ve noticed that the happiest moments are often shared with people who genuinely care for me. These connections help us weather life’s storms and celebrate our victories, reminding me of the profound impact a supportive community can have on my financial and emotional health.

Little by little, I’ve come to understand that investing time and energy into my relationships reaps rewards in every aspect of my life. By nurturing friendships and connecting with others, I am not only creating an emotional support system but also a network that can lead to new opportunities. Engaging in genuine conversations and spending quality time with friends lay a strong foundation for mutual support, where we can uplift each other in our respective journeys. I’ve found that these relationships often open doors to new ideas and collaborations that can enhance our financial well-being.

Resources, whether they be time, skills, or knowledge, become even more valuable when shared with others. When I actively participate in my community by offering help or sharing what I have learned, I not only strengthen my own understanding but also contribute to a culture of generosity and support. This symbiotic relationship fosters an environment where everyone can thrive together, multiplying our individual successes. As I’ve seen, the exchange of ideas and resources fuels our collective growth, making it clear that no one has to navigate their financial journey alone.

With a spirit of collaboration, I’ve realized that sharing knowledge can spark innovation and creativity. Whether it’s helping a friend understand budgeting basics or co-hosting workshops on investment strategies, every interaction enriches both parties. The more I engage with those around me, the more I learn and grow together with them. By creating a culture of sharing, we can tackle challenges collectively and harness our combined talents to reach new financial horizons. In this way, the support system forged through community strengthens each of us individually, helping us manage our finances with greater confidence and clarity.

Unlike many approaches to money management that emphasize strict saving or high-risk investment, I believe the path to long-term financial happiness must consider a balance between enjoying life today while preparing for future needs. As I investigate into this philosophy, I tend to focus on several vital factors:

Thou should find joy in the balance of financial planning and personal fulfillment.

To achieve a harmonious relationship with money, I strive for a balance between saving for the future and enjoying the present. It’s tempting to think I should just save everything for a rainy day, but I’ve learned it’s vital to allow myself to indulge occasionally. Investing in experiences and simple pleasures doesn’t just enrich my life; it makes the saving feel worthwhile. By allocating funds for both fun and future security, I create a sustainable financial plan that doesn’t feel restrictive.

Ultimately, it’s about prioritizing what brings me joy today while ensuring I am prepared for tomorrow. I’ve learned to treat my financial health as a journey rather than a destination, which helps me revel in small treats without guilt. By consciously making choices that reflect my values, I keep my motivation high and my savings intact.

Lifes circumstances often shift in unexpected ways, and I’ve come to understand the importance of being adaptable with my finances. Whether it’s a new job opportunity, changes in family dynamics, or unplanned expenses, my financial plan needs to be flexible. I regularly assess my situation and adjust my budget to accommodate these transitions, making room for both immediate needs and future aspirations.

Enjoying a life that encompasses my evolving preferences and responsibilities requires me to remain vigilant about my financial footprint. By nurturing an adaptive mindset, I’m better equipped to navigate changes without feeling overwhelmed. This constant assessment allows me to embrace new experiences and responsibilities while reassuring me that I am on the right path towards my financial goals.

Now, cultivating a contented mindset is crucial in managing money like Epicurus. It’s all about focusing on what truly matters in life and learning to be at peace with our choices. When I shift my perspective and prioritize inner happiness over material possessions, I find myself feeling more fulfilled. Adopting a mindset that values experiences and relationships over accumulating wealth helps me appreciate the simple joys of life. This approach aligns beautifully with Epicurus’ philosophy, reminding me that happiness is attainable without needing to chase after the latest trends or gadgets.

Clearly, minimalism plays a significant role in fostering a contented mindset. By reducing the clutter in my life—be it physical belongings or mental distractions—I create more space for joy and tranquility. I find that cutting back on excess allows me to focus on what truly brings me happiness, like spending quality time with loved ones or engaging in enjoyable hobbies. It’s both liberating and empowering to realize that I don’t need piles of material goods to feel fulfilled.

The beauty of a grateful mindset transforms the way I view my life and finances. Each day, I make it a point to acknowledge the things I readily have, whether it’s a warm cup of coffee or a supportive friend. This intentional practice of gratitude not only grounds me but also enriches my perspective, allowing me to appreciate the wealth of experiences that money cannot buy. As I cultivate this mindset, I recognize the abundance around me, which significantly reduces the desire for more.

Practices like keeping a gratitude journal can enhance this experience immensely. Each evening, I jot down three to five things I am thankful for—it could be anything from a beautiful sunset to a pleasant encounter during my day. Over time, this simple act reminds me of the wealth of blessings I already possess, steering me away from the empty pursuit of material gains. It reinforces the idea that true contentment lies within, fostering a fulfilling relationship with my finances.

As a reminder, managing money like Epicurus is all about finding the balance between enjoying life and being financially responsible. I’ve learned that it’s possible to savor the pleasures of life without sacrificing my future security. By focusing on what truly brings me happiness, I can prioritize my spending in a way that aligns with my values and goals. It’s about making choices that enhance my quality of life while ensuring I’m also saving for what’s important down the line.

If you’re looking for a deeper explore this philosophy, you might want to check out How to Enjoy Yourself, Spend Money, and Still Build Wealth. Ultimately, it’s about crafting a lifestyle where I can indulge in simple pleasures, practice mindfulness about my finances, and build wealth for my future. I hope you find the right balance that suits your life, too!

A: Epicurus believed in seeking happiness through simple pleasures and living within one’s means. He advocated for a balanced approach to wealth, emphasizing the importance of moderation, enjoying what you have, and prioritizing relationships over material possessions.

A: To align your budget with Epicurean philosophy, begin by listing your important expenses and distinguishing them from non-important ones. Allocate funds for activities that bring true joy, like experiences with loved ones, while minimizing spending on fleeting pleasures. This promotes a fulfilling life while staying within your financial limits.

A: Epicurus did not oppose the idea of investing; however, he advised doing so in a way that is mindful and measured. By selecting investments that align with your values and long-term happiness (such as ethical or socially responsible investments), you can create financial security that enhances your well-being.

A: Saving money is an important aspect of Epicurean thought. Focus on building a savings plan that prioritizes your peace of mind and future comfort. This involves setting aside funds for emergencies and future joys rather than hoarding wealth unnecessarily, fostering a sense of security and enjoyment in your life.

A: Epicurus would encourage you to challenge societal norms regarding wealth. Instead of comparing yourself to others, focus on your own values and what brings you happiness. Understand that true fulfillment comes from simplicity and companionship, rather than societal status symbols. Surrounding yourself with supportive individuals can further reinforce your perspective.

A: To mitigate financial stress, cultivate self-awareness around your spending habits. Practice mindfulness to identify what truly brings contentment, and seek out non-material sources of happiness. Engage in relaxation techniques and community support to manage anxiety, shifting your focus from financial concern to enjoying the present moment.

A: Absolutely! Being frugal does not mean sacrificing happiness. Prioritize spending on experiences and relationships that enrich your life while being discerning about unnecessary purchases. Strive to find joy in simple and free pleasures, such as nature, friendship, and creativity, which align with Epicurus’s teachings on achieving a fulfilled life.