Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

Career changes! Embracing a new professional path can often come with financial uncertainties, but with the right mindset and tools, transitioning careers can be a smooth journey. Happy Money provides a unique approach towards managing finances during career changes, allowing individuals to navigate this period with confidence and financial stability. In this blog post, we will discuss practical tips and strategies on how to harness the power of Happy Money to successfully transition to a new career while staying financially secure.

Even the most thought-out career transition can come with financial implications. It’s important to prepare yourself financially before making a major career shift to ensure a smooth transition. By evaluating your current financial status and creating a financial safety net, you can navigate the uncertainties of a career change with confidence and peace of mind.

Before commenceing on a career shift, take stock of your current financial situation. Evaluate your savings, investments, debts, and monthly expenses. Determine how much runway you have in terms of covering your living expenses without a steady income. Understanding your financial standing will help you make informed decisions about when to make the leap to a new career.

Consider speaking with a financial advisor to get a professional assessment of your financial health. They can help you understand the potential risks and rewards associated with your career change and provide personalized recommendations based on your financial goals and circumstances.

Building a financial safety net is crucial when preparing for a career shift. Aim to have an emergency fund that covers at least three to six months’ worth of living expenses. This fund will serve as a cushion in case of unexpected expenses or a longer-than-anticipated job search period. Set aside a portion of your savings specifically for this purpose to ensure you have peace of mind during your transition.

Financial stability is key to weathering the ups and downs that come with changing careers. By proactively creating a financial safety net, you can focus on pursuing your new career path without the added stress of financial uncertainty. Keep in mind, having a solid financial foundation will give you the freedom and flexibility to explore new opportunities and pursue your passion.

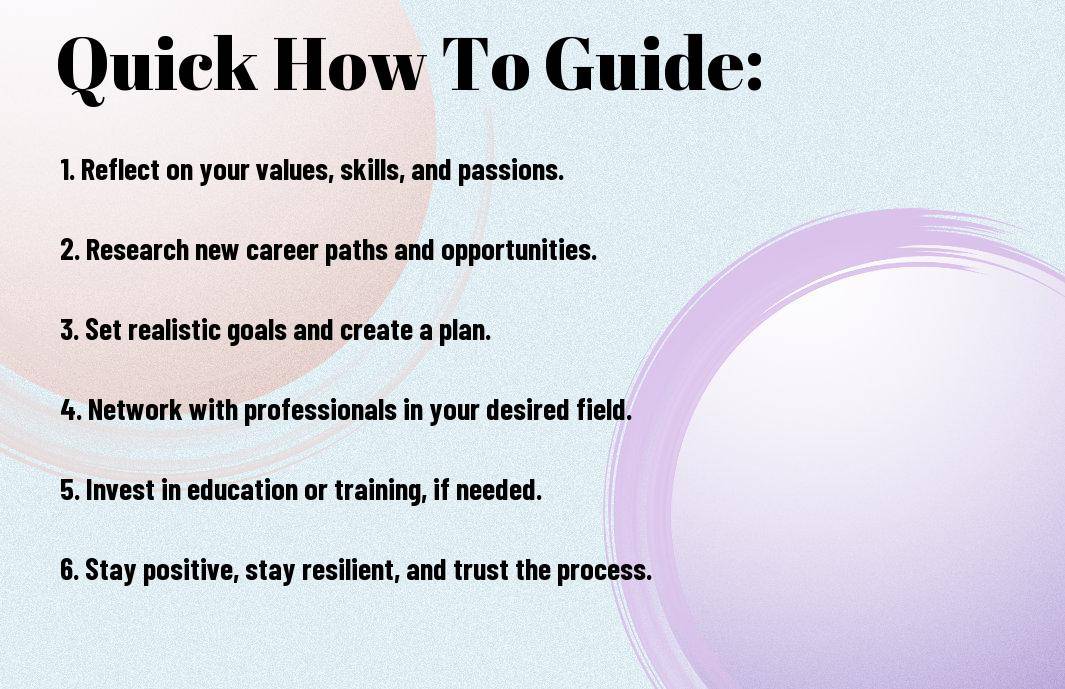

Keep career changes can be both exciting and daunting. It is crucial to approach this transition with thoughtfulness and a strategic plan. One key aspect of successfully navigating a career change is to identify your transferable skills and values.

With any career change, it is vital to recognize the skills and values that you possess and how they can be applied to a new role or industry. Transferable skills are those that are adaptable and can be relevant across different professions. These can include communication skills, leadership abilities, problem-solving capabilities, and more. Identifying these skills will help you understand how they can be leveraged in a new career path.

When considering a career change, also assess your values and what is important to you in a job. Understanding your core values will help you align your career goals with what truly matters to you. This introspection will guide you towards opportunities that align with your beliefs and passions.

For those launching on a career change, thorough research is key to finding new opportunities that align with your skills and values. Utilize online resources, attend industry events, and connect with professionals in your desired field to gather valuable insights. Networking can open doors to hidden job opportunities and provide valuable information about potential career paths.

For individuals changing careers, it’s important to stay open to unexpected opportunities that may arise. While having a plan is crucial, being flexible and open-minded can lead to serendipitous moments and new paths that you may not have considered.

For individuals navigating career changes, it is crucial to have a solid financial plan in place, especially when facing the prospect of reduced income. Budgeting becomes even more critical during these times to ensure financial stability and peace of mind. Start by evaluating your current expenses and identifying areas where you can cut back. Categorize your expenses into vitals and non-vitals to prioritize spending on necessities such as rent, utilities, and groceries.

Consider creating a new budget that aligns with your anticipated income level. Look for opportunities to reduce discretionary spending and explore alternative ways to save money, such as cooking at home instead of dining out or finding affordable entertainment options. It’s also vital to build an emergency fund to cover unexpected expenses that may arise during your career transition.

Transitions in your career can be challenging, but with the right mindset and financial strategies, you can navigate them successfully. Embracing the concept of Happy Money can help you make smarter financial decisions that align with your values and bring joy and fulfillment. Start by prioritizing spending on experiences and purchases that truly bring you happiness and add value to your life.

With a focus on Happy Money, you can shift your perspective on financial planning and see it as a tool for achieving a more fulfilling life rather than just meeting basic needs. By aligning your spending with your values and goals, you can create a sustainable and fulfilling financial plan that supports you throughout your career transitions and beyond.

A strategic approach to managing your finances during career transitions can set you up for long-term success and financial well-being. By incorporating principles of Happy Money into your financial planning, you can not only weather the uncertainties of changing careers but also thrive and find fulfillment in the process. Remember to stay flexible and open to adjustments as you navigate the twists and turns of your career journey.

All career changes come with financial implications. On your new career path, it’s crucial to maintain financial health to ensure a smooth transition. Start by creating a budget that reflects your new income and expenses. Cutting back on unnecessary spending and setting financial goals can help you stay on track.

Consider building an emergency fund to cover unexpected expenses and continue contributing to retirement accounts to secure your financial future. It’s also wise to explore any additional income opportunities or ways to grow your savings to provide a financial cushion during this transitional period.

LongTermOn your new career journey, it’s imperative to plan for long-term career satisfaction. Take the time to reflect on your values, interests, and skills to ensure alignment with your new career path. Seeking opportunities for growth and advancement within your field can help you stay motivated and fulfilled in the long run.

Research potential career paths, consider further education or certifications to enhance your skill set, and network with professionals in your industry to gain valuable insights and connections. By taking a proactive approach to your career development, you can pave the way for long-term success and satisfaction.

It’s imperative to set clear goals and milestones to track your progress and make adjustments as needed to stay on course. Regularly assessing your career satisfaction and making necessary changes can help you maintain a fulfilling and rewarding career over the long term.

As a reminder, navigating career changes with Happy Money involves considering both financial stability and personal happiness. Understanding your values and priorities can help guide you towards a fulfilling career path. For more insights on balancing money and happiness, you can read the article Money or happiness?

A: Happy Money is a financial company that helps individuals improve their relationship with money, offering tools and resources to make smarter financial decisions and live happier lives.

A: Navigating career changes can have a significant impact on your financial well-being. Happy Money provides support and guidance to help you make informed decisions during transitional moments in your career.

A: Happy Money offers financial planning services, budgeting tools, and personalized advice to help you navigate career changes with confidence and financial security.

A: Common challenges when transitioning careers include financial instability, uncertainty about the future, and the need to adapt to a new work environment. Happy Money can help you address these challenges effectively.

A: Happy Money can help you create a financial plan, build an emergency fund, and explore new income streams to prepare for a career change and mitigate financial risks.

A: While Happy Money primarily focuses on financial wellness, they may offer resources or referrals to career coaching services to support individuals during career transitions.

A: To get started with Happy Money for career change support, you can visit their website, explore their services, and reach out to their team for personalized assistance tailored to your specific needs.