Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

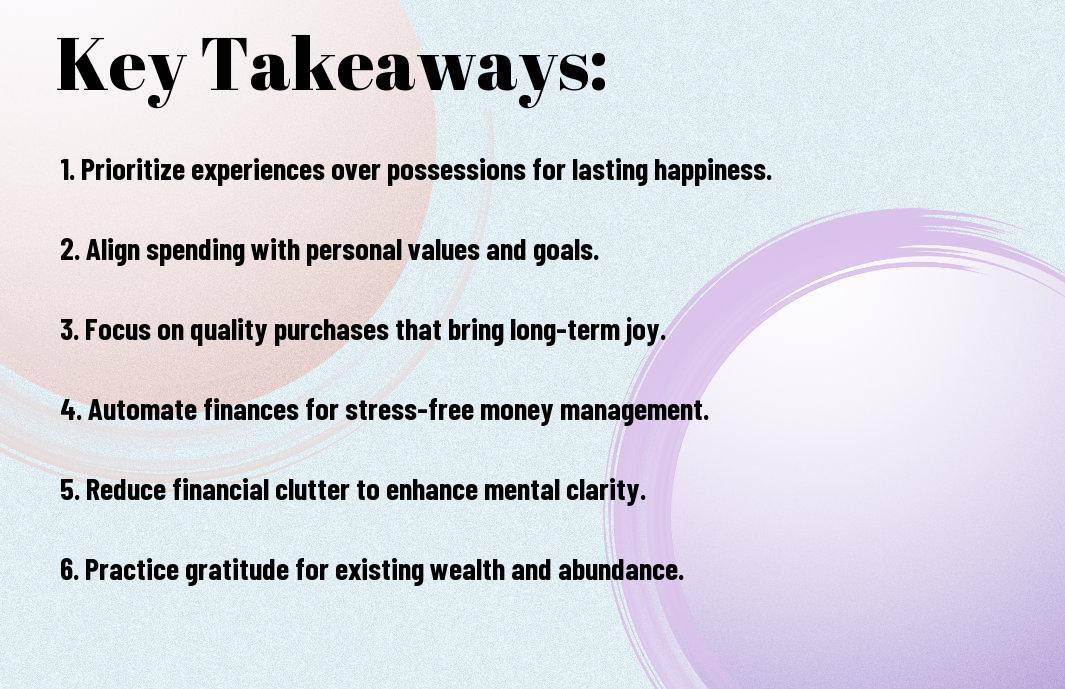

Simplify Your Financial Life! By embracing the principles of minimalism, you can simplify your finances, reduce clutter, and focus on what truly brings you joy. In this blog post, we will explore how incorporating minimalism into your financial habits can lead to happier and more meaningful money management.

Obviously, when it comes to our finances, we all want to be happy, but what exactly is happy money and how can we achieve it? To probe deeper into this topic, check out my MINIMALISM & MONEY playlist for more insights.

Happy money is about more than just the numbers in our bank account. It’s about the emotional value that our purchases bring to our lives. By focusing on spending money on experiences rather than material possessions, we can increase our overall happiness and satisfaction with life.

Practical Steps to Aligning Spending with Joy

With happy money in mind, it’s important to evaluate our spending habits and make adjustments where necessary. Start by identifying the areas where you derive the most joy from your spending. This could be travel, quality time with loved ones, or investing in personal development.

This mindful approach to spending not only helps us maximize our happiness but also ensures that our financial resources are being used to enhance our well-being in a meaningful way. Note, it’s not about depriving yourself of things you enjoy, but rather about aligning your spending with what truly brings you joy.

Now more than ever, people are turning to minimalism as a way to simplify their lives and focus on what truly matters. Embracing minimalism can not only declutter your physical space but also extend to your financial life, helping you achieve a sense of financial freedom and peace of mind.

Decluttering your finances involves taking a step back to assess your spending habits, financial obligations, and investment choices. Start by organizing your financial documents and creating a budget that aligns with your values and goals. Eliminate unnecessary expenses and subscriptions that do not add value to your life.

An necessary part of simplifying your financial life is identifying and cutting out unnecessary expenses. This can include dining out frequently, excessive shopping, or subscriptions you no longer use. By eliminating these expenses, you can redirect your money towards building wealth or achieving your financial goals.

Finances can easily become cluttered with impulse purchases and lifestyle inflation. By evaluating your spending habits and making conscious choices, you can free up resources to focus on what truly matters to you.

Despite the complexities of modern life, it is possible to achieve financial well-being through simplification. By adopting a minimalist approach to your finances, you can declutter your money matters and pave the way for a happier, more stress-free financial future.

An important aspect of simplifying your financial life is to utilize tools that help you track and manage your money effectively. From apps that categorize your expenses to online platforms that offer budgeting insights, there is no shortage of resources available to assist you in gaining a clear overview of your financial situation. By leveraging these tools, you can stay organized and make informed decisions about your money.

Furthermore, automating your finances can be a game-changer when it comes to simplification. Setting up automatic payments for bills, savings, and investments can help you stay on top of your financial responsibilities without the need for constant manual intervention. This not only saves you time but also ensures that you never miss a payment, leading to a healthier financial life.

That feeling of joy when you are in control of your finances is priceless. Creating a streamlined budget that sparks joy involves aligning your spending with your values and priorities. By identifying what truly matters to you and allocating your money accordingly, you can cultivate a sense of fulfillment and contentment in your financial decisions.

A streamlined budget focuses on simplicity and intentionality, stripping away unnecessary expenses and allocating resources to areas that bring you the most happiness. By curating your budget in this way, you not only ensure that your money is being spent wisely but also create a financial plan that resonates with your personal goals and aspirations.

A minimalist budget is not about depriving yourself but rather about optimizing your spending to reflect what brings you genuine joy and fulfillment. By simplifying your financial habits and aligning them with your values, you can achieve a healthier relationship with money and pave the way for a more fulfilling life.

Many people are drawn to the concept of Thrift and Minimalism: Simplify Your Life and Save Money as a way to declutter their lives, both physically and financially. However, the journey towards a minimalist financial lifestyle is not always easy. Along the way, you may encounter various challenges that can test your commitment to simplicity.

Overcoming the pressure to keep up with the latest trends and the desire for material possessions can be a significant hurdle on the path to financial minimalism. Society often equates possessions with success, leading many individuals to accumulate items they don’t truly need. It’s vital to stay true to your values and priorities, even if it means resisting the urge to splurge on unnecessary purchases. Do not forget, happiness and fulfillment come from experiences and relationships, not possessions.

For those begining on a minimalist financial journey, it’s crucial to set boundaries and communicate your values to friends and family. Surround yourself with like-minded individuals who support your goals and understand the importance of saving and investing wisely. By staying focused on your financial objectives and building a strong support system, you can navigate social pressures and material desires more effectively.

For many, the challenge lies in maintaining a minimalist financial lifestyle in a world that constantly bombards us with messages of consumerism and excess. Resisting the temptation to overspend can be tough, especially when faced with flashy advertisements and societal expectations. It’s vital to remind yourself of the benefits of simplicity and the freedom that comes from living within your means.

Lifestyle adjustments may be necessary to stay on track with your minimalist financial goals. This could involve creating a budget, adopting frugal habits, and prioritizing experiences over material possessions. Do not forget, the journey towards financial simplicity is a marathon, not a sprint. Stay committed to your values and focus on long-term financial well-being.

On the whole, adopting a minimalist approach to your financial life can bring you a sense of peace and freedom. By focusing on what truly brings you happiness and cutting out unnecessary expenses, you can create a more intentional and fulfilling lifestyle. Recall, it’s not about depriving yourself, but rather about prioritizing your spending in alignment with your values and goals. So, go ahead and declutter your finances, simplify your spending, and let happy money meet minimalism for a more prosperous and content life.

A: “Happy Money Meets Minimalism” is a philosophy that combines the principles of finding happiness through mindful spending and simplifying your financial life through minimalism.

A: Happy Money focuses on spending on experiences, relationships, and personal growth rather than material possessions, leading to a more meaningful and fulfilling life.

A: Minimalism in finance involves decluttering your expenses, focusing on important purchases, and cutting out excess spending to achieve financial freedom and peace of mind.

A: You can incorporate Happy Money principles by prioritizing spending on things that bring you joy and long-term satisfaction, rather than impulse purchases or temporary pleasures.

A: Practical tips for simplifying your financial life through Minimalism include creating a budget, decluttering your expenses, automating savings, and avoiding unnecessary purchases.

A: Yes, adopting the principles of Happy Money Meets Minimalism can significantly reduce financial stress by promoting mindful spending, prioritizing financial goals, and living within your means.

A: You can start by evaluating your current spending habits, identifying areas for improvement, setting financial goals aligned with your values, and gradually implementing changes to align with the philosophy of Happy Money Meets Minimalism.