Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

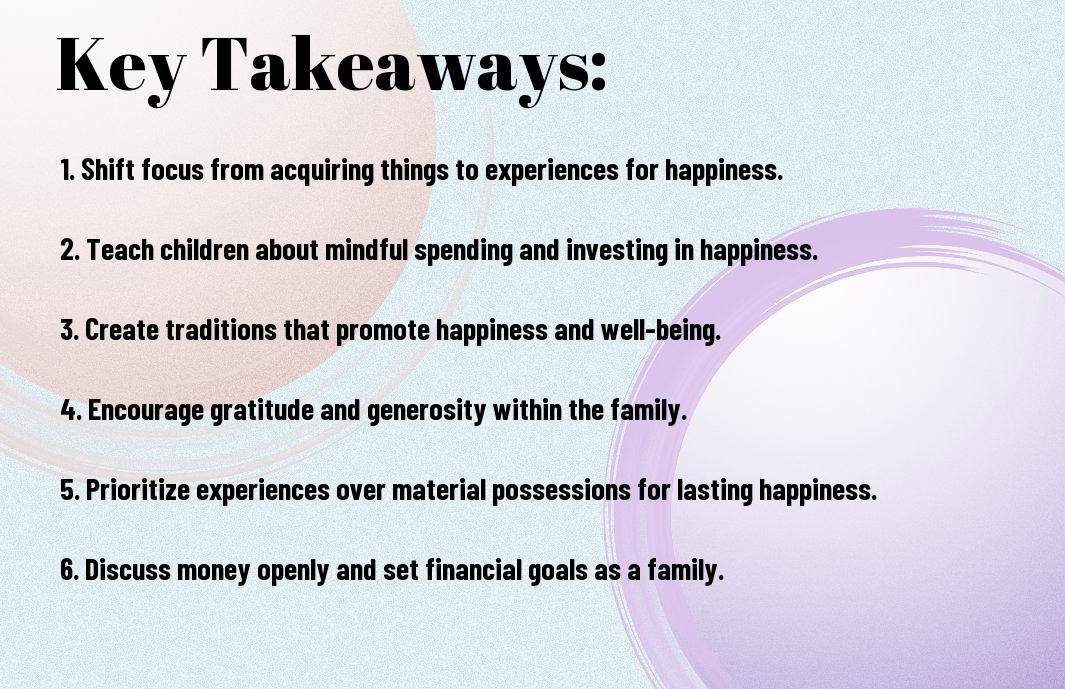

Happy Money Home! Overwhelmed by the constant pressures of financial responsibilities, many families find themselves experiencing stress and tension when it comes to money. In our blog post, “Bringing Happy Money Home – A Guide for Families,” we will explore tips and strategies to help families cultivate a positive and healthy relationship with money. From setting financial goals together to teaching kids about money management, we will discuss how to overcome the challenges and create a joyful and harmonious financial environment at home.

Obviously, cultivating a positive relationship with money is vital for creating a happy and healthy financial future for your family. To start this journey, it’s important to consider tools like Happy Money: Personal Loans, Made Personal that can help you along the way.

Money values play a significant role in shaping our financial decisions and behaviors. Take some time to reflect on what money means to you and your family. Are you motivated by security, independence, or generosity? Understanding these values can guide you towards making smart financial choices that align with your priorities.

Teaching Money Positivity to Kids

Positivity surrounding money is crucial to instilling healthy financial habits in children. Encourage open conversations about money and demonstrate responsible spending and saving habits. Use everyday experiences as teaching moments to help your children understand the value of money and the importance of making wise choices.

A positive money mindset can set your children up for a lifetime of financial success. By fostering a healthy attitude towards money from a young age, you empower them to make sound financial decisions and navigate the complexities of money management with confidence.

Unlike what many believe, managing money doesn’t have to be stressful or boring. In fact, it can be quite liberating and even fun! By incorporating daily practices that promote financial well-being, families can enjoy a happier wallet and a more secure future.

Any family can turn budgeting into a joyful activity by reframing it as a way to align spending with values and goals. Instead of focusing on restrictions, think of a budget as a roadmap to reaching your dreams. Sit down together as a family to discuss your priorities and create a budget that reflects what truly matters to you.

Implementing a budget doesn’t mean you can’t enjoy life. In fact, it can give you the freedom to spend on things that bring you genuine happiness while avoiding unnecessary expenses. Get creative with your budgeting and find joy in watching your savings grow towards your aspirations.

Spending with intention is key to maintaining a healthy financial lifestyle. By developing smart spending habits, families can ensure that every dollar is used wisely. Evaluate your purchases by considering if they align with your values and long-term objectives.

Spending mindfully can lead to a more fulfilling life as you invest in experiences and items that truly enrich your family’s well-being. Consider setting a spending limit for non-necessary purchases to prevent impulse buys and encourage thoughtful consumption.

Budgeting and smart spending habits go hand in hand to support a happier wallet. By taking control of your finances and channeling your resources towards what truly matters, families can enjoy a more fulfilling and prosperous life together.

All families aspire to be financially secure and happy. To achieve this, it’s important to implement long-term strategies that focus on both wealth-building and emotional well-being. By planning ahead and making wise choices, families can pave the way for a bright and secure future.

Strategies for saving for sunny days involve setting aside a portion of your income for the future. This can be achieved by creating a budget, cutting down on unnecessary expenses, and regularly contributing to a savings account or investment fund. By prioritizing saving, families can build a financial safety net that provides peace of mind and stability during unexpected circumstances.

One effective way to save for the future is to automate your savings. By setting up automatic transfers from your checking account to your savings or investment accounts, you can ensure that your savings grow consistently over time. Additionally, consider setting specific financial goals, such as saving for a family vacation, a new home, or your children’s education, to stay motivated and focused on your long-term saving strategy.

Familys looking to secure their financial future should consider investing in assets that appreciate over time. This could include investing in the stock market, purchasing real estate, or starting a retirement account. By diversifying your investments and seeking guidance from financial advisors, you can create a solid foundation for your family’s long-term prosperity.

Investing in Your Family’s Future is not just about monetary wealth. It also involves spending quality time together, fostering a supportive and loving environment, and teaching valuable life skills to your children. By investing in your family’s well-being and happiness, you can create lasting memories and strengthen the bond that holds your family together.

Many families face challenges when it comes to managing their finances and creating a happy money environment at home. In this chapter, we will explore ways to navigate obstacles that can hinder financial well-being and harmony within the family unit.

An important step in overcoming financial stress is open communication within the family. Discussing financial goals, concerns, and priorities allows everyone to be on the same page and work together towards a common objective. It’s also crucial to create a budget that reflects the family’s goals and helps allocate money wisely. By openly addressing financial stressors and working as a team, families can tackle challenges head-on and move towards a more harmonious financial future.

Money can be a source of stress when unexpected challenges arise. Having an emergency fund set aside for unforeseen circumstances can provide a safety net and alleviate financial strain during difficult times. It’s also important to continuously educate oneself about financial matters to be better prepared for any unexpected financial hurdles that may come your way.

Money management tools such as online budgeting apps and financial planning resources can also be beneficial in preparing for unexpected challenges. These tools can help families track their expenses, set financial goals, and stay organized when facing financial uncertainties.

A: “Bringing Happy Money Home – A Guide for Families” is a book that offers families practical advice on how to manage their finances in a way that promotes happiness and well-being.

A: The author of “Bringing Happy Money Home – A Guide for Families” is [Author’s Name], a financial expert who specializes in family finances and happiness.

A: Incorporating happiness into money management for families is important because it helps create a positive and healthy relationship with money, reduces stress, and promotes overall well-being within the family.

A: The book offers practical tips on budgeting, saving, setting financial goals as a family, teaching children about money, and finding joy in financial decision-making.

A: By fostering open communication about money, encouraging teamwork in financial decisions, and teaching valuable money skills to children, the book can help strengthen family relationships and create a positive money mindset.

A: Yes, the book is designed to be helpful for families of all types, whether you’re a traditional nuclear family, a single-parent household, or any other family structure.

A: “Bringing Happy Money Home – A Guide for Families” is available for purchase online at major book retailers like Amazon, Barnes & Noble, and Book Depository. Check your local bookstore as well.