Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

Overwhelmed by the idea of achieving financial independence? The key might lie in building effective routines that support your goals. In this blog post, we will explore how implementing James Clear’s Atomic Habits can help you establish healthy financial habits that nurture your path to financial independence.

Even the most ambitious financial goals can be achieved through consistent habits and routines. To establish a solid foundation for financial independence, it is crucial to focus on building sustainable habits that align with your goals. For a comprehensive guide on habit formation, check out How to Build New Habits: This is Your Strategy Guide.

Some people define financial independence as the ability to maintain a desired lifestyle without actively working for income. This can be achieved through building passive income streams, investing wisely, and managing expenses effectively. Understanding what financial independence means to you is the first step towards creating a roadmap to reach your goals.

Habits play a critical role in achieving financial goals as they shape our daily behaviors and decisions. By developing positive money habits such as budgeting, saving consistently, and investing regularly, individuals can move closer to financial independence. Cultivating healthy financial habits not only helps in building wealth but also in sustaining it over the long term.

To unlock the full potential of your financial journey, it is vital to cultivate strong habits that lead to financial success. Consistency, discipline, and mindset are key components that can propel you towards your goals. By focusing on building habits that support your financial objectives, you can set yourself up for a secure and prosperous future.

Many of us go through life without paying much attention to our daily financial habits. However, these small actions can have a significant impact on our ability to achieve financial independence. By taking the time to analyze your current financial habits, you can gain valuable insights that will help you make the necessary changes to reach your goals.

The first step in building better financial habits is to understand where you currently stand. Take a moment to review your income, expenses, savings, and investments. Identify any patterns or behaviors that may be holding you back from reaching financial independence. By having a clear picture of your current financial situation, you can create a roadmap for where you want to go.

The key to making lasting changes in your financial habits is to identify which ones are helping you and which ones are hindering you. Assuming you want to achieve financial independence, it’s important to pinpoint the habits that are aligning with this goal and the ones that are working against it. This could include overspending on unnecessary items, not saving enough, or avoiding investment opportunities that could grow your wealth over time.

Not sure where to start when it comes to saving? Setting clear and realistic savings goals is key to building your financial independence. Begin by identifying your short-term and long-term financial objectives. Break down your goals into smaller, achievable milestones to track your progress and stay motivated. Remember to prioritize your goals based on their importance to you and your financial well-being. By setting specific, measurable, and time-bound objectives, you can take proactive steps towards saving more effectively.

Thou, setting effective savings goals can pave the way for long-term financial success and stability. Take the time to define your goals and establish a clear roadmap for your saving journey.

Any moment can be an opportunity to reinforce your saving habits by creating triggers that prompt you to take action. Whether it’s receiving your paycheck or logging into your online banking portal, identify key moments that you can leverage to save consistently. Additionally, establish visual cues such as sticky notes or reminders on your phone to stay focused on your saving goals.

Plus, associating specific actions with your saving habits can help solidify these behaviors over time. By linking saving with routine tasks or daily rituals, you can seamlessly integrate financial wellness into your lifestyle. Make consistency a priority to establish lasting saving habits and achieve your financial goals.

Once again, understanding the factors that influence our spending decisions is crucial in our journey towards financial independence. Some important factors include social influences, emotional triggers, and habitual behavior. Our spending habits are often shaped by our environment, emotions, and routines, making it important to be aware of these influences.

Perceiving these influences can help us make more conscious and intentional decisions about where our money goes, leading us towards a more financially stable future.

Little changes in our daily habits can make a big difference in how we manage our finances. On a daily basis, there are several strategies we can implement to streamline our spending habits and work towards financial independence. From setting a budget to tracking expenses, these practices can help us build a solid financial foundation.

Knowing where our money goes is the first step towards taking control of our financial future and establishing healthy spending habits that support our goals.

On top of setting a budget and tracking expenses, it’s important to regularly assess our spending patterns and adjust as needed. By analyzing where we tend to overspend or where we can cut back, we can make more informed decisions about our finances and work towards financial independence with confidence.

Knowing where adjustments are needed and taking action to course-correct can lead to significant progress towards our financial goals.

Investing can be intimidating for many, with numerous options and risks to consider. Unlike other aspects of your financial journey, where habits play a crucial role, investment decisions can often seem complex and overwhelming. A key strategy to counter this is by simplifying your investment decisions.

The secret to successful investing lies in consistency. The more disciplined and consistent you are with your investments, the better the results over time. Setting up automated transfers to your investment accounts can help ensure you consistently contribute without having to actively remember to do so each month. This approach builds the habit of saving and investing regularly, leading to long-term financial growth.

Another crucial strategy for consistent investment habits is to diversify your investment portfolio. Diversification spreads your risk across different asset classes, reducing the impact of poor performance in any one investment. This approach helps you stay on track towards your financial goals, even during market fluctuations.

Despite the challenges that may arise on your path to financial independence, it is vital to maintain momentum in your journey. By implementing Tiny Steps, Big Money: The Magic of Atomic Investment Habits, you can create a routine that keeps you focused and motivated towards your goals.

Clearly, there will be obstacles along the way that may test your commitment to financial independence. Whether it’s unexpected expenses, market fluctuations, or personal setbacks, maintaining resilience is key. By viewing challenges as opportunities for growth and learning, you can adapt your strategies and stay on course.

Any journey towards financial independence is filled with milestones worth celebrating. Whether it’s paying off a debt, reaching a savings goal, or increasing your investment portfolio, taking time to acknowledge these achievements is crucial for staying motivated. Additionally, adjusting your strategies as you progress can help you stay agile and make necessary changes to continue moving forward towards your ultimate financial goals.

To sustain your momentum in the long run, it’s important to celebrate your wins, no matter how small, and adjust your strategies accordingly. By staying resilient in the face of challenges and remaining flexible in your approach, you can continue making steady progress towards financial independence.

So, by implementing the routine-building strategies outlined in Atomic Habits, you can effectively work towards achieving financial independence. Remember that small changes in your daily habits can lead to significant long-term results. Build positive routines that align with your financial goals and watch as your habits help you reach greater financial stability and independence.

A: Building routine is important for financial independence because it helps in developing consistent habits that lead to better money management, goal setting, and saving practices.

A: Atomic habits focus on making small, incremental changes that compound over time, leading to significant improvements in behavior and outcomes related to finances.

A: Examples of atomic habits for financial independence include tracking daily expenses, setting specific saving targets, automating bill payments, and reviewing financial goals regularly.

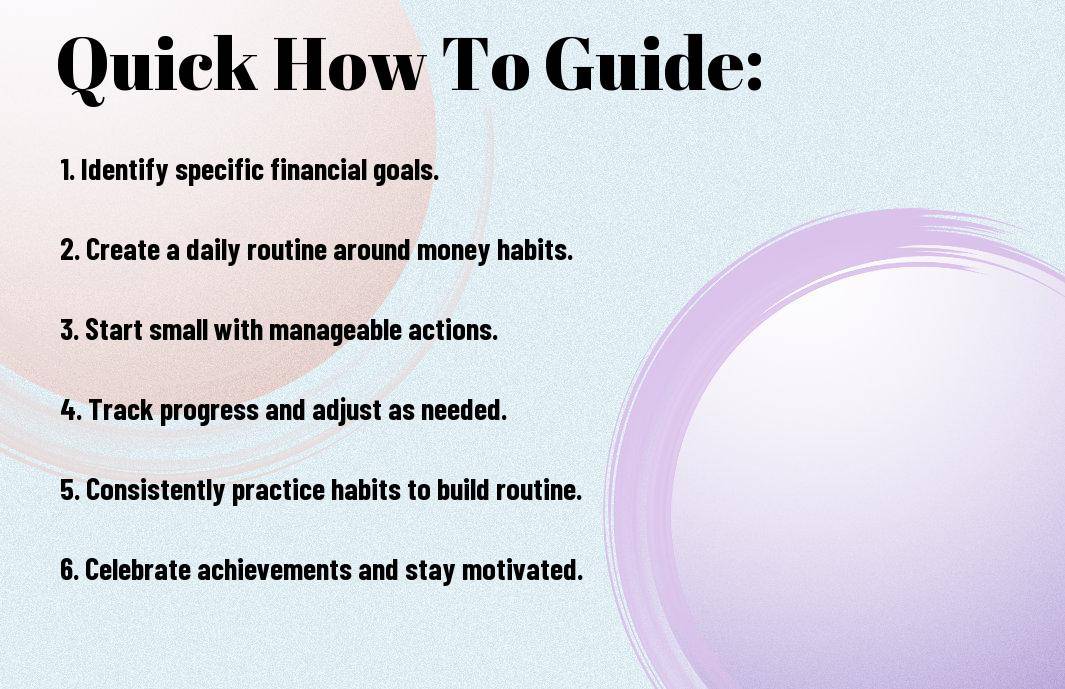

A: To create a routine for financial independence, start by identifying your financial goals, breaking them down into smaller actionable steps, setting a daily schedule for financial tasks, and tracking your progress regularly.

A: Consistency is key in building routines for financial independence as it helps in forming lasting habits, staying committed to financial goals, and making meaningful progress towards financial freedom.

A: Results from implementing atomic habits for financial independence can vary for each individual, but generally, consistent practice of these habits over a few weeks to months can lead to noticeable improvements in financial habits and outcomes.

A: Some challenges one might face include procrastination, lack of motivation, unexpected expenses, breaking old habits, and staying disciplined in following the routine consistently. Overcoming these challenges with determination and perseverance is crucial for long-term success in achieving financial independence.