Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

Happy Money Ken Honda key takeaways! Delve into the profound teachings of Ken Honda’s book “Happy Money” and discover key takeaways that can transform your personal growth journey. By understanding the principles of money and happiness, you can cultivate a mindset that invites abundance and joy into your life. Learn how to shift your perspective on money, gratitude, and self-worth to create a more fulfilling and prosperous existence. Let’s explore the transformative power of happy money and unlock the door to a more enriching life.

Any individual’s relationship with money is complex and deeply rooted in their upbringing, experiences, and beliefs. Ken Honda, in his book ‘Happy Money,’ emphasizes the importance of understanding this relationship to achieve financial well-being and personal growth. By exploring our emotional responses to money and shifting from a scarcity to abundance mindset, we can transform our financial reality and overall happiness.

With money being such a significant aspect of our lives, it is natural to have emotional responses tied to it. Some individuals may feel anxious, stressed, or even guilty about money, while others may experience joy, security, or empowerment. Understanding and acknowledging these emotions is crucial in reshaping our relationship with money. By recognizing our emotional reactions, we can work towards healing any negative associations and cultivate a healthier mindset towards wealth and abundance.

Emotions like fear, shame, or envy around money can hold us back from achieving financial success and fulfillment. It is crucial to explore the root of these feelings and how they influence our money habits and decisions. Through introspection and self-awareness, we can gradually replace these negative emotions with positive ones, leading to a more harmonious relationship with money.

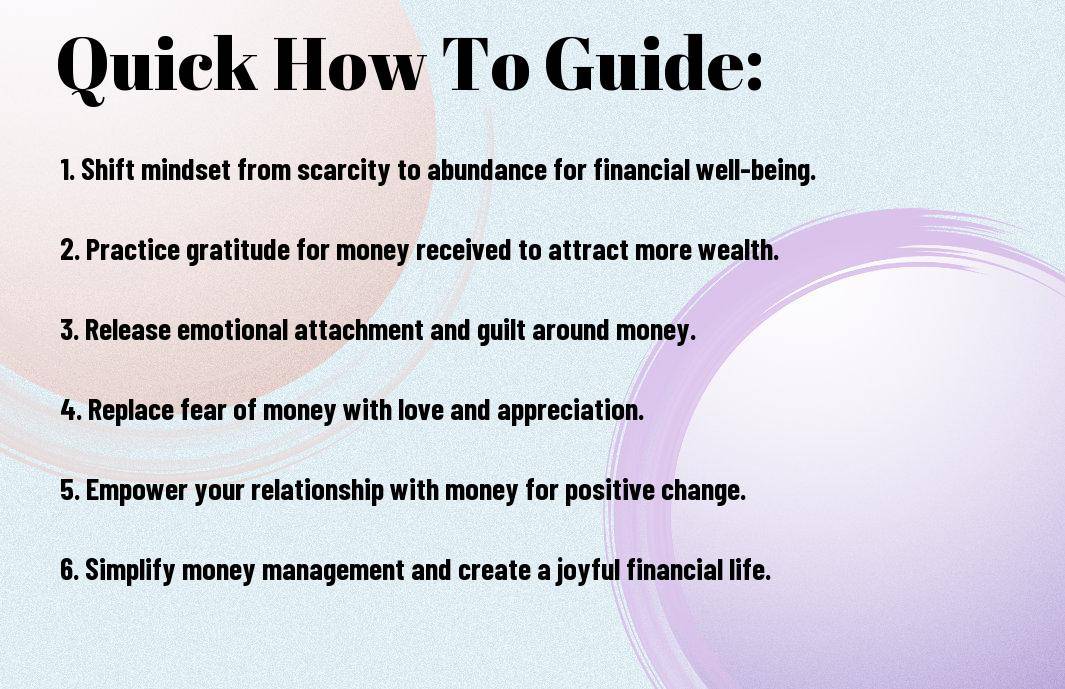

Scarcity mindset is characterized by a fear of lack, constant worry about not having enough, and feelings of deprivation. This mindset can lead to making fear-based financial decisions, hoarding money, or being overly frugal to the point of limiting opportunities for growth and enjoyment. Shifting from scarcity to abundance mindset involves changing our perspective from one of lack to one of gratitude and abundance.

Your mindset plays a significant role in shaping your financial reality. By embracing an abundance mindset, you acknowledge the abundance already present in your life, whether it be in the form of relationships, opportunities, or resources. This shift in perspective allows you to attract more wealth and opportunities, as you become open to receiving and sharing your blessings with others. Cultivating an abundance mindset is a powerful tool in transforming your relationship with money and creating a more fulfilling and prosperous life.

To truly integrate the Happy Money principles into your life, it is imperative to understand and apply the key concepts shared by Ken Honda. By incorporating these principles into your daily routine and mindset, you can cultivate a healthier relationship with money and experience greater happiness and fulfillment in your life.

To cultivate a thankful attitude toward money, start by practicing gratitude for the money you have now, regardless of the amount. Take time each day to reflect on the ways in which money has positively impacted your life, whether it’s providing for your needs, enabling experiences, or offering a sense of security. By shifting your focus to the positives, you can begin to see money as a tool for creating a more abundant and fulfilling life.

To enhance your money happiness, it’s crucial to understand the factors that influence your relationship with money. Your upbringing, cultural influences, and past experiences all play a significant role in shaping your beliefs and attitudes toward money. By gaining awareness of these factors, you can begin to unravel and reframe any limiting beliefs that may be holding you back from experiencing true financial abundance.

For instance, reflecting on how your parents’ attitudes toward money have influenced your own beliefs can provide valuable insights into your money mindset. By examining these influences, you can begin to cultivate a healthier and more empowering relationship with money, leading to greater financial well-being and happiness.

Many people aspire to grow personally and achieve greater fulfillment in life. One often-overlooked aspect of personal growth is the role that financial habits play in shaping our journey. By developing healthy financial habits, individuals can create a positive foundation for personal growth and overall well-being.

On the path to personal growth, creating a positive cash flow is crucial. This involves managing expenses, increasing income streams, and cultivating a mindset of abundance. By tracking expenses, setting a budget, and finding ways to boost your income, you can create a healthy financial flow that supports your personal development goals.

To enhance your financial well-being, consider automating your savings and investments to build a solid financial future. Setting aside a portion of your income for savings and investments can provide a sense of security and create opportunities for growth. By making intentional financial decisions and prioritizing your long-term goals, you can lay the groundwork for a prosperous future.

Financial well-being is deeply interconnected with personal growth. By investing in activities and practices that nourish your well-being, you can cultivate a positive mindset and resilience in the face of challenges. Take the time to prioritize self-care, invest in experiences that bring you joy, and seek opportunities for growth and learning.

Financial investments in your well-being can take various forms, such as investing in education, health, relationships, and personal development. Allocate resources towards activities that align with your values and contribute to your overall well-being. By taking a holistic approach to financial management and well-being, you can create a fulfilling and balanced life that supports your personal growth journey.

Your financial journey to personal growth and abundance starts now. By implementing the Happy Money principles shared by Ken Honda, you can transform your relationship with money and experience true wealth in all areas of your life.

With a Happy Money mindset, debt can be seen as an opportunity for growth and learning rather than a burden. Take the time to understand your debts, create a plan to pay them off, and view each payment as a step towards financial freedom. By shifting your perspective on debt, you can release feelings of stress and anxiety and move towards a healthier financial future.

Note, debt is simply a tool that can be used to achieve your goals. By approaching it with a Happy Money mindset, you can leverage debt in a positive way and take control of your financial well-being.

To cultivate mindful spending and saving habits, start by tracking your expenses and identifying areas where you can cut back. Set clear financial goals for yourself and create a budget that aligns with your values and priorities. By practicing gratitude for what you have and focusing on intentional spending, you can make wiser financial decisions that support your overall well-being.

Approach your finances with a sense of mindfulness and intentionality. By adopting a Happy Money mindset, you can create a healthy relationship with money and experience true wealth and abundance in your life. Any decision you make regarding your finances has the power to shape your future, so choose wisely.

With this in mind, embracing the principles outlined in Happy Money by Ken Honda can lead to significant personal growth. By recognizing the connection between our emotions and financial well-being, we can cultivate a healthier relationship with money and ultimately increase our happiness. Ken Honda’s key takeaways offer valuable insights into how we can transform our mindset about money and abundance. To investigate deeper into these concepts, check out My Notes from the Book – Happy Money. By Ken Honda for a more comprehensive understanding of this transformative approach.

A: Happy Money Ken Honda is a well-known author, speaker, and personal development expert who is known for his teachings on financial well-being and personal growth.

A: Some key takeaways from Happy Money Ken Honda’s teachings include the importance of having a positive relationship with money, the concept of “happy money” vs. “unhappy money,” and the idea that money can bring happiness when used in alignment with your values.

A: Happy Money Ken Honda’s principles can help with personal growth by shifting your mindset around money, helping you develop a healthier relationship with finances, and ultimately leading to greater overall well-being and fulfillment.

A: “Happy money” is a term coined by Ken Honda that refers to money that is earned, spent, and received with a sense of gratitude, joy, and positivity. This kind of money has the power to bring more happiness and abundance into your life.

A: You can start implementing Happy Money Ken Honda’s teachings in your life by practicing gratitude for the money you have, adopting a positive mindset when it comes to finances, and being mindful of how you earn and spend your money.

A: Happy Money Ken Honda addresses common misconceptions about money such as the belief that more money equals more happiness, the idea that money is inherently evil, and the notion that financial success is only achieved through hard work and sacrifice.

A: Happy Money Ken Honda’s teachings can help improve your overall well-being by reducing financial stress and anxiety, fostering a more positive relationship with money, and ultimately leading to a greater sense of peace, fulfillment, and happiness in your life.