Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

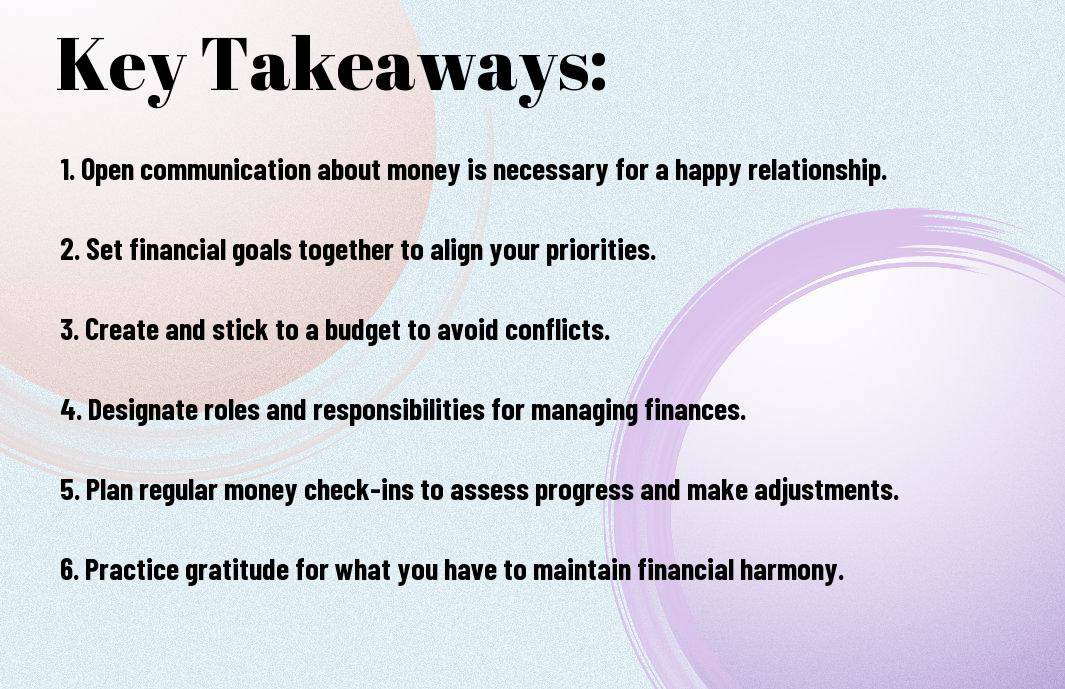

Money Tips for Couples! You know what they say, money matters can make or break a relationship. In terms of managing finances as a couple, it’s necessary to find harmony to ensure both partners are on the same page. In this blog post, we will share tips and strategies to help you and your significant other achieve financial bliss together. For more detailed tips on managing money as a couple, check out Valentine’s Day financial bliss: Five money management …. Let’s dive in and discover how you can create happy money habits with your partner!

Even in the strongest relationships, communication is necessary, especially when it comes to money matters. Building a healthy financial dialogue with your partner can lead to a harmonious and happy relationship.

With a calm and open mindset, sit down with your partner to establish ground rules for discussing finances. Agree on a safe space and time to have these conversations, ensuring that both parties feel respected and heard.

When discussing budgets, goals, and financial decisions, agree to listen actively, avoid blame, and focus on finding solutions together. Recall, you’re a team working towards a shared future.

With sensitivity and understanding, approach sensitive financial topics by acknowledging each other’s feelings and perspectives. Practice empathy and compassion when discussing challenging subjects like debt, spending habits, or financial fears.

It’s important to be patient and supportive during these discussions, listening to your partner’s concerns without judgment. Recall, your goal is to strengthen your relationship and reach financial agreements that work for both of you.

Not being on the same page about finances can create tension in a relationship. To avoid conflicts and build a strong financial foundation, couples should plan together for a brighter future.

Brighter Begin by discussing individual financial goals and dreams, then work together to craft shared financial goals that reflect your collective values and aspirations. These goals could include saving for a dream vacation, buying a house, or planning for retirement. Be mindful of, your goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

Brighter Schedule regular check-ins to track your progress and make adjustments as needed. Celebrate milestones together and support each other through challenges. By aligning your financial goals, you’ll strengthen your relationship and pave the way for a brighter future together.

Team Embrace budgeting as a team sport. Utilize tools like budgeting apps, spreadsheets, or even good old pen and paper to track your income, expenses, and savings goals. Assign roles based on each other’s strengths and interests, whether it’s managing bills, monitoring investments, or finding ways to cut costs.

Team Communicate openly and honestly about your financial situation. Set aside time regularly to review your budget, discuss any upcoming expenses, and address any concerns. By working together as a team, you’ll build trust, improve financial literacy, and achieve your goals faster.

Any successful budget is built on collaboration and compromise. Be mindful of, it’s not about sacrificing individual wants, but rather prioritizing your shared financial well-being. By approaching budgeting as a team, you’ll strengthen your relationship and set yourselves up for a brighter financial future.

Your journey towards financial harmony as a couple may have its share of challenges, but facing them together will only strengthen your bond and secure your future.

Challenges related to debt can be daunting, but remember, you’re a team. Start by openly discussing your debts and creating a plan together to tackle them. Establishing a joint savings account can also help in building a financial cushion for unexpected expenses or future goals.

Uncertainty is common when it comes to finances, but by working as a unit, you can navigate through it successfully. Set clear financial goals and regularly review your progress. This will not only keep you both accountable but also create a sense of accomplishment when you achieve those milestones together.

Stress related to finances can take a toll on relationships if not addressed proactively. Communication is key in such situations. Listen to each other’s concerns without judgment and offer support. Note, you’re a team, and together you can overcome any financial challenge that comes your way.

Unlike popular belief, achieving financial happiness as a couple doesn’t have to be a daunting task. By incorporating positive habits and making small changes in your daily routine, you can create a sense of harmony in your finances. Here are some simple tips to help you foster everyday joy in your financial journey together:

Assume that by incorporating these small changes into your routine, you can cultivate a sense of financial well-being that will bring you closer as a couple.

Financial harmony in a relationship often stems from the daily habits that couples practice. Simple actions like setting a budget together, tracking expenses, and having regular money dates can contribute to a healthier financial partnership. These habits create a strong foundation of trust and transparency in your relationship, making it easier to navigate financial challenges together.

Couples who prioritize open communication about money, set shared financial goals, and make joint decisions about their finances are more likely to feel secure and aligned in their financial journey.

Habits of financially happy couples also include knowing when to splurge and when to hold back. It’s important to find a balance between enjoying life’s luxuries and being responsible with your finances. By identifying your priorities and understanding each other’s spending habits, you can make informed decisions about when to treat yourselves to something special and when to save for the future.

When you find that perfect balance between enjoying the present moment and planning for the future, you can create a sense of fulfillment and contentment in your financial life together.

Ultimately, achieving financial harmony in a relationship requires open communication, understanding, and compromise. By acknowledging and respecting each other’s money mindset, couples can create a solid foundation for managing their finances together. For more tips on understanding your partner’s money mindset, check out Understanding Your Partner’s Money Mindset: The Key to Financial Harmony. Recall, working together towards common financial goals can lead to a happier and more fulfilling partnership.

A: Financial harmony in a relationship is crucial as it enables couples to work together towards common financial goals, reduces conflicts over money, and strengthens trust and communication.

A: Couples can achieve financial harmony by discussing their financial values and goals openly, creating a joint budget, and regularly communicating about their finances.

A: Some tips for managing finances as a couple include setting financial goals together, creating a monthly budget, saving for emergencies, and discussing major purchases before making them.

A: Couples can handle differences in spending habits by finding a middle ground, setting spending limits, and discussing the reasons behind their spending habits with understanding and empathy.

A: Saving and investing as a couple can help build financial security for the future, enable couples to reach their financial goals faster, and strengthen their partnership through shared accomplishments.

A: Couples can navigate financial challenges together by staying united, seeking professional financial advice when needed, and working as a team to find solutions that benefit both partners.

A: Celebrating financial milestones as a couple helps reinforce positive financial behaviors, strengthens the bond between partners, and encourages continued teamwork towards financial success.