Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

Financial Mindset! You can transform your financial outlook by embracing happy money principles that focus on emotional well-being rather than just monetary wealth. By understanding the psychology behind spending and saving, you can develop a healthier relationship with money that leads to lasting happiness and financial stability. Say goodbye to stress and anxiety about money and hello to a positive mindset that will benefit your overall well-being.

Clearly, transforming your financial mindset is a powerful way to improve your overall well-being. By adopting Happy Money principles, you can shift your perspective on money and create a more positive relationship with your finances.

With Happy Money principles, you can gain a deeper understanding of your relationship with money. It’s vital to reflect on your past experiences, beliefs, and emotions surrounding money to uncover any negative patterns or limiting beliefs that may be holding you back.

By acknowledging and addressing these factors, you can begin to cultivate a healthier mindset towards money. This self-awareness is the first step towards transforming your financial well-being and creating a positive relationship with money.

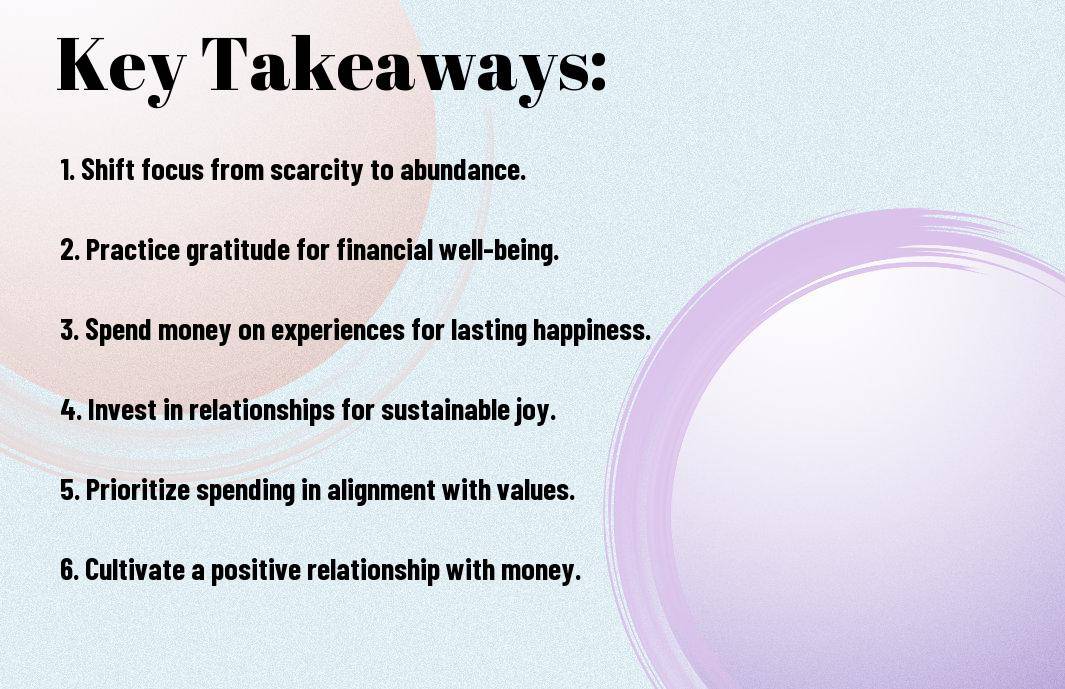

An abundance mindset is vital for attracting more prosperity and fulfillment into your life. By shifting from a scarcity mindset, where you focus on what you lack, to an abundance mindset, where you appreciate what you have, you can open yourself up to greater opportunities and abundance.

To make this shift, practice gratitude for the resources and opportunities you currently have, and visualize your financial goals as already achieved. This mindset shift can attract more positive energy and financial prosperity into your life.

To fully embrace the Happy Money mindset, it’s crucial to consistently practice gratitude, positivity, and abundance in your daily life. By cultivating these habits, you can transform your relationship with money and create a more prosperous and fulfilling financial future.

Despite the hustle and bustle of daily life, incorporating Happy Money principles into your financial mindset can bring a profound shift in your overall well-being. By understanding and embracing these principles, you can cultivate a healthier relationship with money and enhance your overall happiness.

Practicing mindful spending involves being intentional with your purchases and understanding the true value they bring to your life. Before making a buying decision, pause and reflect on whether the item or experience aligns with your values and long-term goals. This shift in mindset can help you prioritize purchases that truly matter to you, leading to greater satisfaction and fulfillment.

Additionally, mindful spending encourages you to focus on quality over quantity. Instead of chasing the latest trends or succumbing to impulse buys, take the time to consider the lasting impact of your purchases. By making intentional choices and avoiding unnecessary expenses, you can create a more meaningful and sustainable relationship with your finances.

Mindful investing in experiences and relationships emphasizes the importance of allocating your resources towards activities and connections that nourish your soul. Research shows that spending money on experiences, like travel or dining with loved ones, tends to bring more lasting happiness than material possessions. Similarly, nurturing relationships through quality time and shared experiences can enrich your life in ways that money alone cannot.

Spending on experiences and relationships not only enhances your well-being but also fosters a sense of belonging and fulfillment. When you prioritize meaningful interactions and memorable moments over material wealth, you invest in a wealth of happiness that transcends monetary value.

One of the first steps in transforming your financial mindset with Happy Money principles is to keep track of how your purchases are affecting your overall happiness. There are various tools and apps available that can help you monitor your expenses and gauge your satisfaction levels with each spending.

Consider using a happiness tracker or journal to keep notes on how different purchases make you feel. By actively reflecting on your spending habits and their impact on your well-being, you can make more informed decisions about where to allocate your money in the future.

Happy Money encourages creating a budget that aligns with your values and brings you joy. Happy budgets are not just about restrictions; they are about prioritizing spending on things that truly matter to you and bring happiness into your life.

With a joyful budget, you can allocate resources towards experiences and items that have a positive impact on your well-being. This approach can help you live a more fulfilling life while also achieving your financial goals.

Now, if you’re looking to transform your financial mindset with the principles of Happy Money: The Science of Smarter Spending, it’s crucial to address and overcome common financial obstacles that can hinder your progress towards financial well-being.

Financial beliefs play a significant role in shaping our financial behavior. Some of these beliefs may be deeply ingrained and could be holding you back from achieving your financial goals. *It’s important to identify and challenge these beliefs to pave the way for a healthier financial mindset.* By questioning and reframing negative money beliefs, you can open up new possibilities for financial growth and success.

That said, debt is a common financial obstacle that many people face. *However, it’s crucial to approach debt management with a positive spin.* Instead of viewing debt as a burden, see it as an opportunity to learn valuable lessons in financial responsibility and discipline. By creating a realistic repayment plan and focusing on progress rather than perfection, you can gradually work towards becoming debt-free.

Any successful debt management strategy should also include regular budget reviews, seeking opportunities to increase income, and exploring options for consolidating or refinancing debt to reduce interest rates. *By staying proactive and optimistic in your approach to debt management, you can take control of your financial situation and set yourself up for long-term financial stability.*

To truly transform your financial mindset and create a future filled with happiness and abundance, it’s vital to apply the principles of Happy Money in every aspect of your financial life. By understanding how to use money in a way that brings joy and fulfillment, you can build a foundation for a secure and prosperous future.

With Happy Money principles, setting financial goals goes beyond just numbers and milestones. It involves aligning your goals with your values, passions, and overall sense of happiness. When you set goals that are in line with what truly brings you joy, you are more likely to stay motivated and committed to achieving them.

One way to set goals aligned with happiness is to focus on experiences and relationships rather than material possessions. Whether it’s saving up for a dream vacation with your loved ones or investing in activities that bring you joy, prioritize spending on things that truly make you happy in the long run.

One of the keys to sustaining your financial transformation is to continue practicing gratitude and mindfulness when it comes to money. By appreciating what you have and being intentional about where your money goes, you can continue to create a positive and fulfilling relationship with your finances.

Consistency is key when it comes to sustaining your financial transformation. Make a habit of regularly reviewing your goals, tracking your progress, and making adjustments as needed. By staying proactive and engaged with your finances, you can ensure that you are always moving towards a future filled with abundance and happiness.

Goals achieved through happy money principles can lead to long-lasting fulfillment and contentment. By staying true to your values and focusing on what truly brings you joy, you can build a future that is not only financially secure but also emotionally rewarding. Embrace the power of happy money to transform your financial mindset and create a life filled with abundance.

All good things must come to an end, including our journey into transforming your financial mindset with Happy Money principles. But fear not, for the lessons learned and practices adopted will stay with you for a lifetime. As you continue to embrace the happiness-driven approach to money, remember that your mindset is the key to unlocking a more fulfilling and abundant financial future.

An important aspect to consider is the ripple effect of Happy Money practices. When you invest in experiences, make mindful purchases, and prioritize connections with others, you not only benefit yourself but also positively impact those around you. Your newfound financial mindset can inspire others to reassess their own relationship with money, creating a ripple effect of happiness and abundance.

An necessary part of cultivating financial happiness is incorporating practices that align with your values and goals. By consistently choosing to spend on what truly brings you joy, practicing gratitude for what you have, and setting intentions for your financial decisions, you are actively shaping a future filled with abundance and contentment.

With every financial decision you make, you have the opportunity to reinforce your commitment to a happy and fulfilling life. By mindfully reflecting on your spending habits, seeking ways to align your values with your financial choices, and staying true to your intentions, you can continue to nurture your financial happiness and well-being.

A: Happy Money Principles are guidelines that help transform your financial mindset by focusing on how money can bring joy, fulfillment, and happiness to your life.

A: By embracing Happy Money Principles, you can cultivate a positive relationship with money, make better financial decisions, and ultimately lead a more fulfilling life.

A: Yes, Happy Money Principles are accessible to everyone regardless of their income level or financial situation.

A: Key aspects include spending money on experiences rather than material possessions, investing in relationships, giving back to others, and practicing gratitude for what you have.

A: You can start by assessing your current spending habits and values, setting financial goals that align with your values, practicing mindful spending, and reflecting on the impact of your financial decisions on your overall well-being.

A: Embracing Happy Money Principles may involve some adjustments to your spending habits and mindset, but it is more about shifting your perspective on money rather than making drastic changes to your lifestyle.

A: You can explore books, online resources, workshops, and courses that explore deeper into Happy Money Principles and provide practical tips on how to apply them in your daily life.