Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

Delve into the intriguing world of personal finance and mindset with this guide to understanding the Happy Money philosophy by renowned author Ken Honda. Discover the secrets behind viewing money as a source of happiness and fulfillment rather than stress and anxiety. Uncover practical tips and insights on how to cultivate a positive relationship with your finances and ultimately lead a more harmonious and prosperous life. Dive into this comprehensive breakdown of Ken Honda’s transformative principles and start on your journey to financial well-being and emotional wealth today.

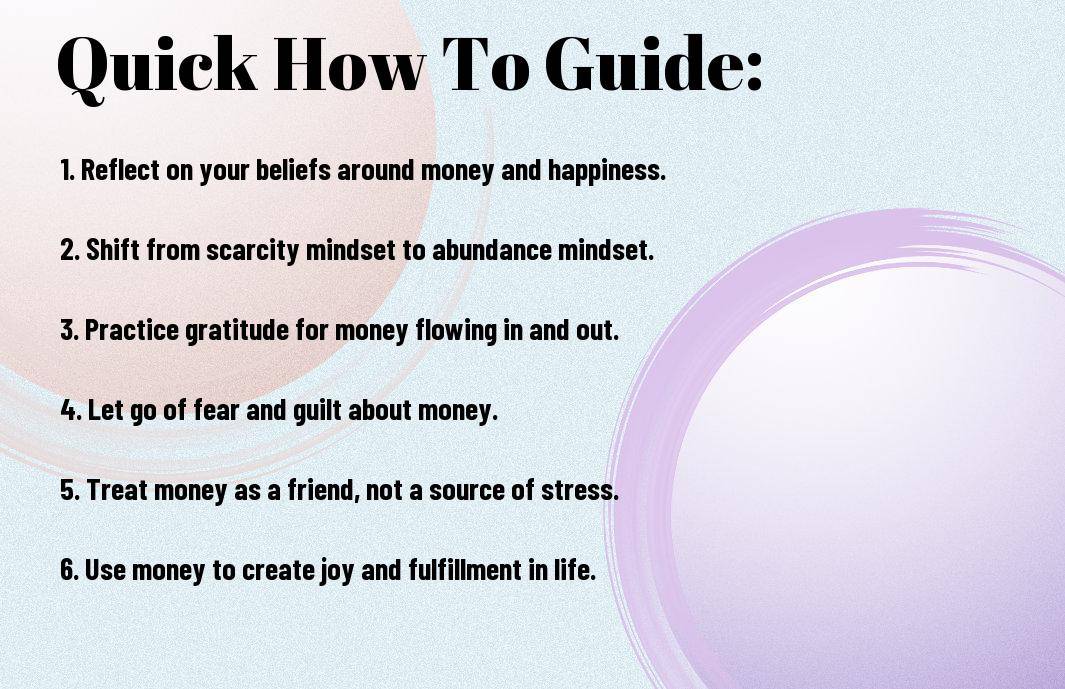

Assuming you are ready to transform your relationship with money and cultivate a happy money mindset, there are key steps you can take to achieve financial well-being and abundance in your life. The philosophy of Happy Money, as articulated by Ken Honda, emphasizes the importance of understanding your emotional relationship with money and releasing negative money emotions to invite more wealth and positivity into your life.

Relationship with money is deeply intertwined with our emotions and beliefs. Our past experiences, upbringing, and societal conditioning all play a role in shaping how we perceive money. Ken Honda encourages individuals to explore their emotional responses to money – whether it is fear, guilt, shame, or joy – and understand the root causes behind these feelings. By acknowledging and accepting our emotional relationship with money, we can begin the process of healing and transforming our mindset towards a more positive and abundant outlook.

It is crucial to recognize that our emotions and beliefs about money directly impact our financial behaviors and outcomes. By taking the time to reflect on our money stories and patterns, we can gain valuable insights into our relationship with money and make conscious choices to shift towards a happier and healthier mindset.

One of the key practices in cultivating a happy money mindset is to release negative money emotions that may be holding you back from experiencing financial abundance. Some tips to help you release these emotions include:

With a willingness to let go of old patterns and embrace new beliefs, you can start to shift your energy towards attracting more positive experiences with money. By perceiving money as a source of joy, gratitude, and abundance, you can create a new reality where financial well-being flows effortlessly into your life.

Keep a positive mindset and open yourself up to receiving abundance in all forms, including money. Happy Money flows freely to those who are grateful and appreciative of the wealth that comes their way. By adopting an attitude of abundance and positivity, you can attract more Happy Money into your life.

For those seeking to invite more Happy Money into their lives, it is important to consider the factors that influence money happiness. These may include your beliefs about money, your relationship with money, and the energy you put out into the universe regarding wealth. Any negative self-talk or limiting beliefs about money can block the flow of Happy Money into your life.

Factors such as your financial goals, spending habits, and investment choices can all impact the happiness of your money. By setting clear financial goals, monitoring your expenses, and making conscious decisions about where to invest your money, you can increase the happiness of your wealth. The key is to align your actions with your values and priorities to ensure that your money is bringing you joy and peace of mind.

Factors such as financial security, autonomy, and the ability to support your desired lifestyle can all contribute to the happiness of your money. The more in tune you are with your financial needs and aspirations, the happier your money will be. The key is to create a healthy and harmonious relationship with money that brings you not only wealth but also joy and fulfillment.

To truly sustain happiness in our lives, it is important to understand the philosophy of Happy Money, as advocated by Ken Honda. Happy Money is the concept of using your money in a way that brings joy, fulfillment, and positivity into your life. While many people believe that acquiring more money will lead to increased happiness, Ken Honda suggests that true happiness comes from how we choose to spend our money.

Sustaining happiness through money starts with identifying what expenditures bring you true joy and contentment. Ken Honda encourages individuals to reflect on their purchases and expenses to determine which ones contribute positively to their well-being. A happy money expenditure is one that aligns with your values, brings a sense of fulfillment, and nurtures your relationships and personal growth.

By recognizing the difference between expenditures that bring temporary pleasure and those that sustain long-term happiness, you can make more conscious choices with your money. Happy Money expenditures are those that leave you feeling grateful, fulfilled, and connected to the people and experiences that matter most to you.

When practicing mindful spending according to Happy Money principles, it is important to focus on experiences rather than material possessions. Invest in activities, travel, or learning opportunities that enrich your life and create lasting memories. Avoid impulsive purchases and prioritize investments that align with your values and long-term goals.

The key to sustaining happiness through mindful spending is to cultivate a deep appreciation for the value that your money brings to your life. By prioritizing experiences and investments that align with your values and goals, you can create a sustainable source of joy and fulfillment that extends beyond material possessions.

On the whole, delving into Ken Honda’s philosophy of Happy Money has been enlightening and empowering. Learning to understand the energy and emotions behind our financial transactions can truly transform our relationship with money and bring us a sense of peace and abundance. For more insights on unlocking the potential of Happy Money for a prosperous and fulfilled life, check out this article on Unleash the Power of Happy Money for a Prosperous, Fulfilling Life.

A: Ken Honda is a bestselling author from Japan who focuses on the concept of Happy Money, which is the idea of transforming our relationship with money to bring more joy and fulfillment into our lives.

A: The philosophy behind Happy Money is based on the belief that money can be a source of happiness and positive energy when used and received with gratitude, generosity, and mindfulness.

A: Ken Honda suggests that we can improve our relationship with money by practicing gratitude for what we have, being mindful of our spending and saving habits, and approaching money with a spirit of generosity and positivity.

A: Some practical tips from Ken Honda include expressing gratitude for the money we receive, letting go of limiting beliefs around money, and cultivating a mindset of abundance and positivity.

A: Embracing the Happy Money philosophy can lead to a greater sense of peace, contentment, and joy in our lives, as we learn to view money as a tool for enhancing our well-being and the well-being of others.

A: Yes, the Happy Money philosophy is accessible to everyone, regardless of their current financial situation. It’s more about our mindset and attitude towards money than the actual amount we possess.

A: We can start implementing the principles of Happy Money by practicing gratitude for the money we have, setting clear intentions for how we want to use and receive money, and being mindful of our financial interactions and decisions.