Embark on a journey to redefine your relationship with money and pave the way for prosperity with the revolutionary concept of Happy Money. By incorporating Buddhist principles and modern psychology, Happy Money offers a fresh perspective on financial abundance and well-being. In this guide, we will explore practical strategies and mindset shifts to help you cultivate a more positive and fulfilling approach to money management. Say goodbye to limited beliefs and scarcity mindset, and welcome a new era of financial empowerment and joy.

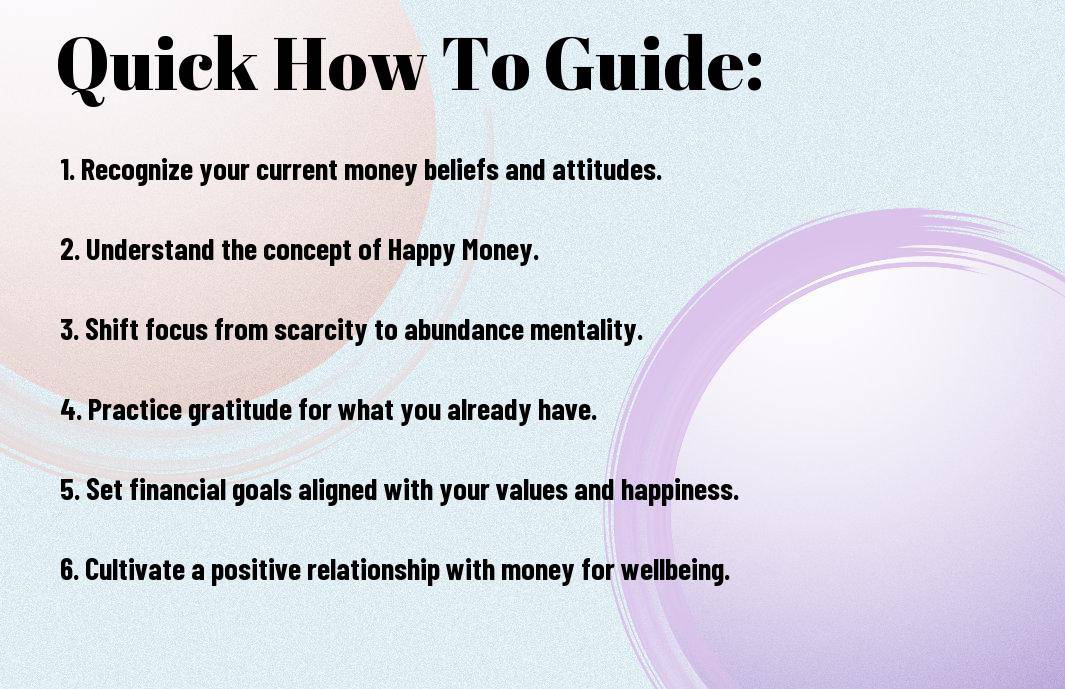

Key Takeaways:

- Understanding the concept of Happy Money: Happy Money focuses on the emotional connection to money and promotes spending on experiences rather than material goods.

- Shifting from a scarcity mindset to an abundance mindset: Changing your perspective from lack to prosperity can lead to a more positive relationship with money.

- Practicing gratitude for financial assets: Acknowledging and appreciating what you have can increase feelings of abundance and contentment.

- Setting financial goals aligned with values: Aligning your financial goals with your core values can bring a sense of purpose and fulfillment to your money management.

- Focusing on financial well-being over wealth accumulation: Prioritizing financial well-being, including security, freedom, and peace of mind, can lead to a more fulfilling life.

- Embracing mindful spending habits: Being aware of your spending choices and their impact can lead to more intentional and fulfilling financial decisions.

- Investing in experiences and relationships: Prioritizing experiences and relationships over material possessions can lead to greater happiness and well-being in the long run.

Assessing Your Current Financial Mindset

Little do we realize how much our mindset about money can impact our financial well-being. By taking the time to assess your current financial mindset, you can start making positive changes to secure a more prosperous future.

Identifying Your Money Beliefs

An necessary step in transforming your financial mindset is to identify your money beliefs. These are the deep-rooted thoughts and attitudes you hold about money that have been shaped by your upbringing, experiences, and societal influences. Whether you believe that money is scarce and hard to come by, or if you see it as abundant and a tool for creating opportunities, your money beliefs play a significant role in shaping your financial reality.

Reflect on your attitudes towards saving, spending, investing, and earning. Do you feel guilty when you spend money on yourself? Are you constantly worried about not having enough? Understanding your money beliefs is crucial in helping you uncover any negative thought patterns that may be holding you back from financial abundance.

The Impact of Your Attitude on Finances

For many individuals, their attitude towards money can either propel them towards financial success or keep them stuck in a cycle of lack. Your attitude towards money influences your financial decisions, habits, and ultimately, your financial outcomes. If you have a positive and abundance mindset, you are more likely to take risks, seek opportunities for growth, and attract wealth into your life.

This is why it is crucial to cultivate a positive attitude towards money. By shifting your mindset from scarcity to abundance, you can open yourself up to new possibilities and create a healthier relationship with money. Recognizing the impact of your attitude on your finances is the first step towards transforming your financial reality for the better.

Principles of Happy Money

Your financial mindset plays a crucial role in shaping your relationship with money. By understanding the principles of Happy Money, you can transform your attitude towards finances and cultivate a more positive and fulfilled life.

Understanding the Psychology Behind Spending

Any understanding of Happy Money begins with delving into the psychology behind spending. Research has shown that how we spend our money is directly linked to our happiness levels. It’s imperative to recognize that experiences bring more lasting joy than material possessions. By prioritizing experiences over material goods, you can maximize the happiness derived from your spending.

Furthermore, the way we allocate our money can also impact our well-being. Investing in others and contributing to causes we care about can create a sense of fulfillment and purpose. Understanding the emotional aspects of spending is key to unlocking the potential for Happy Money in your life.

Tips for Aligning Your Finances with Happiness

Finances are intertwined with our overall well-being, and aligning your financial decisions with your happiness goals is crucial. To start, consider setting clear financial priorities that align with your values and long-term objectives. By defining what truly matters to you, you can make more intentional and fulfilling choices with your money.

After understanding your priorities, create a budget that reflects your values and allows you to allocate resources towards experiences that bring joy and fulfillment. Establishing a healthy relationship with money involves mindful spending and saving habits that support your overall happiness and well-being.

Understanding the psychology behind spending and aligning your finances with happiness are key principles of Happy Money. By prioritizing experiences over material possessions and investing in what truly matters to you, you can transform your financial mindset and cultivate a more fulfilling life.

Practical Steps to Transform Your Financial Mindset

How to Create a Happy Money Plan

All great transformations start with a solid plan, and your financial mindset is no exception. To create a Happy Money plan, start by evaluating your current financial situation. Take a close look at your income, expenses, savings, and debt. Set clear financial goals that align with your values and priorities. Create a budget that allows you to live within your means while still enjoying life. Make a plan to track your progress and adjust as needed.

Another important step in creating a Happy Money plan is to practice gratitude for what you already have. Cultivate a mindset of abundance rather than scarcity. Focus on the positive aspects of your financial situation and look for ways to increase your financial well-being through smart choices and mindful spending.

Factors to Consider for Long-Term Financial Well-Being

When transforming your financial mindset, it’s necessary to consider factors that contribute to long-term financial well-being. This includes building an emergency fund to cover unexpected expenses, investing in your future through retirement accounts or other investments, and protecting your assets with insurance. Additionally, consider ways to increase your income through career advancement, side hustles, or passive income streams to secure your financial future.

- Regularly review and adjust your financial plan to stay on track towards your goals.

The journey to long-term financial well-being involves cultivating healthy financial habits, such as saving regularly, avoiding debt, and investing wisely. It’s important to educate yourself about personal finance and seek guidance from financial professionals when needed. By taking a proactive approach to your financial well-being, you can ensure a stable and secure financial future for yourself and your loved ones.

- Stay disciplined and focused on your financial goals, making mindful decisions with your money.

Maintaining a Happy Money Mindset

Daily Habits for Sustaining Positive Financial Behavior

Keep your financial mindset in check by incorporating daily habits that reinforce positive financial behavior. Start each day by reviewing your financial goals and priorities. Take a few minutes to track your expenses and income to stay on top of your financial situation. By staying conscious of your financial habits on a daily basis, you can make small adjustments as needed to stay aligned with your goals.

To further sustain positive financial behavior, practice gratitude for your current financial situation. Take time to appreciate the resources you have and the progress you’ve made towards your financial goals. By fostering a mindset of abundance and gratitude, you can shift your perspective towards a more positive relationship with money.

Measuring Your Progress and Adjusting Your Approach

To ensure you are on track with your financial goals, regularly measure your progress and adjust your approach as needed. Keep track of your savings, investments, and debts to monitor your financial growth. Set benchmarks and milestones to celebrate your achievements and stay motivated on your financial journey.

Behavioral patterns can sometimes hinder your financial progress. If you notice any negative behaviors or thought patterns impacting your financial mindset, take the time to reflect and make necessary changes. Seek support from financial advisors or resources to help you stay on track and adjust your approach for long-term success.

Final Words

Conclusively, transforming your financial mindset with Happy Money is a powerful way to take control of your financial well-being. By understanding and shifting your beliefs about money, you can create a positive and abundant relationship with your finances. To learn more about how you can improve your money mindset, visit the Money Mindset sales page today and start your journey towards financial happiness.

FAQ

Q: What is Happy Money and how does it help in transforming your financial mindset?

A: Happy Money is a concept that focuses on the emotional aspects of money and how it can impact our overall well-being. By understanding and embracing Happy Money principles, you can change your relationship with money and shift towards a more positive and abundant financial mindset.

Q: How can practicing gratitude improve my financial mindset?

A: Practicing gratitude allows you to focus on the abundance in your life rather than scarcity. This shift in perspective can help you make better financial decisions, prioritize what truly matters, and attract more positivity and prosperity into your life.

Q: What role does mindfulness play in transforming your financial mindset?

A: Mindfulness helps you become more aware of your thoughts, emotions, and behaviors around money. By practicing mindfulness, you can make more conscious financial choices, avoid impulsive decisions, and cultivate a sense of calm and clarity in your financial life.

Q: How does setting intentions impact my financial mindset?

A: Setting intentions allows you to clarify your financial goals and align your actions with your values. By setting clear intentions around money, you can stay focused, motivated, and proactive in creating the financial future you desire.

Q: What are some practical tips for cultivating a Happy Money mindset?

A: Some practical tips for transforming your financial mindset with Happy Money include creating a gratitude journal, practicing mindful spending, setting financial goals, visualizing your financial success, and surrounding yourself with positive influences.

Q: How can I overcome limiting beliefs and fears about money?

A: To overcome limiting beliefs and fears about money, it’s important to first identify and acknowledge them. Then, challenge these beliefs by reframing them in a more positive light, seeking support from mentors or coaches, and taking small steps towards financial empowerment and growth.

Q: How long does it take to see results from transforming your financial mindset with Happy Money?

A: The timeline for seeing results from transforming your financial mindset with Happy Money may vary for each individual. Some may experience immediate shifts in their attitude and behaviors around money, while for others, it may take time and consistent effort to see lasting changes. It’s important to be patient, persistent, and committed to the process of transforming your financial mindset for long-term success.