College students and Money! Embark on a journey to financial freedom as a college student with our expert tips on managing your money wisely and cultivating a positive relationship with your finances. In this guide, we will reveal the secrets to creating a budget that works for you, saving for the future, and finding satisfaction in your financial decisions. Take control of your financial well-being and pave the way for a brighter future with our Happy Money advice.

Key Takeaways:

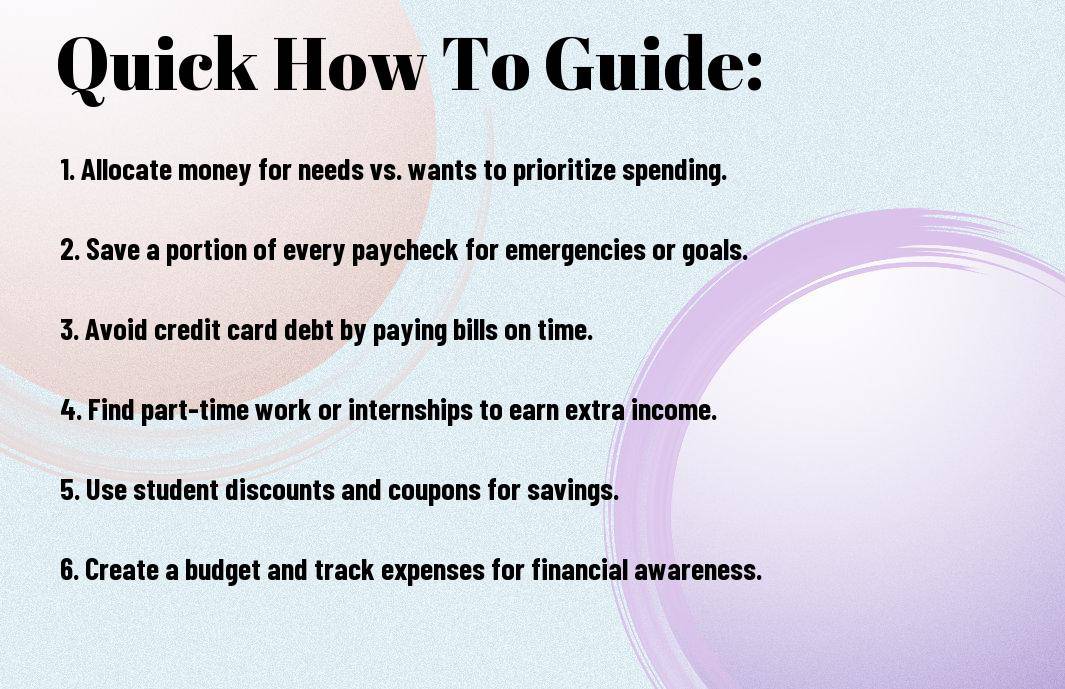

- Create a budget: Establish a budget to help manage your finances and include all expenses such as tuition, books, housing, and personal expenses.

- Avoid credit card debt: Be cautious with credit cards to prevent accumulating debt and high-interest payments.

- Save consistently: Develop a habit of saving money regularly, even if it’s a small amount, to build a financial cushion for emergencies or future goals.

- Invest in experiences: Prioritize spending on experiences rather than material possessions as they usually provide more long-lasting happiness.

- Be mindful of lifestyle inflation: As your income increases, avoid the temptation to increase your spending at the same rate to maintain financial stability.

- Utilize student discounts: Take advantage of student discounts on various products and services to save money while you are in college.

- Consider part-time work: Explore part-time job opportunities that can help cover your expenses and provide practical experience for your future career.

How-To Establish Your Financial Foundation

Little by little, you can build a strong financial foundation that will set you up for success throughout your college years and beyond. One of the key steps in establishing your financial security is creating a realistic budget that helps you manage your expenses and savings effectively.

Tips for Creating a Student Budget

Start by tracking your income and expenses to get a clear picture of where your money is going each month. Identify areas where you can cut back on spending and set limits for discretionary purchases. Consider using budgeting apps or spreadsheets to help you stay organized and on track with your financial goals. Make sure to prioritize saving a portion of your income for emergencies and future expenses.

- Set a realistic budget based on your income and expenses.

- Track your spending habits and identify areas where you can save.

- Automate savings to make it easier to stick to your budget.

Factors That Affect Your Financial Health

The student lifestyle can be challenging when it comes to managing finances, but understanding the factors that impact your financial health can help you make informed decisions. Your financial health is influenced by various factors such as your spending habits, income level, debt situation, and financial goals.

- Creating a budget and sticking to it is crucial for your financial well-being.

- Building a good credit history can open up opportunities for better financial products in the future.

- Investing in your education and future earning potential is an important aspect of your financial health.

Factors That Affect Your Financial Health

Financial literacy and discipline play a significant role in shaping your financial future. By staying informed about personal finance topics and making smart decisions with your money, you can create a solid foundation for long-term financial stability. Remember that your financial health is a reflection of your choices and habits, so it’s necessary to prioritize financial well-being in your college years and beyond.

- Building an emergency fund can protect you from unexpected expenses and financial setbacks.

- Investing in your skills and knowledge can lead to better career opportunities and financial growth.

- Evaluating your financial progress regularly can help you adjust your strategies and stay on track towards your goals.

How-To Make Smart Spending Choices

Keep a close eye on your spending habits as a college student to ensure you are making smart financial decisions. Learning to differentiate between wants and needs is key to managing your money effectively.

Tips to Differentiate Between Wants and Needs

When making purchasing decisions, ask yourself if the item is important for your basic needs or just something you desire. Focus on prioritizing necessities like food, housing, and textbooks over indulgent purchases like designer clothing or the latest gadgets. Creating a budget and sticking to it can help you distinguish between what you need and what you simply want.

- Avoid impulse buying and take time to evaluate whether the purchase aligns with your priorities.

- Consider the long-term value of the item and how it will contribute to your overall well-being.

Knowing the difference between wants and needs will help you make more mindful spending decisions and allocate your funds wisely.

How to Apply the Happy Money Approach to Everyday Expenses

Choices

For instance, instead of mindlessly spending money eating out every day, consider purchasing groceries and cooking meals at home. Not only will this save you money, but it can also bring greater satisfaction as you take control of your diet and finances.

How-To Grow Your Money While in College

Tips for Saving and Investing on a Student’s Budget

For college students looking to grow their money while still in school, there are several tips to consider for saving and investing on a student’s budget. First and foremost, it’s important to create a budget and stick to it. By tracking your expenses and income, you can identify areas where you can cut back and save more effectively.

- Open a high-interest savings account to maximize your savings potential.

- Consider investing in low-cost index funds to start building a diverse investment portfolio.

- Explore student discounts and benefits to save money on everyday expenses.

The key to successful saving and investing as a college student is to start early and stay disciplined. By prioritizing your financial goals and making smart money decisions, you can set yourself up for long-term financial success.

The

Factors to Consider Before Taking Financial Risks

Investing in college can be tempting, but it’s crucial to weigh the risks and rewards carefully before making any financial decisions. Factors to consider before taking financial risks include your risk tolerance, investment timeline, and financial goals. It’s important to evaluate how much you can afford to lose and what level of risk you are comfortable with.

- Research different investment options and seek advice from financial professionals before making any decisions.

- Diversify your investments to spread out risk and potentially increase your returns over time.

- Stay informed about market trends and economic conditions that could impact your investments.

Before exploring into any risky financial ventures, make sure to fully understand the potential outcomes and have a solid plan in place to mitigate any potential losses. The key is to approach investing with caution and a long-term perspective to maximize your chances of financial success.

The

More Information on Factors to Consider Before Taking Financial Risks

Before exploring into risky investments, it’s important to assess your financial situation thoroughly. Consider factors such as your current income, expenses, debt obligations, and savings goals. Understanding your financial standing will help you make informed decisions about where and how much to invest.

- Evaluate your investment strategy regularly and make adjustments as needed to stay on track with your financial goals.

- Seek guidance from financial advisors or mentors who can provide valuable insights and guidance on investment opportunities.

- Keep an emergency fund for unexpected expenses to avoid dipping into your investments during financial challenges.

Before taking any financial risks, ensure you have a clear understanding of your financial position and a well-thought-out plan to navigate potential challenges. Be mindful of, informed decisions lead to better financial outcomes in the long run.

How-To Plan for a Financially Sound Future

Your college years are a crucial time to lay the foundation for a financially sound future. By being mindful of your expenses, managing student loans and debt effectively, and planning ahead, you can set yourself up for long-term financial success.

Tips for Managing Student Loans and Debt

Managing student loans and debt is an important part of your financial journey. Start by creating a detailed budget that includes all your expenses and income. Look for ways to reduce costs, such as opting for used textbooks or cooking meals at home instead of eating out.

- Regularly review your loan statements and keep track of your total balance.

- Consider making extra payments whenever possible to reduce interest costs.

- Explore repayment options, such as income-driven repayment plans, to ease your financial burden.

Perceiving student loans as an investment in your future can help you stay motivated to manage them wisely and ultimately achieve financial freedom.

Preparing for Life After College: Financial Planning Steps

Planning for life after college involves creating a roadmap to achieve your financial goals. Start by setting short-term and long-term objectives, whether it’s building an emergency fund, saving for a down payment on a home, or investing for retirement.

To ensure a smooth transition post-graduation, familiarize yourself with concepts like budgeting, investing, and building credit. Educate yourself on different financial products and services, and seek guidance from financial advisors or mentors to make informed decisions about your money.

Summing up

Conclusively, implementing the principles of happy money can benefit college students by helping them prioritize spending on experiences, prioritize intrinsic values, and foster stronger social connections. By following these guidelines, students can avoid the trap of materialism, focus on what truly brings them joy, and build a financially sustainable lifestyle. To probe deeper into personal finance tips for college students, check out Personal Finance 101: 13 Essential Tips for College Students for more in-depth advice.

FAQ

Q: What is the key to managing money happily as a college student?

A: The key to managing money happily as a college student is to prioritize needs over wants, create a budget, track your expenses, and save for the future.

Q: How can college students save money effectively?

A: College students can save money effectively by taking advantage of student discounts, buying used textbooks, cooking meals at home instead of eating out, and using public transportation or biking instead of owning a car.

Q: Why is it important for college students to start saving early?

A: It is important for college students to start saving early because it allows for compound interest to work in their favor, builds good financial habits, and provides a safety net for unexpected expenses.

Q: What are some common money mistakes that college students make?

A: Some common money mistakes that college students make include overspending on unnecessary items, not creating a budget, relying too heavily on credit cards, and not saving for the future.

Q: How can college students increase their income while studying?

A: College students can increase their income while studying by taking on part-time jobs, freelancing, selling items online, participating in paid surveys or focus groups, and seeking out paid internships or co-op opportunities.

Q: What are some strategies for paying off student loans efficiently?

A: Some strategies for paying off student loans efficiently include making extra payments when possible, prioritizing high-interest loans first, exploring loan forgiveness programs, and refinancing to lower interest rates.

Q: How can college students develop healthy financial habits for the future?

A: College students can develop healthy financial habits for the future by setting financial goals, creating a realistic budget and sticking to it, building an emergency fund, investing in their future, and seeking guidance from financial advisors or resources.