Utilizing the principles of Happy Money can significantly transform one’s daily life by fostering a healthier relationship with money and promoting overall well-being. By incorporating these principles into your financial decisions and habits, you can cultivate a sense of satisfaction, contentment, and mindfulness in your everyday transactions. This guide will provide you with practical tips and strategies on how to apply Happy Money principles effectively and effortlessly in your routine, ultimately leading to a more fulfilling and prosperous life.

Key Takeaways:

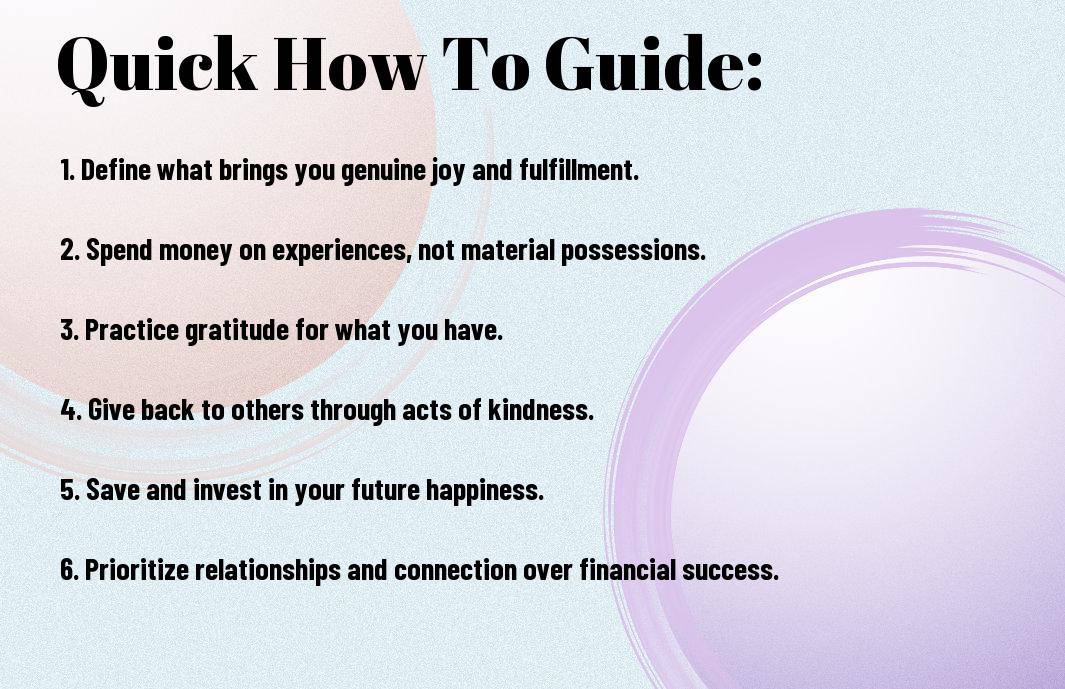

- Be intentional: Apply the Happy Money principles by being mindful of how you spend your money and why you are spending it.

- Invest in experiences: Allocate your financial resources towards experiences that create lasting memories and happiness rather than material possessions.

- Buy time: Consider using money to buy time, such as outsourcing tasks or services that free up your time for more meaningful activities.

- Show gratitude: Express gratitude for your purchases and investments, appreciating the value they bring to your life.

- Give back: Practice the principle of giving back by contributing to causes or organizations that align with your values and support your community.

- Spend on others: Prioritize spending on others, whether through gifts, experiences, or acts of kindness, to cultivate deeper connections and promote happiness.

- Track your spending: Monitor your spending habits to ensure alignment with your values and goals, making adjustments as needed to promote a happier financial outlook.

How to Align Your Spending with Happiness

Some people believe that the key to true happiness lies in mindful spending. Happy Money principles emphasize the importance of aligning your financial decisions with your values and well-being. By reevaluating your current spending habits and making intentional choices, you can create a more fulfilling and satisfying relationship with money.

Assessing Your Current Spending Habits

Happiness begins with understanding how your spending habits impact your well-being. Take a close look at where your money goes each month. Are your purchases in line with what brings you joy and fulfillment, or are they driven by impulse or external influences? Identifying patterns in your spending can help you make more conscious decisions moving forward.

Tips for Mindful Spending

With respect to aligning your spending with happiness, mindfulness is key. Before making a purchase, pause and ask yourself if it truly aligns with your values and goals. Consider the long-term impact of your spending choices on your well-being. To practice mindful spending:

- Avoid making impulse purchases that may not bring lasting contentment.

- Focus on experiences and relationships rather than material possessions for lasting joy.

For those looking to cultivate a more mindful approach to spending, it’s imperative to shift the focus from accumulating things to investing in experiences that enrich your life. By choosing to spend on activities that align with your values and bring genuine happiness, you can create a more meaningful and fulfilling relationship with money.

- Assume that every dollar you spend is a vote for the kind of life you want to live.

Investing in Experiences over Objects

All too often, we find ourselves caught up in the cycle of materialism, constantly seeking happiness through the accumulation of possessions. However, research has shown that true lasting happiness comes from investing in experiences rather than material goods. By shifting our spending habits towards experiential purchases, we can cultivate a more fulfilling and joyful life.

The Joy of Experiential Purchases

To truly understand the value of experiential purchases, one must recognize the fleeting nature of material possessions. While objects may provide a temporary sense of satisfaction, the memories created through experiences can last a lifetime. Whether it’s traveling to a new destination, attending a concert, or simply trying out a new hobby, the joy derived from these experiences is far more enduring and meaningful than any material item.

Experiential purchases have been found to contribute more to our overall well-being and happiness than material possessions. The anticipation leading up to an experience, the shared memories created with loved ones, and the personal growth that comes from trying new things all contribute to a sense of fulfillment that material goods simply cannot replicate.

Practical Strategies for Shifting Your Spending Patterns

In the context of shifting your spending towards experiential purchases, it’s important to set clear intentions and priorities. Begin by assessing your current spending habits and identifying areas where you can cut back on materialistic purchases in favor of experiences that bring you joy and fulfillment. Consider creating a budget specifically dedicated to experiential purchases to ensure that you allocate funds towards activities that will enrich your life.

Another practical strategy for shifting your spending patterns is to prioritize experiences that align with your values and passions. Whether it’s exploring nature, learning a new skill, or spending quality time with loved ones, choose experiences that resonate with you on a deeper level. By being mindful of where you invest your time and money, you can cultivate a greater sense of happiness and well-being in your daily life.

Cultivating a Culture of Sharing and Giving

Your journey towards incorporating Happy Money principles into your daily life involves cultivating a culture of sharing and giving. By embracing generosity and prioritizing the act of giving, you can create a positive impact on both your own well-being and the world around you.

Factors Influencing the Contentment of Giving

Any act of giving is influenced by various factors that can enhance the contentment derived from such actions. Factors such as the intention behind the act, the level of personal connection with the recipient, and the impact of the contribution on the recipient’s life play a significant role in amplifying the joy and fulfillment experienced through giving. Recognizing and reflecting on these factors can help you make more meaningful and impactful contributions.

- Intention behind the act of giving

- Personal connection with the recipient

- Impact of the contribution on the recipient’s life

How-To Guide for Incorporating Generosity Into Your Budget

Generosity is a powerful tool that can transform your financial habits and mindset. By consciously allocating a portion of your budget towards acts of giving, you can cultivate a sense of abundance and generosity that will not only benefit others but also enrich your own life. Incorporating generosity into your budget involves setting aside a specific amount of money for charitable donations, random acts of kindness, or supporting causes that resonate with you.

Sharing your resources with others not only spreads positivity and goodwill but also fosters a sense of interconnectedness and community. Through sharing, you can create a ripple effect of kindness and compassion that has the potential to impact individuals and communities in profound ways. By embracing a mindset of abundance and prioritizing generosity in your financial planning, you can contribute to a more harmonious and fulfilling existence for yourself and those around you.

Maximizing Financial Well-Being

The Role of Savings and Debt in Happy Money

After mastering the art of spending money wisely, the next step in maximizing financial well-being is understanding the critical role that savings and debt play in the Happy Money concept. Savings serve as a safety net during unexpected financial emergencies, helping to reduce stress and anxiety. On the other hand, debt can be a significant source of financial stress and negatively impact overall happiness if not managed effectively.

With a focus on Happy Money principles, it is vital to prioritize saving for both short-term and long-term goals. Building an emergency fund that covers three to six months of living expenses can provide a sense of security and peace of mind. Additionally, actively working towards paying off high-interest debt can free up more financial resources to allocate towards investments that bring joy and fulfillment.

Tips for Financial Planning with Happiness in Mind

In the context of financial planning through the lens of happiness, it’s important to set clear goals that align with your values and priorities. Create a budget that reflects your spending preferences while also allowing room for guilt-free splurges on experiences that bring joy. Automate your savings by setting up recurring transfers to your savings account to ensure consistent progress towards your financial goals.

- Track your expenses to identify areas where you can cut back and redirect funds towards activities that enhance your overall well-being.

Mindfully approaching financial decisions by considering how they align with your values and long-term happiness can lead to a more fulfilling financial life. By being intentional with your spending and saving habits, you can create a financial plan that not only supports your well-being but also brings a sense of contentment and satisfaction.

- Knowing that your financial decisions are in line with your values can bring a sense of peace and confidence in your overall financial well-being.

Nurturing Relationships through Financial Decisions

To truly apply the principles of Happy Money in our daily lives, it’s necessary to understand how our financial decisions can impact our relationships with others. Money has the power to either strengthen or strain relationships, depending on how it is managed and communicated about. By aligning our financial values and goals with those of our loved ones, we can nurture deeper connections and create a more fulfilling life together.

Strengthening Bonds Through Shared Financial Goals

Any successful relationship requires open communication and mutual understanding, especially when it comes to finances. One way to strengthen bonds with your partner, family, or friends is by setting shared financial goals. Whether it’s saving for a dream vacation, buying a home, or planning for retirement, working towards common financial objectives can foster teamwork, trust, and a sense of unity.

Financial decisions impact not only individuals but also the collective well-being of all parties involved. Balancing personal financial needs with the needs of the relationship or family unit is crucial for long-term harmony and prosperity. Through transparent discussions, compromise, and shared responsibility, individuals can navigate the complexities of managing money within a relationship while fostering a sense of togetherness and shared purpose.

Summing up

From above, applying the principles of Happy Money in daily life can lead to increased happiness and satisfaction with spending choices. By focusing on experiences over material possessions, prioritizing time-saving investments, and maximizing social connections, individuals can enhance their well-being. The Happy Money principles serve as a guide to make mindful decisions that bring more joy and fulfillment into daily routines. To explore deeper into these concepts, refer to the Happy Money guide for a comprehensive understanding and practical application in everyday life.

FAQ

Q: What are Happy Money principles?

A: Happy Money principles are based on the idea that how we spend our money can significantly impact our happiness and well-being. It focuses on using money in ways that promote joy, fulfillment, and positive experiences.

Q: How can I apply Happy Money principles in my daily life?

A: To apply Happy Money principles in your daily life, you can start by being mindful of your spending habits, prioritizing experiences over material possessions, investing in relationships and personal growth, and being intentional about how you use your money to create lasting happiness.

Q: What are some practical ways to implement Happy Money principles in daily life?

A: Some practical ways to implement Happy Money principles include creating a budget that aligns with your values and goals, practicing gratitude for what you have, supporting causes that are meaningful to you, and choosing to spend money on experiences that bring you joy.

Q: How can Happy Money principles improve my overall well-being?

A: By following Happy Money principles, you can enhance your overall well-being by fostering positive emotions, strengthening relationships, reducing stress and anxiety related to finances, and increasing your sense of fulfillment and purpose in life.

Q: Can applying Happy Money principles help me achieve financial goals?

A: Yes, applying Happy Money principles can help you achieve financial goals by encouraging mindful spending, prioritizing experiences that bring long-term happiness, and promoting a healthy relationship with money that supports your financial well-being.

Q: What are the key benefits of incorporating Happy Money principles into daily life?

A: The key benefits of incorporating Happy Money principles into daily life include increased happiness and life satisfaction, improved financial well-being, stronger relationships, reduced stress related to money, and a deeper sense of fulfillment and purpose.

Q: How can I stay committed to applying Happy Money principles in the long term?

A: To stay committed to applying Happy Money principles in the long term, it is important to regularly review your financial habits, set meaningful goals, celebrate your progress, seek support from like-minded individuals, and remind yourself of the positive impact that these principles have on your overall well-being.