Financial management through Happy Money! Embark on a transformative journey towards financial happiness with the principles of Happy Money. In this comprehensive guide, we will explore how to infuse joy and satisfaction into your financial management practices. By understanding the psychology behind spending and saving, incorporating mindful budgeting techniques, nurturing a positive relationship with money, and aligning your values with your financial decisions, you can revolutionize your approach to money management. Say goodbye to stress and anxiety about finances, and say hello to a fulfilling and prosperous financial future with Happy Money.

Key Takeaways:

- Shift your mindset: Change your perspective on money from a source of stress to a tool for happiness and well-being.

- Align spending with values: Prioritize spending on things that bring you joy and align with your personal values.

- Practice mindfulness: Be intentional with your financial decisions and focus on the present moment to cultivate a sense of gratitude.

- Cultivate relationships: Invest in experiences and connections with others rather than material possessions for lasting happiness.

- Set meaningful goals: Define clear financial goals that resonate with your values and bring a sense of purpose to your money management.

- Automate your finances: Simplify your financial management by setting up automatic transfers and payments to achieve your goals effortlessly.

- Celebrate small wins: Acknowledge and celebrate your progress towards financial goals to create a positive feedback loop and reinforce good money habits.

Embracing a Positive Financial Mindset

Clearly, one of the keys to finding joy in financial management is embracing a positive mindset. By shifting our perspective and attitudes towards money, we can cultivate a healthier relationship with our finances and ultimately lead a more fulfilling life. This chapter explores the various ways in which we can adopt a positive financial mindset and reap the benefits of Happy Money.

Cultivating Financial Awareness

Financial awareness is the foundation of a positive financial mindset. It involves being conscious of our spending habits, savings goals, and overall financial health. By tracking our income and expenses, setting financial goals, and regularly reviewing our financial status, we can gain a better understanding of where our money is going and make more informed decisions about how to manage it effectively.

Developing financial awareness also allows us to identify areas where we can improve and make adjustments to our financial habits. By being mindful of our financial choices and taking proactive steps to enhance our financial literacy, we can build a strong financial foundation that supports our long-term financial well-being.

Shifting from Stress to Enjoyment

One of the most transformative shifts we can make in our financial journey is moving from a place of stress and anxiety to one of enjoyment and empowerment. This involves reframing our relationship with money from one of scarcity and fear to one of abundance and gratitude. By focusing on the positives in our financial lives, such as the ability to provide for ourselves and our loved ones, we can cultivate a sense of contentment and peace around our finances.

A positive financial mindset enables us to approach financial challenges with resilience and optimism, knowing that we have the skills and resources to overcome them. By embracing a mindset of possibility and abundance, we can open ourselves up to new opportunities for growth, prosperity, and ultimately, true financial well-being.

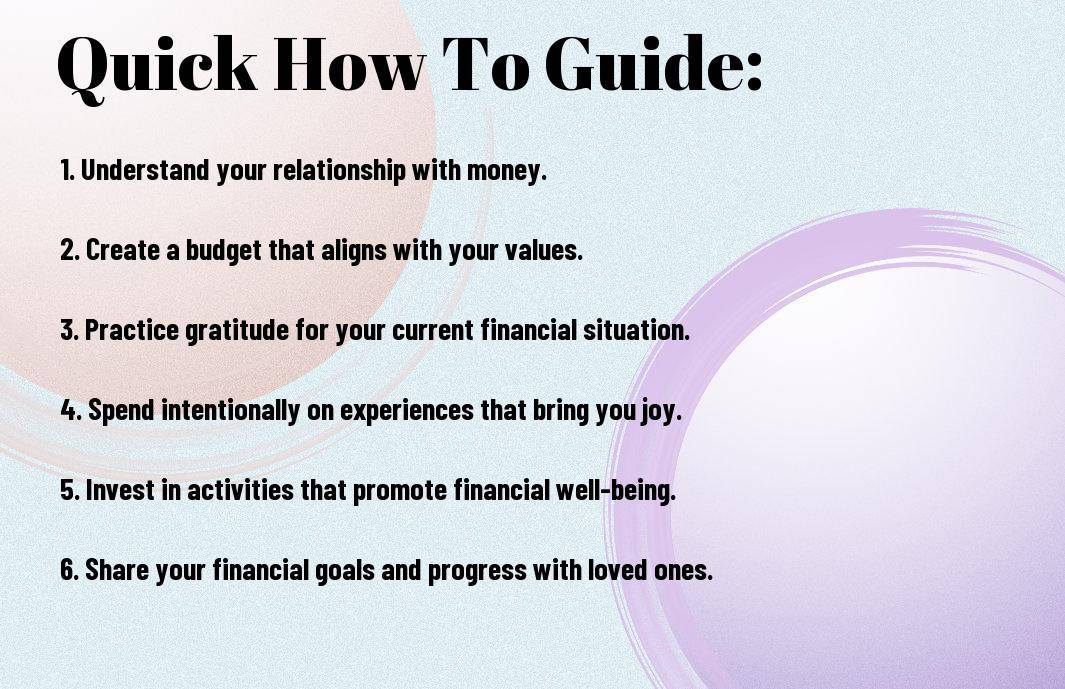

Practical Tips for Joyful Money Management

For many, the idea of managing finances can be daunting and overwhelming. However, with the right approach, financial management can actually bring joy and peace of mind. By following these practical tips, you can transform your relationship with money and experience the happiness that comes with it.

How-to Create a Budget That Sparks Joy

Tips:

- Start by tracking your expenses for a month to get a clear picture of where your money is going.

- Identify areas where you can cut back on spending and reallocate those funds to things that bring you joy.

Creating a budget that aligns with your values and priorities can help you feel empowered and in control of your finances. Perceiving your budget as a tool for achieving your financial goals can make the process more enjoyable and rewarding.

Factors to Consider for Happy Saving and Spending

With:

- Set specific savings goals that excite you and keep you motivated to stick to your budget.

- Practice mindful spending by only investing in things that truly bring you happiness and align with your values.

By being intentional with your saving and spending habits, you can cultivate a sense of fulfillment and satisfaction in how you manage your money. Any financial decisions you make should align with your long-term goals and bring you closer to financial freedom.

Joyful financial management is not just about the numbers; it’s about aligning your money habits with your values and finding happiness in the process. By implementing these practical tips and considering the factors that contribute to happy saving and spending, you can create a positive and fulfilling relationship with money.

Long-Term Strategies for Financial Wellbeing

Not only is financial management crucial for our present comfort and stability, but it also plays a significant role in securing our future. Long-term strategies for financial wellbeing are imperative for achieving peace of mind and financial security in the years to come.

Building a Happy Money Plan for the Future

To truly cultivate financial wellbeing, it is important to create a Happy Money plan for the future. This involves setting clear goals and objectives, such as saving for retirement, investing in assets that appreciate over time, and building an emergency fund for unexpected expenses. By outlining a roadmap for your financial future, you can navigate through life’s uncertainties with confidence and ease.

Another critical aspect of building a Happy Money plan for the future is to continuously assess and reassess your financial situation periodically. Regularly reviewing your savings, investments, and financial goals can help you stay on track and make necessary adjustments to ensure long-term success and sustainability.

Tips for Mindful Investment and Wealth Growth

Money: In the matter of mindful investment and wealth growth, it is important to understand the power of compounding. By reinvesting your earnings and letting your investments grow over time, you can harness the magic of compounding to exponentially increase your wealth.

- Set clear investment goals and objectives to guide your financial decisions.

- Diversify your investment portfolio to mitigate risk and maximize returns over the long term.

- Perceiving market trends and economic indicators can help you make informed investment choices and adjust your strategy as needed.

Wellbeing: Achieving financial wellbeing is not just about accumulating wealth; it’s about creating a sense of security and peace of mind for the future. By following these long-term strategies and mindful investment tips, you can pave the way towards a brighter financial future and enjoy the fruits of your labor with happiness and contentment.

Overcoming Common Financial Challenges

Your journey towards financial happiness may encounter some common challenges along the way. However, with the right mindset and tools, you can overcome these obstacles and continue on the path to financial well-being and joy.

Dealing with Debt While Maintaining Happiness

Challenges related to debt can be overwhelming and stressful, making it difficult to stay positive while managing your finances. However, it is important to remember that you are not defined by your debt, and it is possible to navigate through this obstacle while maintaining a sense of happiness. By creating a realistic repayment plan, seeking support from a financial advisor or counselor, and focusing on small victories along the way, you can gradually reduce your debt and reclaim control of your financial well-being.

It is necessary to shift your perspective towards debt from a burden to a temporary challenge that you are actively working to overcome. By staying focused on your goals and celebrating progress, you can stay motivated and optimistic throughout the debt repayment process.

Tips for Staying Positive During Financial Setbacks

During times of financial setbacks, it is normal to feel discouraged or stressed. However, staying positive is crucial for overcoming these challenges and continuing on your journey towards financial happiness. To maintain a positive mindset, practice gratitude, focus on what you can control, and seek inspiration from success stories of others who have overcome similar setbacks.

- Practice mindfulness and self-care to reduce stress and anxiety

- Set realistic goals and celebrate your achievements, no matter how small

With these tips, you can navigate through financial setbacks with resilience and determination, knowing that challenges are temporary and that you have the power to overcome them.

- Bear in mind, setbacks are opportunities for growth and learning

Plus, by staying positive and proactive during financial challenges, you are not only building a stronger financial foundation but also cultivating a mindset of abundance and joy in your financial management journey.

To wrap up

So, embracing the Happy Money philosophy can transform the way you think about financial management. By focusing on aligning your spending with your values and priorities, you can find joy in making financial decisions that support your well-being and happiness. Learn more about how Happy Money can help you achieve your financial goals at Happy Money: Personal Loans, Made Personal.

FAQ

Q: What is Happy Money?

A: Happy Money is a philosophy that emphasizes the connection between money and well-being, focusing on using money in ways that bring happiness and fulfillment.

Q: How can I find joy in financial management through Happy Money?

A: By aligning your spending with your values and priorities, practicing gratitude for what you have, and focusing on experiences over material possessions, you can find joy in financial management through Happy Money.

Q: What are some practical tips for incorporating Happy Money into my financial routine?

A: Start by tracking your spending to identify areas where you can reallocate funds towards things that bring you joy, create a budget that reflects your values, and practice mindfulness when making financial decisions.

Q: How does practicing gratitude contribute to financial well-being?

A: Practicing gratitude helps shift your focus from what you lack to what you have, leading to a greater sense of contentment and reducing the impulse to overspend on things that provide only temporary satisfaction.

Q: Why is it important to prioritize experiences over material possessions in financial management?

A: Experiences have been shown to contribute more to long-term happiness than material possessions, as they create lasting memories and connections that can bring joy and fulfillment over time.

Q: How can Happy Money help me build a healthy relationship with finances?

A: Happy Money encourages you to approach finances with intention and mindfulness, helping you make decisions that align with your values and goals while fostering a positive relationship with money.

Q: What are the benefits of integrating Happy Money principles into my financial management strategy?

A: By embracing Happy Money principles, you can improve your overall well-being, reduce financial stress, enhance your satisfaction with how you use money, and increase your sense of control over your financial future.