Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

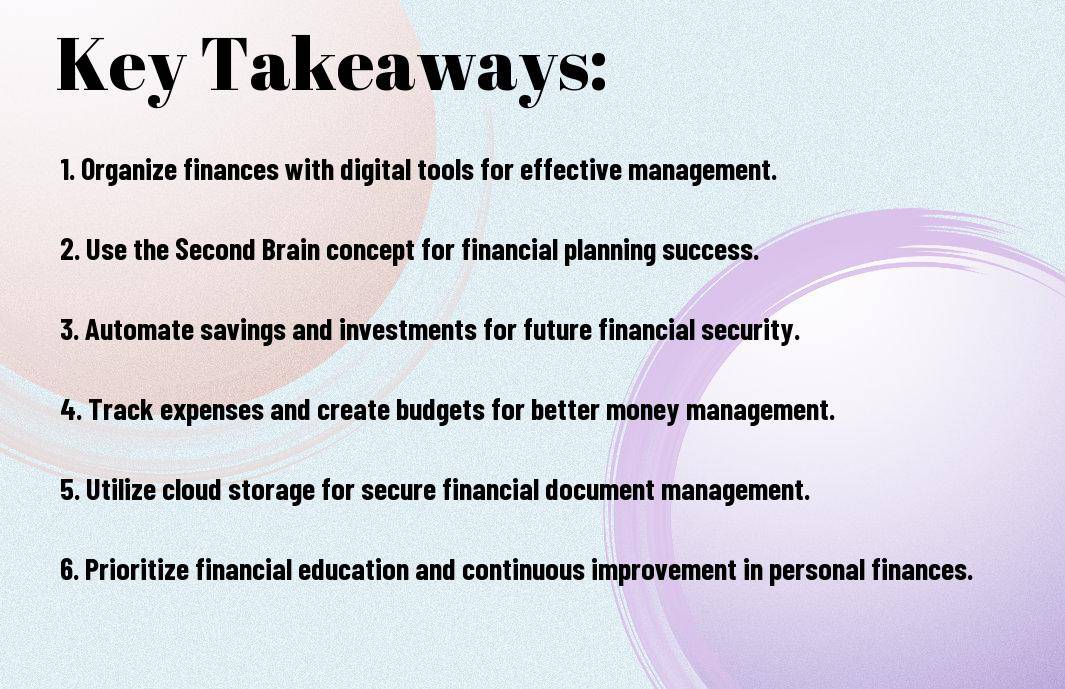

Personal Finance! Finances can often feel overwhelming and chaotic, but with the Second Brain concept, you can take control and master your personal financial situation. This innovative approach, popularized by Tiago Forte, helps individuals organize and optimize their digital information for enhanced productivity and decision-making. By applying the principles of a Second Brain to your finances, you can streamline budgeting, planning, and investing for a more secure financial future.

If you’re curious about incorporating the Second Brain concept into your financial management strategy, check out How to Build a Second Brain to learn more about this powerful tool and start taking control of your money today.

You have made the decision to take control of your financial future by mastering personal finances using the Second Brain concept. This approach will help you organize, store, and retrieve crucial information about your financial life efficiently.

Laying the foundation for your financial Second Brain involves understanding the philosophy behind it. Your Second Brain is vitally an extension of your mind, an external digital space where you can dump all financial information without worrying about forgetting or losing track of important details. By embracing this philosophy, you can free up mental space and dedicate your cognitive resources to making informed financial decisions and planning for the future.

Any successful endeavor requires the right tools, and setting up your financial Second Brain is no different. You will need a reliable note-taking app, spreadsheet software, document scanner, and password manager. These tools will help you capture, organize, and secure all financial data in one central location, making it easily accessible whenever you need it.

It is vital to choose tools that you are comfortable using and that fit your unique needs and preferences. Experiment with different applications to find the ones that work best for you in streamlining your financial information and tasks.

For many people, getting their finances organized can feel like a daunting task. However, with the Second Brain concept, you can streamline the process and take control of your financial well-being. By following a few simple steps, you can create a system that will help you stay on top of your finances and make informed decisions about your money.

An imperative first step in mastering your personal finances is gathering all your financial information in one place. This includes bank statements, bills, investment accounts, and any other relevant documents. Once you have everything together, categorize your expenses and income into broad categories such as housing, transportation, groceries, entertainment, and savings. This will give you a clear picture of where your money is coming from and where it is going.

Categorizing your financial documents is crucial in creating a streamlined filing system. Invest in a filing cabinet or use digital folders to organize your paperwork by category. Make sure to label each folder clearly so you can easily locate documents when needed. Regularly review and update your filing system to ensure it remains organized and efficient. By keeping your financial documents in order, you can quickly access important information and stay on top of your financial responsibilities.

To learn more about mastering personal finances, I highly recommend checking out Mastering Personal Finances: A Biblical Approach. This insightful resource offers a unique perspective on managing your money effectively and aligning your financial goals with your values.

For a successful financial journey, setting S.M.A.R.T goals is vital. These goals are Specific, Measurable, Achievable, Relevant, and Time-bound. By establishing clear objectives such as saving a specific amount for retirement or paying off debt by a certain date, you can create a roadmap for your financial success.

Actionable steps are crucial for turning your financial goals into reality. Once you have identified your S.M.A.R.T goals, break them down into smaller, manageable tasks. This approach allows you to track your progress, stay motivated, and adjust your strategies as needed to stay on course.

Breaking down your goals into actionable steps empowers you to take consistent and meaningful actions towards your financial objectives. By focusing on incremental progress and celebrating small victories along the way, you can maintain momentum and stay committed to achieving your long-term financial goals.

Many people struggle with managing their personal finances effectively. However, with the help of the Second Brain concept, you can take control of your budgeting and make significant progress towards financial freedom. Your Second Brain acts as a digital extension of your mind, helping you organize, plan, and optimize your budget for success.

Personal budgeting is not a one-size-fits-all approach. Your financial situation, goals, and lifestyle are unique to you, and your budget should reflect that. Start by understanding your income, expenses, and financial objectives. Use your Second Brain to categorize your spending, set realistic financial goals, and create a budget that aligns with your priorities. Bear in mind, a budget is a flexible tool that should adapt to your changing needs.

Your financial circumstances are bound to change over time, which is why monitoring and adjusting your budget is crucial. Regularly review your spending patterns and compare them to your budgeted amounts. If you notice any discrepancies or areas where you consistently overspend, it’s time to make adjustments. Being proactive in managing your budget can help you avoid financial pitfalls and stay on track towards your goals.

Another important aspect of monitoring and adjusting your budget is staying mindful of unexpected expenses or income fluctuations. Life is full of surprises, and having a contingency plan in place can make a significant difference in how you navigate financial challenges. By leveraging your Second Brain to anticipate and respond to changes, you can maintain financial stability and adapt to any financial curveballs that come your way.

Efficient saving involves setting clear financial goals, creating a budget, and actively tracking expenses. One strategy is to automate your savings by setting up regular transfers to a separate savings account. This way, you can ensure that a portion of your income is consistently being saved without having to think about it. Additionally, consider cutting down on unnecessary expenses and redirecting those funds towards your savings goals. By being mindful of your spending habits, you can maximize the amount you save each month.

Efficient investing requires a good understanding of your risk tolerance, investment goals, and time horizon. Diversification is key to reducing risk in your investment portfolio. By spreading your investments across different assets, you can mitigate the impact of market fluctuations on your overall portfolio. It’s also important to regularly review and adjust your investments to ensure they align with your goals and risk tolerance.

Intelligent investing involves conducting thorough research before making investment decisions. Consider factors such as the company’s financial health, performance history, and future growth potential. It’s also advisable to seek advice from financial professionals or use online resources to stay informed about investment opportunities and trends. By making informed decisions and staying disciplined, you can build a strong investment portfolio over time.

Your journey to mastering personal finances begins with managing your debt effectively. Developing a plan to tackle debt is crucial in gaining control over your financial well-being. Start by creating a list of all your debts, including the amount owed, interest rates, and minimum monthly payments. This will give you a clear understanding of your financial obligations and help you prioritize which debts to pay off first.

Managing your credit wisely is imperative for improving your financial health. Your credit score plays a significant role in determining your ability to borrow money and the interest rates you’ll receive. Understanding how your credit score is calculated and taking steps to enhance it can make a huge difference in achieving your financial goals.

Developing a habit of making timely payments on your credit accounts, keeping your credit utilization low, and regularly checking your credit report for errors are key strategies in improving your credit score.

Keep your financial second brain running smoothly by scheduling regular check-ins and updates. Set aside time each week or month to review your financial goals, track your spending, and ensure that all your accounts are up to date. This habit will help you stay on top of your finances and make informed decisions about your money management.

Second, be flexible and adaptable with your financial second brain. Life changes, such as getting a new job, starting a family, or dealing with unexpected expenses, can impact your financial situation. It’s important to adapt your system to accommodate these changes. Make adjustments to your budget, savings goals, and investment strategies as needed to reflect your current financial reality.

Your financial second brain should evolve with you as your life circumstances change. By staying proactive and adjusting your system accordingly, you can continue to make progress towards your financial goals and secure your financial future.

For instance, if you receive a promotion at work and a salary increase, you may want to revise your budget to allocate more towards savings or investments. On the other hand, if you encounter unexpected medical expenses, you may need to adjust your spending in other areas to cover these costs without derailing your financial progress.

On the whole, mastering personal finances with the Second Brain concept can be a game-changer in your financial journey. By organizing your thoughts, goals, and strategies in a digital second brain, you can effectively track your expenses, plan your budget, and make informed financial decisions. This approach allows you to have a clear overview of your financial situation and empowers you to take control of your money with confidence.

A: The Second Brain Concept is a method of managing and organizing your personal finances by using digital tools and systems to optimize your financial decision-making processes.

A: By applying the Second Brain Concept, you can effectively track your expenses, set financial goals, analyze your spending patterns, and make informed financial decisions to improve your overall financial well-being.

A: Some popular digital tools for implementing the Second Brain Concept include note-taking apps like Evernote or Notion, budgeting apps like Mint or YNAB, and spreadsheet software like Microsoft Excel or Google Sheets.

A: To start, create a dedicated system for organizing your financial documents, set up digital folders for storing receipts and statements, and establish a routine for reviewing and updating your financial information regularly.

A: No, the Second Brain Concept is designed to be user-friendly and accessible to individuals with varying levels of tech-savviness. It simply involves leveraging digital tools to streamline and optimize your financial management process.

A: By utilizing the Second Brain Concept, you can gain a deeper understanding of your financial habits, identify areas for improvement, and implement strategies to save more money, reduce debt, and work towards your long-term financial goals.

A: While the Second Brain Concept can greatly enhance your financial management abilities, it’s important to remember that no system is foolproof. It may require time and effort to set up initially, and periodic maintenance to ensure its ongoing effectiveness.