Saving money! Most of us strive to save more money, but we often overlook the power of small habits in achieving this goal. By incorporating atomic habits into our daily routine, we can gradually build significant savings over time. In this guide, we will explore simple yet effective strategies to help you transform your financial habits and secure a better future.

Key Takeaways:

- Consistency is key: Small savings habits practiced consistently can lead to significant savings over time.

- Set specific goals: Define clear and achievable savings goals to stay motivated and track your progress.

- Automate your savings: Set up automatic transfers to your savings account to make saving effortless.

- Avoid impulse purchases: Implement a waiting period before making non-necessary purchases to prevent impulse buying.

- Track your spending: Keep a record of your expenses to identify areas where you can cut back and save more.

- Reward yourself: Celebrate small wins in your savings journey to stay motivated and reinforce positive habits.

- Review and adjust: Regularly evaluate your savings strategies, make adjustments as needed, and continue to improve your financial habits.

The Basics of Atomic Habits

Little changes can lead to big results when it comes to saving money. If you’re looking to improve your financial habits, consider applying Atomic Habits to your finances. By understanding the power of small changes, you can make significant progress towards your savings goals.

What Are Atomic Habits?

Atomic habits are small, incremental changes that compound over time to create large, positive outcomes. These habits are based on the idea that tiny adjustments in behavior can lead to significant transformations in the long run. By focusing on making small improvements consistently, you can gradually build momentum and make lasting changes in your financial habits.

The Compound Effect of Small Changes

To maximize the compound effect of small changes, it’s important to stay consistent and patient. Over time, these tiny adjustments can snowball into significant savings. For instance, cutting back on small daily expenses like buying coffee or eating out can add up to substantial savings over the course of a year. By being mindful of your spending habits and making small adjustments, you can achieve your financial goals faster than you think.

Setting Your Saving Goals

How to Define Your Financial Objectives

To set effective saving goals, start by taking a look at your current financial situation. Assess your income, expenses, and debts to determine how much you can realistically save each month. Next, consider your long-term financial objectives, such as buying a home, starting a business, or retiring comfortably. Setting specific and measurable goals will help you stay motivated and focused on building your savings.

Tips for Creating Attainable Goals

You can make your saving goals more achievable by breaking them down into smaller milestones. Start by setting short-term objectives that you can reach within a few months or a year. Use tools like budgeting apps and automatic transfers to make saving easier and more convenient. Additionally, consider adjusting your goals as your financial situation changes to stay on track towards building a solid financial foundation.

Little by little, you can make significant progress towards your saving goals by adopting habitual changes in your spending and saving behaviors. With patience and determination, you’ll be able to achieve your financial objectives and build a secure future for yourself and your loved ones.

- Break down long-term goals into smaller milestones

- Use budgeting apps and automation for convenience

- Adjust goals as your financial situation evolves, Perceiving progress along the way.

This approach helps you stay motivated and focused on saving by providing clear targets and a roadmap for financial success. By breaking down your goals into manageable steps and leveraging technology and flexibility, you can overcome challenges and make steady progress towards achieving your dreams.

Habit Formation for Financial Health

The Science Behind Habit Formation

If you have ever struggled to stick to a budget or save money, you’re not alone. All too often, our financial actions are influenced by impulse rather than intentional decision-making. If you want to set yourself up for financial success, understanding the science behind habit formation is key. Habits are formed when a cue triggers a routine that results in a reward. By identifying and reshaping these cues and rewards, you can modify your financial behaviors for the better.

Strategies for Building Effective Saving Habits

Now is the time to start building effective saving habits that will lead you towards your financial goals. If you want to make saving money a consistent part of your routine, consider starting small and gradually increasing your efforts. Set specific, achievable savings goals, automate your savings, and track your progress regularly. Additionally, surround yourself with a supportive community or partner who can help keep you accountable.

Financial health is crucial for overall well-being, and small habits can lead to significant long-term savings. By understanding the science behind habit formation and implementing effective strategies, you can take control of your finances and build a secure future for yourself. Note, every small step counts towards a brighter financial tomorrow.

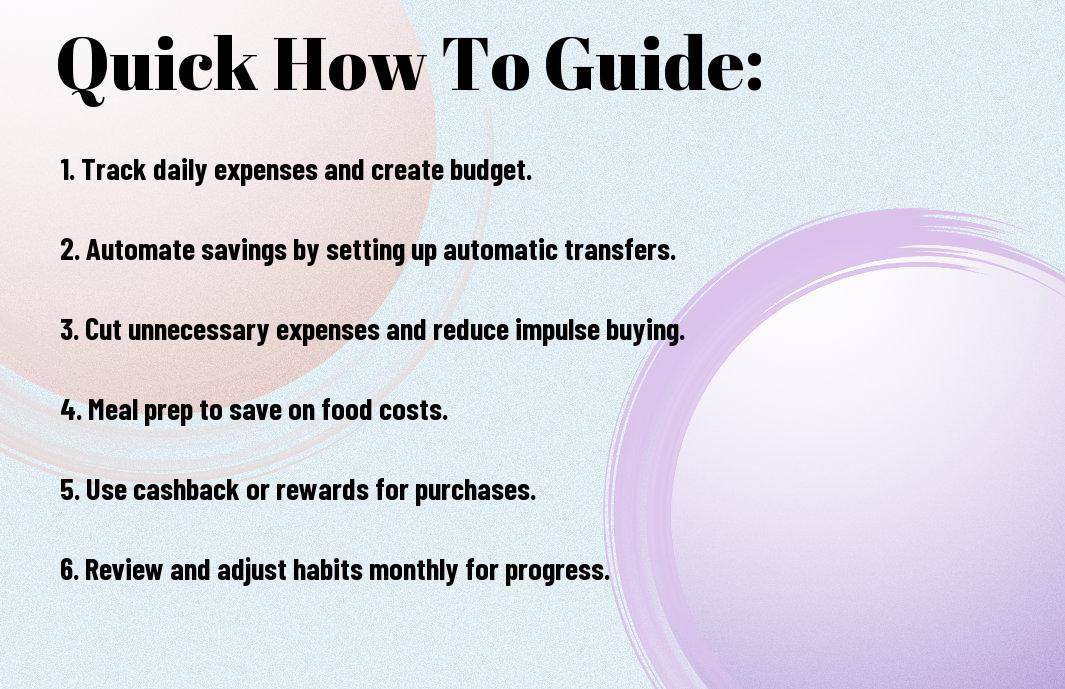

Practical Tips for Implementing Atomic Saving Habits

Once again, developing atomic saving habits can truly transform your financial well-being over time. To make these habits stick, here are some practical tips to help you along the way:

Identifying Spending Triggers and How to Overcome Them

Practical tip: Begin by identifying your spending triggers – is it stress, boredom, or social pressure? Once you know your triggers, find alternative activities to replace the urge to spend. For example, if stress triggers your spending, try going for a walk or practicing deep breathing instead.

- Acknowledge your triggers

- Replace spending urges with healthier alternatives

- Seek support from friends or family to stay accountable

Thou, by understanding and addressing your spending triggers, you can take control of your financial decisions and avoid impulse purchases.

Automate Your Savings – Set It and Forget It

Them, automating your savings is a game-changer when it comes to building wealth over time. Set up automatic transfers from your checking account to your savings or investment accounts. By doing this, you remove the temptation to spend the money before saving it.

Habits, automating your savings helps you consistently set aside money without having to think about it. This method enables you to save effortlessly and stay on track towards your financial goals.

Factors Influencing Your Saving Success

Not all habits are created equal when it comes to saving money. There are several factors that can influence your ability to successfully save for the future. Understanding these factors can help you make small changes that lead to big savings over time.

- Mindset: Your mindset plays a crucial role in your saving success. Having a positive attitude towards saving and being disciplined in your spending habits can make a significant difference in reaching your financial goals.

- Environment: The environment you surround yourself with can also impact how well you save money. Whether it’s the people you spend time with or the places you frequent, your environment can either support or hinder your saving efforts.

- Financial knowledge: Understanding basic financial principles and concepts can empower you to make better saving decisions. By educating yourself on money management, you can set yourself up for long-term financial success.

The Role of Mindset in Saving Money

Money mindset plays a critical role in how successful you are at saving money. Your beliefs and attitudes towards money can influence your spending habits and overall financial well-being. By cultivating a mindset that values saving and financial security, you can set yourself up for a more stable and prosperous future. Any small changes you make in your mindset towards money can have a big impact on your saving success.

Adapting Your Environment for Better Financial Habits

One way to improve your saving habits is by adapting your environment to support your financial goals. This could mean surrounding yourself with like-minded individuals who value saving, or creating a workspace that promotes productivity and financial mindfulness. By making small changes to your environment, you can create a more conducive space for building healthy financial habits. Environment strongly influences our behavior when it comes to money, so it’s important to create an environment that supports your saving goals.

Maintaining Your Momentum

How to Keep Going When Motivation Wanes

Unlike quick fixes or temporary solutions, establishing ATOMIC HABITS for Financial Freedom involves creating sustainable changes that stand the test of time. However, we all face moments when our motivation to save money dwindles. That’s when it’s crucial to rely on the power of your habits. By consistently practicing small saving habits, even on tough days, you reinforce your commitment to your financial goals.

Adjusting Your Habits as Your Life Changes

Some life changes, like starting a new job, moving to a new city, or having a baby, can disrupt your saving routine. To ensure that your progress stays on track, it’s vital to be flexible and adapt your habits accordingly. Any effective saving strategy should be tailored to fit your current circumstances, allowing you to continue making progress no matter what life throws your way.

Understanding that life is full of surprises and challenges will help you stay prepared to adjust your saving habits as needed. Whether you need to modify your budget, find new ways to save, or set new objectives, being adaptable is key to maintaining your financial momentum. Flexibility and resilience are your allies in staying on course towards achieving your savings goals.

Conclusion

Conclusively, implementing atomic habits for saving money can have a significant impact on your financial well-being in the long run. By focusing on small changes and consistent actions, you can gradually build up your savings and achieve your financial goals.

Do not forget, Rome wasn’t built in a day, and neither will your savings account be. Stay committed to your habits and be patient with the process. Small steps taken consistently over time will lead to big results. So start today and watch your savings grow!

FAQ

Q: Why is saving money important?

A: Saving money is important because it provides financial security, helps achieve long-term goals, and can reduce stress during emergencies.

Q: How can small habits help with saving money?

A: Small habits can help with saving money by making saving a consistent and automatic part of your daily routine, leading to significant savings over time.

Q: What are some examples of small habits for saving money?

A: Examples of small habits for saving money include tracking expenses, setting a budget, avoiding impulse purchases, and automatically transferring a portion of your income to savings.

Q: How can I stay motivated to save money through small habits?

A: You can stay motivated to save money through small habits by setting specific, achievable goals, celebrating your progress, and visualizing the benefits of achieving your savings goals.

Q: Is it possible to save money even with a limited income?

A: Yes, it is possible to save money even with a limited income by prioritizing saving, cutting unnecessary expenses, and finding creative ways to increase your savings, no matter how small the amount.

Q: How long does it take to see the impact of small habits on savings?

A: The impact of small habits on savings can vary depending on individual circumstances, but many people start to see positive results within a few months of consistently practicing good saving habits.

Q: What are some tips for building lasting saving habits?

A: Tips for building lasting saving habits include starting small, being consistent, rewarding yourself for progress, and seeking support from friends or family members who share your saving goals.