Money-Smart Kids! It’s never too early to start teaching financial literacy to children and instilling positive money habits that will benefit them for life. By introducing concepts such as money management, saving, and giving back at a young age, parents can raise money-smart kids with happy money values. In this blog post, we will explore practical tips and strategies to help nurture a healthy relationship with money in children and set them up for a successful financial future.

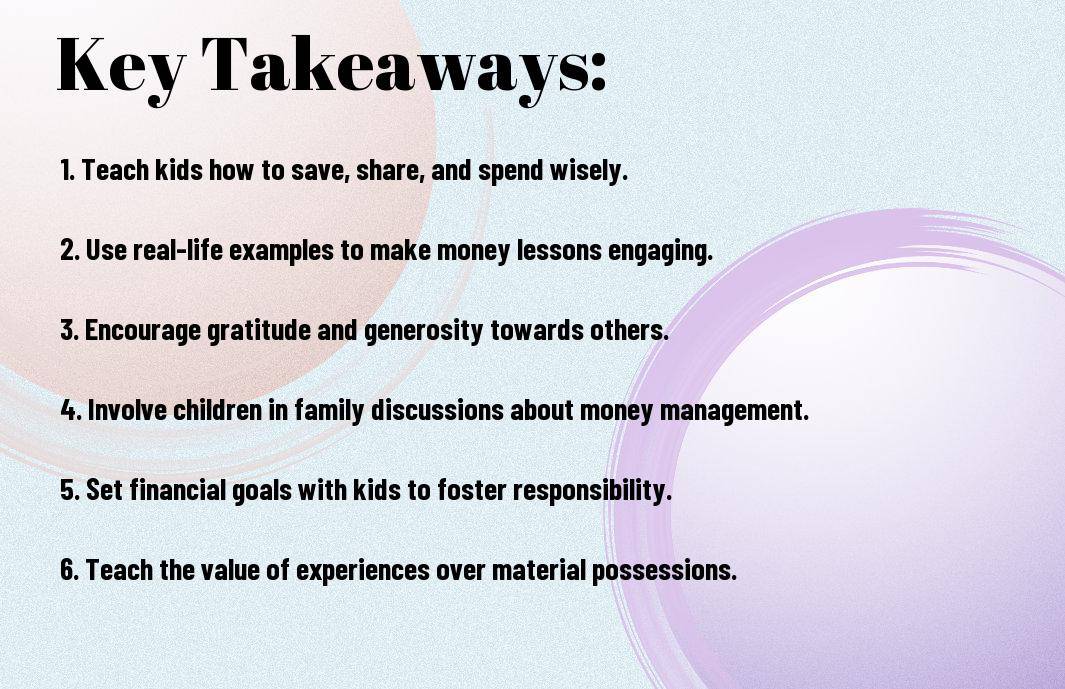

Key Takeaways:

- Teach Financial Values Early: Start teaching your kids about money management and the value of savings from a young age to instill good financial habits early on.

- Lead by Example: Show your kids positive money behaviors by being a good role model with your own financial decisions and actions.

- Make Learning Fun: Use games, activities, and interactive experiences to make financial education enjoyable and engaging for your kids.

Laying the Foundations of Financial Literacy

While it’s never too early or too late to start teaching your kids about money, laying a strong foundation of financial literacy early on can set them up for a lifetime of smart decision-making and financial independence. By instilling money-smart habits and happy money values in your children from a young age, you can help them develop a healthy relationship with money and set them on the path to financial success.

Making Cents of Allowances: The Basics

The key to teaching kids about money is to start with the basics. Allowances are a great way to introduce children to the concept of earning and managing money. Encourage your kids to earn their allowance by completing age-appropriate chores around the house. This not only teaches them the value of hard work but also gives them a sense of responsibility and ownership over their finances.

Happy Money Habits: Saving and Spending

To instill healthy money habits in your children, it’s important to teach them the value of saving and spending wisely. Encourage your kids to set savings goals for things they want to buy and help them create a simple budget to track their spending. By teaching them to prioritize their spending and save for the things that truly matter to them, you can help them develop a mindset of mindful consumption and financial responsibility.

Cents By teaching your kids the importance of saving and spending wisely, you are laying the foundation for a lifetime of financial success. Encouraging them to develop happy money habits early on can help set them up for a future where they feel confident and empowered to make smart financial decisions.

Instilling the Value of Earnings

After teaching children the basic concepts of money management, the next step is to instill the value of earnings. Understanding that money is earned through hard work is important in shaping their money-smart mindset.

Fun Ways to Earn the First Dollars

First things first, it’s important to make earning money a fun and engaging experience for kids. Encourage them to take on simple tasks like setting up a lemonade stand, helping with household chores, or even selling handmade crafts. These activities not only teach the value of earning but also spark creativity and entrepreneurship.

Additionally, consider incentivizing their efforts by offering a small allowance or rewards for accomplishing tasks. This will motivate them to work towards their goals and understand the correlation between effort and financial gain.

Beyond Chores: Encouraging Entrepreneurial Spirit

On top of regular chores, parents can nurture their children’s entrepreneurial spirit by encouraging them to start small ventures. Whether it’s a neighborhood car wash service, a bake sale, or a dog-walking business, these activities provide valuable lessons in planning, marketing, and customer service.

A supportive environment that allows children to explore different ways of making money will help them develop invaluable skills that will serve them well in the future. Encouraging entrepreneurial pursuits from a young age can lay the foundation for a lifetime of financial independence and innovation.

Smart Spending: The Joy of Being Money-Wise

Unlike other financial habits, smart spending is an vital skill that children should learn from a young age. Teaching kids the value of money and how to spend it wisely is crucial for their financial well-being in the future. According to Raising Money Smart Kids, instilling smart spending habits can lead to a lifetime of financial success and security.

Teaching Kids to Spend with Intention

With a world full of advertisements and peer pressure, teaching kids to spend with intention is more important than ever. Encouraging children to think about their purchases before making them can help them differentiate between needs and wants. One way to instill this habit is by involving them in discussions about budgeting and the value of items they wish to purchase. This can empower them to make informed decisions and prioritize their spending based on their values and goals.

Charity and Sharing: The Pleasure of Giving Back

Intentional giving is a core value that goes hand in hand with smart spending. Teaching kids about charity and sharing not only instills empathy and compassion but also cultivates a sense of gratitude for what they have. By involving children in acts of giving back, whether through donations, volunteering, or simple acts of kindness, they learn the joy that comes from helping others and making a positive impact in the world.

Charity brings joy and fulfillment not only to the recipients but also to the givers. By incorporating charitable activities into their lives, kids can develop a sense of responsibility towards their communities and become more grateful for their own blessings. These experiences shape them into compassionate individuals who understand the importance of generosity and empathy.

Preparing for the Future: Investments and Growth

Not all children may grasp the concept of investments and growth early on, but introducing them to these ideas can set them up for financial success in the future. Teaching children about how money can work for them and grow over time is a valuable lesson in building a secure financial future.

Simple Investments for the Young Minds

Simple investments like setting up a savings account for children can be a great way to introduce them to the concept of growth. Encourage them to save a portion of their allowance or any monetary gifts they receive in this account. This can help them see how their money can grow over time with the power of compounding interest.

Toys like piggy banks and savings jars can also be used to teach children about saving and investing. These interactive tools can make learning about money fun and engaging. Learning about investments at a young age can instill good financial habits that will benefit them later in life.

Games and Tools for Understanding Money Growth

Not all kids find numbers and finance stimulating, which is why incorporating games and tools can make learning about money growth more enjoyable. Board games like Monopoly and The Game of Life can teach children about investments, financial decisions, and the importance of saving money for the future.

Money-focused apps and online platforms can also be excellent resources for children to learn about investments and growth. These tools can make learning interactive and provide real-world examples that children can relate to.

FAQ

Q: What is the importance of raising money-smart kids?

A: Raising money-smart kids is important because it sets them up for a financially secure future and teaches them valuable life skills.

Q: How can I teach my kids about money management?

A: You can teach your kids about money management through hands-on experiences, like giving them an allowance and involving them in budgeting decisions.

Q: What are happy money values?

A: Happy money values are centered around using money in ways that bring joy, fulfillment, and meaning to your life and the lives of others.

Q: How can I instill happy money values in my kids?

A: You can instill happy money values in your kids by leading by example, discussing the importance of gratitude and generosity, and encouraging mindful spending.

Q: At what age should I start teaching my kids about money?

A: It’s never too early to start teaching kids about money. You can begin introducing basic money concepts as soon as they show an interest.

Q: What are some fun ways to teach kids about money?

A: Some fun ways to teach kids about money include playing financial literacy games, setting up a pretend store or restaurant, and creating savings challenges.

Q: How can I help my kids develop a healthy relationship with money?

A: You can help your kids develop a healthy relationship with money by fostering open communication about finances, encouraging smart money habits, and emphasizing the value of experiences over material possessions.