You know developing financial saving habits is crucial for a secure future, yet it can sometimes feel overwhelming to know where to start. The key to success lies in the small, consistent actions we take each day that eventually lead to significant changes over time. By implementing the principles of Atomic Habits into your life, you can make saving money a natural and effortless part of your routine.

James Clear’s groundbreaking book, Atomic Habits, provides practical strategies for building good habits and breaking bad ones. By applying these concepts to your financial goals, you can set yourself up for long-term success and financial stability. In this guide, we will explore how you can harness the power of Atomic Habits to develop healthy saving habits that will help you achieve your financial dreams.

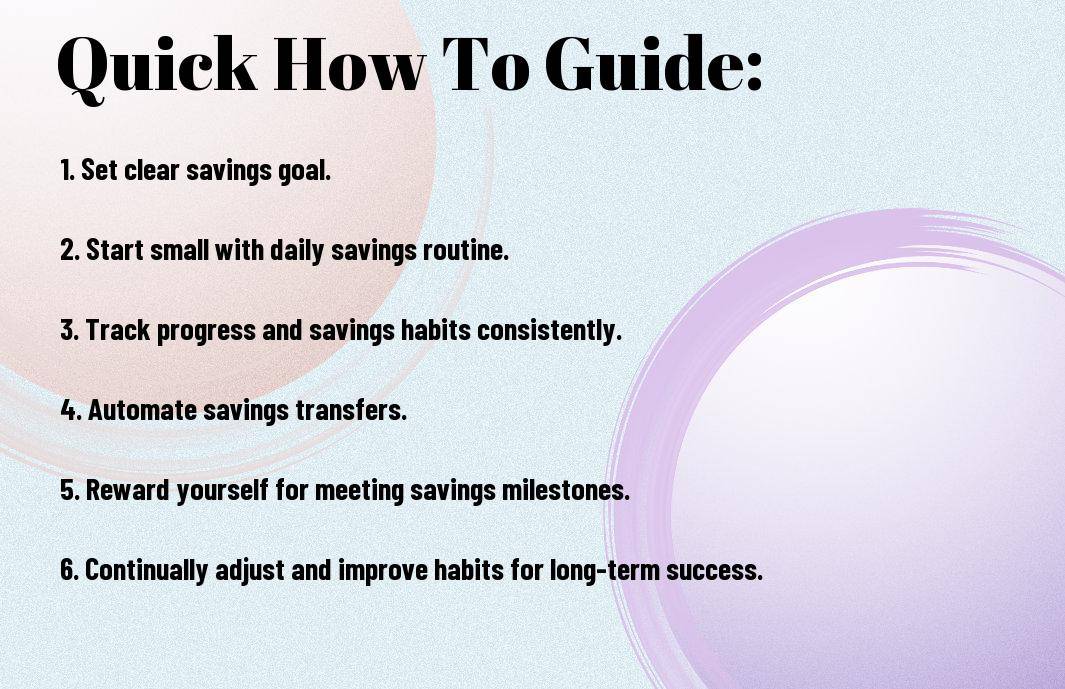

Key Takeaways:

- Start small: Begin by saving a small amount regularly, even if it seems insignificant.

- Automate savings: Set up automatic transfers to your savings account to avoid the temptation of spending it.

- Track your progress: Monitor your savings habits to stay motivated and see the impact of your efforts.

- Visualize your goals: Create a vision board or chart to remind yourself why you are saving and stay focused.

- Reward yourself: Celebrate small milestones in your savings journey to reinforce positive habits.

- Find an accountability partner: Share your savings goals with a friend or family member to keep each other on track.

- Review and adjust: Regularly assess your savings strategy and make changes as needed to improve your financial habits.

Understanding Your Financial Goals

It is crucial to understand your financial goals before initiateing on the journey of developing saving habits. By clearly defining what you want to achieve financially, you can create a roadmap that will guide your habits and actions.

Setting Clear, Achievable Objectives

Clear goals are necessary when it comes to saving money. Whether you aim to build an emergency fund, save for a vacation, or invest in your retirement, setting specific and measurable objectives will help you stay motivated and on track. Make sure your goals are realistic and achievable within a reasonable timeframe.

Tailoring Your Habits to Your Financial Vision

Clear habits aligned with your financial vision can significantly impact your success in achieving your goals. Identify the habits that will support your objectives and make them a consistent part of your routine. Whether it’s cutting back on dining out, setting up automated transfers to your savings account, or tracking your expenses diligently, customize your habits to fit your unique financial situation.

Achievable goals and habits that are tailored to your financial vision will set you up for long-term success in saving money. Do not forget, it’s not about depriving yourself of things you enjoy, but rather making intentional choices that support your financial wellbeing. Celebrate small victories along the way and stay focused on the bigger picture of financial stability and security.

The Foundations of Atomic Financial Habits

For a powerful guide on building financial saving habits, look no further than the principles outlined in the book “Atomic Habits” by James Clear. This book offers valuable insights into how small changes can lead to remarkable results in saving and managing money. To examine deeper into the synergy between habit formation and financial well-being, check out How the Book “Atomic Habits” Changed My Perspective on Finances.

The Science Behind Habit Formation

For those looking to cultivate better financial habits, understanding the science behind habit formation is key. Clear’s concepts emphasize the power of small changes and consistent actions in shaping behavior. By breaking down financial goals into manageable tasks and routines, individuals can set themselves up for long-term success in saving and budgeting.

Identifying Your Saving Triggers and Rewards

Saving money involves more than just setting aside a portion of your income. It’s crucial to identify the triggers that lead to your spending habits as well as the rewards you gain from saving. By recognizing what prompts you to make financial decisions and understanding the positive outcomes of saving, you can create a sustainable saving plan that aligns with your goals.

Another imperative aspect of identifying saving triggers and rewards is acknowledging the emotional connection you have with money. Whether it’s the thrill of making a purchase or the sense of security that comes with saving, understanding your emotions around money can help you develop healthier financial habits.

Creating Your Financial Habit Loop

The Cue: Initiating Your Saving Routine

After deciding to develop better financial habits, the first step is to create a cue that triggers your saving routine. There’s an array of cues you can choose from, such as setting a specific time each day to review your finances, receiving a notification on your phone, or associating saving with a daily activity like having your morning coffee.

The Routine: Making Saving a Seamless Part of Your Day

After establishing your cue, it’s time to develop a routine that seamlessly incorporates saving into your daily life. Your routine can be as simple as transferring a set amount of money to your savings account each day or setting up an automatic transfer on payday. By making saving a habitual part of your day, you’ll be more likely to stick to your financial goals and see lasting results.

For instance, you can place a piggy bank in a visible spot in your home and deposit loose change into it every evening. This simple action can serve as a physical reminder to save and can add up over time, contributing to your financial security.

The Reward: Establishing Positive Reinforcement

After completing your saving routine, it’s important to establish a rewarding experience that reinforces your behavior. Positive reinforcement can take many forms, such as celebrating reaching a savings milestone, treating yourself to a small indulgence, or tracking your progress towards a larger financial goal.

Reinforcement helps to solidify your saving habit by associating positive feelings with the action of saving. By creating a reward system for yourself, you’ll be more motivated to continue saving and build a strong financial foundation for the future.

Strategic Tips for Developing Strong Saving Habits

Now, developing strong saving habits takes time and consistency. By implementing the principles of Atomic Habits into your financial routine, you can pave the way for a more secure future. Here are some strategic tips to help you on your journey to financial stability:

Starting Small: The Power of Tiny Gains

The key to building solid saving habits is to start small. Make small adjustments to your daily routine that contribute to your long-term financial goals. Whether it’s setting aside a small percentage of your income each month or cutting back on unnecessary expenses, these tiny gains can add up over time and make a significant impact on your overall financial health.

Stacking Habits: Leveraging Existing Behavior

One powerful strategy for developing saving habits is to stack them onto existing behaviors. For example, if you already have the habit of checking your email every morning, you can pair it with reviewing your weekly finances. By linking saving habits to behaviors you already do consistently, you can create a powerful routine that will help you stay on track with your financial goals.

One benefit of stacking habits is that it helps you stay consistent with your saving goals by integrating them into your daily life seamlessly. By leveraging existing behaviors, you are more likely to stick to your saving habits in the long run. This approach also minimizes the effort required to develop new habits, making it easier to maintain your financial commitments over time. This sustainable strategy can lead to significant financial gains and improved financial well-being over time.

Overcoming Common Obstacles to Saving

Dealing with Financial Temptations

Unlike our best-laid plans, we often find ourselves facing unexpected financial temptations that can throw us off course when trying to save. From the urge to splurge on a new gadget to the temptation of dining out at fancy restaurants, these moments can challenge our commitment to saving.

Little steps can help you resist these temptations. Try setting up automatic transfers to your savings account each month before you have a chance to spend the money elsewhere. Additionally, consider creating a budget that allows for some fun money to satisfy your cravings while still prioritizing your savings goals.

Adjusting Habits in Response to Life Changes

Obstacles like job loss, unexpected medical expenses, or major life events can disrupt our saving habits. While these challenges may seem daunting, they also provide an opportunity to reevaluate our financial priorities and make necessary adjustments to our saving strategies.

Adjusting your habits in response to life changes doesn’t have to be overwhelming. By staying flexible and being proactive, you can navigate through these obstacles while staying on track with your financial goals. Consider seeking advice from a financial advisor to help you navigate through these transitions smoothly.

Measuring and Tracking Your Financial Progress

Many people find it challenging to save money consistently, but a key aspect of building this habit is measuring and tracking your financial progress. By monitoring your finances regularly, you can stay motivated and make informed decisions about your spending and saving habits.

Selecting Metrics That Matter

Little changes can add up to significant progress when it comes to saving money. When dicking out metrics to track your financial progress, focus on key indicators such as your monthly savings rate, emergency fund growth, or debt reduction. These metrics can give you a clear understanding of how well you are managing your money and where adjustments may be needed.

Utilizing Tools and Apps to Stay on Track

There’s a wide range of financial tools and apps available that can help you stay on track with your savings goals. These platforms can automatically categorize your expenses, set budget limits, and provide insights into your spending patterns. By utilizing these tools, you can efficiently monitor your financial progress and make informed decisions to improve your saving habits.

The key is to find a tool or app that aligns with your saving goals and preferences. Whether you prefer a hands-on approach with detailed reports or a more automated system, there is likely a tool out there that can help you achieve financial success.

Sustaining Your Saving Habits Long Term

Despite our best intentions, it can be challenging to maintain our saving habits over the long term. However, by applying Atomic Habits to your finances, you can set yourself up for success in sustaining your saving habits for the long run.

The Role of Community and Accountability

Clearly, having a supportive community and accountability partner can make a significant difference in helping you stay on track with your savings goals. By sharing your progress, challenges, and successes with others, you not only stay motivated but also receive valuable feedback and encouragement along the way.

Adapting Your Habits to Grow With You

Your financial journey will evolve over time, and so should your saving habits. It’s important to regularly review and adjust your savings strategies to align with your changing financial goals and circumstances. By staying flexible and adaptable, you can ensure that your saving habits continue to support your overall financial well-being.

With consistency and flexibility in your approach, you can navigate through different life stages while maintaining a healthy saving habit that grows with you.

To wrap up

Taking this into account, incorporating the principles from “Atomic Habits” into developing financial saving habits can lead to significant changes in your financial well-being. By focusing on making small, sustainable changes and creating a system that supports your saving goals, you can gradually build up your savings and work towards your financial objectives.

Keep in mind, consistency is key when it comes to forming new habits, so be patient with yourself and celebrate each small victory along the way. With dedication and commitment to improving your saving habits, you can pave the way for a more secure financial future.

FAQ

Q: What are atomic habits?

A: Atomic habits are small changes or routines that compound over time to lead to significant improvements or results.

Q: How can atomic habits help in developing financial saving habits?

A: By implementing small changes in your daily routines related to spending, budgeting, and saving, you can gradually improve your financial habits and savings.

Q: What are some examples of atomic habits for saving money?

A: Examples of atomic habits for saving money include setting a budget, tracking expenses, automating savings transfers, and avoiding impulse purchases.

Q: How can I make atomic habits stick when it comes to saving money?

A: To make atomic habits stick for saving money, start small, be consistent, track your progress, and reward yourself for achieving your savings goals.

Q: Why are atomic habits more effective than drastic changes for financial saving habits?

A: Atomic habits are more sustainable and manageable than drastic changes because they focus on gradual improvement and consistency, leading to long-term success.

Q: How long does it take to see results from implementing atomic habits for financial saving?

A: Results from implementing atomic habits for financial saving can vary, but with consistency and persistence, you can start seeing positive changes in a matter of weeks or months.

Q: Can atomic habits for financial saving be personalized to fit individual lifestyles?

A: Yes, atomic habits for financial saving can and should be personalized to fit your unique lifestyle, preferences, and financial goals to make them more effective and sustainable.