With the ever-changing landscape of the financial industry, it is crucial for financial advisors to cultivate strong fiscal discipline to navigate through the challenges and uncertainties. In this blog post, we will explore how the principles of James Clear’s Atomic Habits can be applied by financial advisors to build sustainable financial habits and achieve long-term success for themselves and their clients.

Imagine you’re navigating through the dense forest of personal finance, where each step forward feels like a venture into the unknown. Then, amid the thick foliage, you stumble upon a tool so potent, yet so simple, it seems almost magical: the concept of atomic habits, popularized by James Clear. This isn’t just another financial strategy; it’s a beacon of light guiding you to fiscal discipline and long-term success.

Remember that time you decided to skip that daily coffee purchase and, instead, directed those funds into your savings? That was you unknowingly practicing an atomic habit. It’s the small choices, those seemingly inconsequential decisions, that compound over time into significant financial growth. This principle isn’t just a theory; it’s the lived experience of countless individuals who’ve turned their financial lives around, one small habit at a time.

So, as you stand at the crossroads of financial decision-making, consider this: success doesn’t require monumental changes. It starts with the tiny, yet powerful, decision to be better today than you were yesterday. Whether it’s automating your savings, dedicating just ten minutes a day to review your financial goals, or simply tracking your spending, these habits are your stepping stones to building a robust financial future.

Let’s embark on this journey together, transforming our financial habits atom by atom. With each small step, you’ll not only cultivate stronger fiscal discipline but also navigate the path to achieving your long-term financial dreams. The power of atomic habits lies within you; it’s time to unlock it.

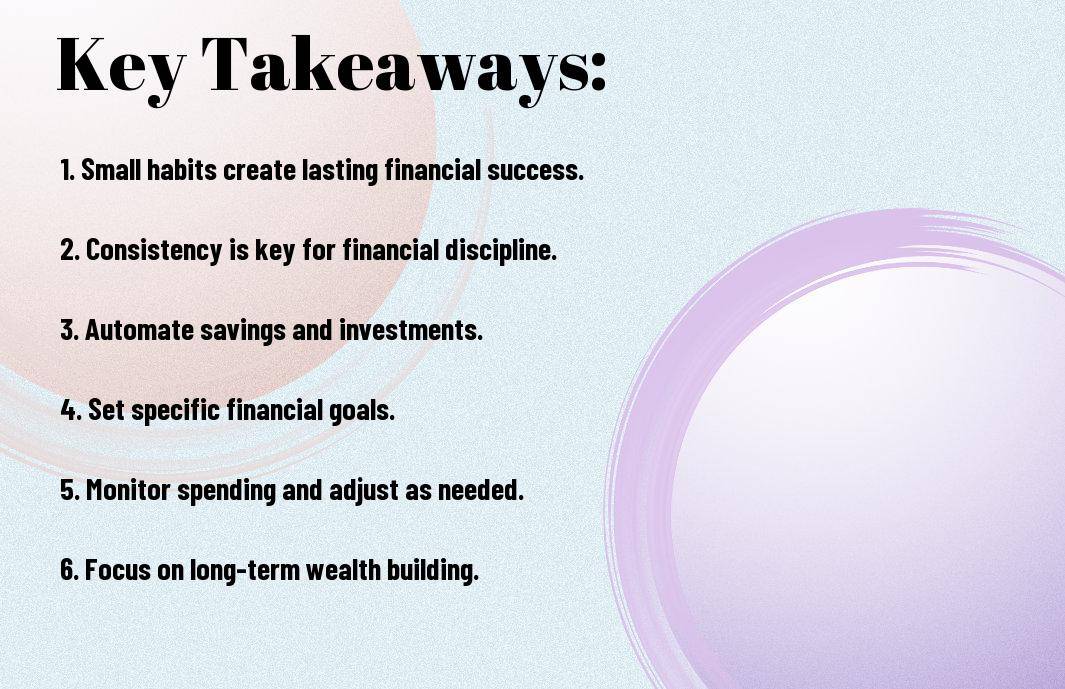

Key Takeaways:

- Start small: Focus on making tiny changes in your financial habits that will compound over time.

- Be consistent: Develop a routine and stick to it to build lasting fiscal discipline.

- Track your progress: Monitor your financial habits and identify areas for improvement.

- Set specific goals: Define clear financial objectives that are measurable and achievable.

- Avoid temptations: Create an environment that supports your financial goals and minimizes distractions.

- Automate savings: Set up automatic transfers to savings accounts to ensure consistent contributions.

- Seek accountability: Share your financial goals with a trusted advisor or partner to stay motivated and on track.

Decoding Atomic Habits: What They Are and How They Work

Understanding the Atomic Habit Loop

There’s a popular saying that goes, “You are what you repeatedly do.” This quote perfectly captures the essence of atomic habits. Atomic habits are small, incremental changes that we make in our daily routines that can lead to significant long-term results. These habits work on the principle of creating a loop – Cue, Craving, Response, and Reward. By understanding and mastering this loop, we can cultivate positive financial habits that lead to fiscal discipline.

The Science of Building Good Habits and Breaking Bad Ones

WorkWith the right understanding of how habits work, we can effectively build good ones and break bad ones. The science behind habit formation lies in the reward system of our brains. When we perform a habit that is followed by a reward, our brain releases dopamine, reinforcing the behavior. On the other hand, breaking bad habits involves identifying the cues and cravings that trigger them and finding alternative responses that will not only satisfy the craving but also lead to a positive outcome.

Decoding the Science of Building Good Habits and Breaking Bad Ones involves delving deeper into the psychology of habit formation. By understanding the cues, cravings, responses, and rewards associated with our habits, we can consciously design our routines to cultivate positive financial behaviors. This process requires awareness, intentionality, and consistency in order to rewire our brains for lasting change.

Foundation of Fiscal Discipline: Setting the Stage for Success

Unlike many other professions, financial advisors need to cultivate strong fiscal discipline to effectively manage their clients’ wealth. In my blog post Financial Advisors Should Adopt Atomic Habits to Achieve Success, I probe into how adopting atomic habits can revolutionize the way financial advisors approach their work and personal finances.

Clarifying Your Financial Vision

Setting a clear financial vision is the first step towards achieving fiscal discipline. By clearly defining your short and long-term financial goals, you create a roadmap that guides your daily actions and decisions. This vision acts as a beacon, keeping you focused and motivated on your journey towards financial success. Take the time to reflect on what financial freedom means to you and set specific, measurable targets to work towards.

Crafting an Environment Conducive to Financial Discipline

Environment plays a crucial role in shaping our habits and behaviors. Create a space where financial discipline thrives by surrounding yourself with positive influences. This could involve joining professional networks or seeking mentorship from seasoned financial advisors. Additionally, leverage technology to streamline your financial workflows and stay organized. By removing distractions and setting up systems that support your goals, you pave the way for sustained financial success.

Strategies for Financial Advisors: Small Habits, Big Impact

Now is the time for financial advisors to harness the power of small habits that can lead to significant impacts on their clients’ financial well-being. By focusing on cultivating and maintaining these habits, advisors can help clients achieve greater fiscal discipline and long-term financial success.

Daily Habit Techniques for Managing Client Portfolios

Habit: A daily habit technique for managing client portfolios is to set aside a specific time each day to review and analyze the performance of the investments. By consistently dedicating time to this task, financial advisors can stay proactive and make timely adjustments to ensure their clients’ portfolios are aligned with their financial goals. This small but consistent habit can lead to significant improvements in portfolio performance and client satisfaction.

Incremental Steps to Mastering Personal Finance Management

Habits: Pertaining to mastering personal finance management, small incremental steps can make a huge difference. Financial advisors can encourage clients to start with simple habits like tracking their expenses, setting a budget, and automating savings. By gradually incorporating these habits into their daily routine, clients can build a strong foundation for better financial health. Consistency is key in developing these habits, as they can lead to long-lasting positive changes in clients’ financial behaviors.

Finance: Understanding the importance of starting small and building up gradually is crucial in the journey to mastering personal finance management. By breaking down financial goals into manageable steps and focusing on consistent habits, financial advisors can guide clients towards a more secure financial future.

Overcoming Common Challenges: Staying the Course

Many financial advisors face challenges when it comes to cultivating fiscal discipline. However, incorporating The Benefits of Building Atomic Habits as a Financial Advisor can have a significant impact on overcoming these obstacles. By focusing on small, consistent actions and tweaking habits over time, advisors can enhance their financial planning skills and increase client satisfaction.

Identifying and Tackling Financial Procrastination

Financial procrastination is a common hurdle that many advisors face. It can manifest in delaying client meetings, putting off investment decisions, or avoiding necessary paperwork. To combat this, advisors can implement strategies such as setting specific timelines for tasks, breaking down larger projects into manageable steps, and seeking an accountability partner. By addressing procrastination head-on, advisors can improve productivity, build trust with clients, and enhance their professional reputation.

Dealing with Setbacks and Maintaining Motivation

Financial advisors may encounter setbacks such as market downturns, unexpected client challenges, or personal obstacles that affect their motivation. Staying the course requires resilience and a positive mindset. It is crucial to acknowledge setbacks as learning opportunities, seek support from peers or mentors, and revisit long-term goals to stay motivated. By maintaining a growth mindset and focusing on the bigger picture, advisors can navigate challenges and emerge stronger in their practice.

Tools of the Trade: Leveraging Technology for Habit Formation

Your journey towards cultivating fiscal discipline can be greatly supported by leveraging technology to form and track your habits. James Clear’s book, Atomic Habits: An Easy and Proven Way to Build Good …, provides valuable insights on how to make small changes that lead to big results in your financial life. By incorporating technological tools, you can make the process of developing positive habits more seamless and effective.

Apps and Digital Resources for Fiscal Habit Tracking

Resources like budgeting apps, expense trackers, and investment platforms offer a convenient way to monitor your financial activities. These tools provide real-time updates on your spending, saving, and investing behaviors, allowing you to stay on top of your fiscal health. By regularly reviewing your financial data through these apps, you can identify patterns, set goals, and make informed decisions that align with your long-term objectives.

Integrating Tech into Your Daily Financial Advisory Practice

An vital aspect of developing fiscal discipline is incorporating technology into your day-to-day financial advisory practice. Utilizing tools such as customer relationship management (CRM) software, portfolio management systems, and financial planning apps can streamline your workflow, enhance client engagement, and improve the overall efficiency of your practice. By embracing technology, you can provide better service to your clients, strengthen your professional relationships, and position yourself as a trusted advisor in the digital age.

This integration of technology enables financial advisors to leverage data analytics, automate routine tasks, and deliver personalized solutions to their clients. By harnessing the power of technology, advisors can adapt to changing market trends, capitalize on new opportunities, and enhance the overall client experience. Embracing a tech-savvy approach not only fosters growth for your practice but also cultivates a culture of innovation and adaptability in the financial advisory industry.

Measuring Success: Tracking Progress and Making Adjustments

Despite our best intentions and efforts, progress in cultivating financial discipline can sometimes be challenging to measure. This is where tracking our actions and outcomes becomes crucial. By keeping a record of our financial habits and outcomes, we can evaluate our progress and make necessary adjustments to stay on track towards our goals.

Setting Benchmarks and Celebrating Milestones

Adjustments in our financial habits should be guided by clear benchmarks and milestones. Setting specific targets for savings, investments, or debt reduction can help us gauge how well we are sticking to our financial plan. Celebrating small victories along the way, such as reaching a savings goal or paying off a credit card, can provide positive reinforcement and motivation to continue making progress.

When to Pivot: The Art of Refining Your Financial Habits

Benchmarks are not set in stone – they should be flexible enough to accommodate changes in our financial situation or goals. Knowing when to pivot and adjust our strategies is a skill that comes with experience and self-awareness. If certain habits are no longer serving our financial well-being or if unexpected circumstances arise, it may be time to reevaluate and pivot towards a more effective approach.

Nurturing Client Relationships with Atomic Habits

Not only is it important for financial advisors to help clients develop good financial habits, but it is also crucial to nurture strong and lasting relationships with them. By incorporating the principles of atomic habits into client interactions, financial advisors can better assist individuals in achieving their financial goals and building a secure future.

Educating Clients on the Power of Small Financial Choices

One of the key aspects of nurturing client relationships with atomic habits is educating clients on the significant impact of small, consistent financial choices. Many clients may not realize the power of small savings or investments over time, but by demonstrating how these incremental changes can lead to substantial financial growth, advisors can empower clients to make better decisions for their financial well-being.

Building Trust Through Consistent Habitual Financial Advice

Building trust is vital in any client-advisor relationship, and one effective way to establish trust is through consistent, habitual financial advice. Financial advisors who provide reliable, timely guidance and support to their clients create a sense of security and confidence. Consistently delivering sound financial advice over time helps clients see the value in the advisor-client relationship and fosters a sense of trust.

For instance, when a financial advisor consistently monitors a client’s portfolio and offers updates and recommendations, it reassures the client that their financial well-being is a top priority. This level of dedication and personalized attention can go a long way in strengthening the bond between advisor and client, ultimately leading to more successful financial outcomes.

Conclusion

Presently, financial advisors can benefit greatly from implementing the principles of Atomic Habits to cultivate fiscal discipline in both their personal and professional lives. By focusing on small, consistent improvements and creating a system of habits that lead to long-term financial success, advisors can better serve their clients and improve their own financial well-being.

Through the power of compound effects and the implementation of strategies such as habit stacking, temptation bundling, and creating an environment that promotes good financial habits, advisors can enhance their ability to reach their financial goals. By leveraging the principles outlined in Atomic Habits, financial advisors can establish a solid foundation for cultivating fiscal discipline and ultimately drive better outcomes for themselves and their clients.

FAQ

Q: Why is cultivating fiscal discipline important for financial advisors?

A: Cultivating fiscal discipline is crucial for financial advisors as it helps them set a good example for their clients and build trust. It also enables them to manage their own finances effectively and make sound investment decisions.

Q: How can Atomic Habits help financial advisors improve their fiscal discipline?

A: Atomic Habits provides a framework for creating small, manageable changes that can lead to significant improvements over time. By implementing tiny habits consistently, financial advisors can strengthen their fiscal discipline and achieve long-term financial success.

Q: What are some examples of atomic habits that financial advisors can practice?

A: Examples of atomic habits for financial advisors include setting a daily savings goal, reviewing expenses regularly, tracking investment performance, and reading financial news for 15 minutes each day.

Q: How can financial advisors stay motivated to cultivate fiscal discipline?

A: Financial advisors can stay motivated by setting clear goals, tracking their progress, rewarding themselves for small victories, and surrounding themselves with supportive peers who share similar financial goals.

Q: What role does consistency play in building fiscal discipline?

A: Consistency is key to building fiscal discipline as it helps financial advisors form habits that become automatic over time. By consistently practicing small habits, financial advisors can make lasting changes to their financial behavior.

Q: How long does it take to see results from cultivating fiscal discipline?

A: Results from cultivating fiscal discipline may vary depending on individual circumstances, but with consistent effort and dedication, financial advisors can start seeing positive results within a few weeks to a few months.

Q: Can financial advisors help their clients cultivate fiscal discipline using Atomic Habits principles?

A: Yes, financial advisors can apply the principles of Atomic Habits to help their clients cultivate fiscal discipline. By guiding clients to adopt small, sustainable habits and providing ongoing support and accountability, financial advisors can empower their clients to achieve their financial goals.