Debt reduction! Most of us have experienced the stress and anxiety that comes with debt. However, by implementing small daily habits and making tiny changes in our routines, we can take control of our finances and minimize debt effectively. Whether you’re trying to pay off student loans, credit card debt, or any other financial obligations, developing atomic habits can make a significant impact on your journey to financial freedom.

Growing up, I watched my family navigate the choppy waters of financial instability. It wasn’t until I stumbled upon the power of atomic habits that I realized the monumental impact of small, daily changes. By simply reviewing my expenses every evening and questioning each purchase, I transformed my relationship with money. This habit alone helped me pay off my credit card debt months ahead of schedule. It was a game-changer, proving that monumental goals are achievable through the accumulation of tiny, consistent efforts. Let’s dive into how you can harness these habits to not just dream of financial freedom, but live it.

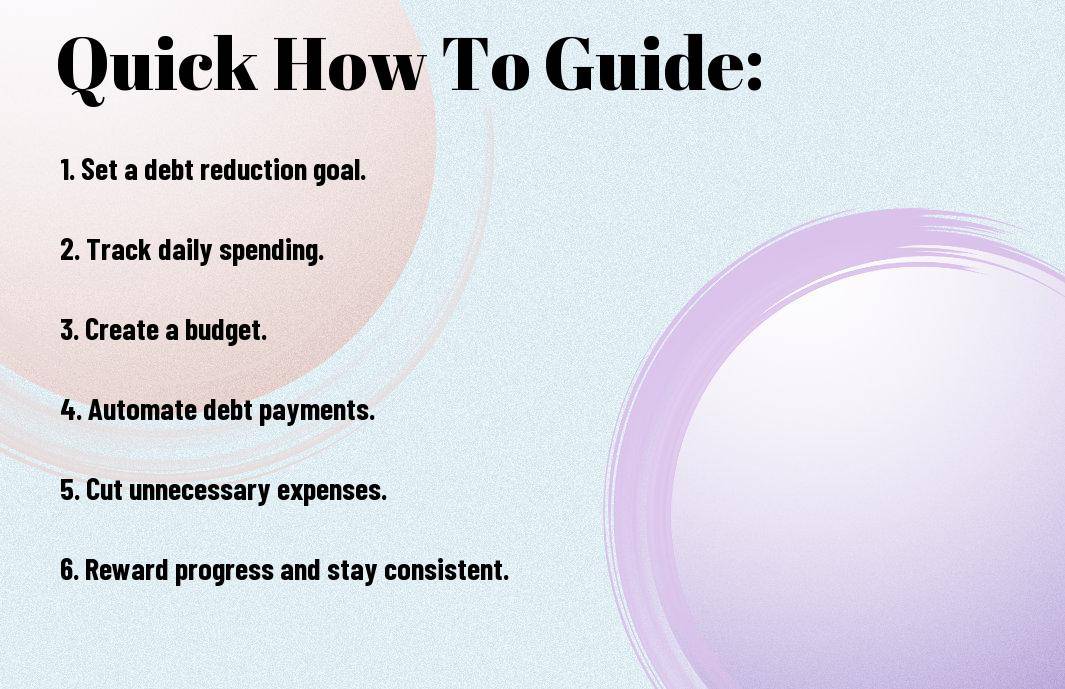

Key Takeaways:

- Consistency is key: Establishing daily habits for debt reduction is crucial in achieving financial goals.

- Track your spending: Monitoring your expenses daily can help you identify areas where you can cut back.

- Create a budget: Setting a budget and sticking to it can prevent unnecessary spending and help you pay off debt faster.

- Avoid impulse purchases: Practice self-discipline and avoid making spontaneous purchases that can contribute to debt.

- Automate your savings: Set up automatic transfers to a savings account to ensure you are consistently putting money towards debt repayment.

- Seek professional help: If you are struggling with debt, consider reaching out to a financial advisor or counselor for guidance.

- Reward yourself: Celebrate small victories along the way to staying motivated and on track with your debt reduction goals.

Setting Your Debt Reduction Goals

Some of the first steps in reducing your debt involve setting achievable goals and staying motivated throughout the journey. By defining clear goals and developing a plan of action, you can effectively work towards a debt-free future.

How to Define Achievable Goals

Some effective strategies for defining achievable debt reduction goals include assessing your current financial situation, identifying the total amount of debt you owe, setting a realistic timeline for debt repayment, and breaking down your goals into smaller targets. For example, you could aim to pay off a certain amount of debt each month or prioritize high-interest debts first. By setting specific and measurable goals, you can track your progress and stay focused on your ultimate objective of reducing debt.

Tips for Staying Motivated Throughout Your Journey

- Track your progress: Keep a record of your debt reduction milestones to celebrate your achievements.

- Reward yourself: Treat yourself when you reach a debt repayment goal to stay motivated.

- Find a support system: Surround yourself with friends or family who can encourage you on your debt reduction journey.

Staying motivated throughout your debt reduction journey can be challenging, but it is necessary for long-term success. By tracking your progress, rewarding yourself for reaching milestones, and seeking support from those around you, you can maintain your dedication to reducing debt. Perceiving each small victory as a step towards financial freedom can help you stay focused and motivated.

The Role of Budgeting in Debt Reduction

To gain a deeper understanding of the role budgeting plays in debt reduction, it’s crucial to consider the insights of experts in the field. According to James Clear Thinks Focusing on Financial Goals Is Short-Term Thinking, putting the focus solely on financial goals may provide short-term satisfaction but not long-term success. Budgeting, on the other hand, offers a strategic approach to managing your finances and reducing debt over time.

Creating a Budget That Works for You

Role in debt reduction starts with creating a budget that aligns with your financial goals and lifestyle. It is important to track all sources of income and expenses to understand where your money is going. By identifying areas where you can cut back on unnecessary spending, you can allocate more funds towards paying off debts. It’s crucial to create a realistic budget that you can stick to consistently to make meaningful progress in reducing debt.

How to Stick to Your Budget Daily

For many individuals, sticking to a budget can be challenging. To overcome this, consider utilizing tools such as budgeting apps or creating visual aids like a vision board to remind yourself of your financial goals. Establish a routine of reviewing your budget daily and tracking your expenses to stay accountable. Consistency and discipline are key in making your budgeting efforts successful.

Daily Spending Habits to Curb Debt Growth

Despite the challenges posed by debt, establishing daily spending habits can significantly reduce the burden over time. By focusing on small, consistent changes in your financial habits, you can make a big impact on your overall debt reduction strategy.

Tracking Your Spending: A How-To Guide

To effectively manage your debt and spending, start by tracking all your expenses. This can be done through various methods such as using budgeting apps, creating spreadsheets, or simply jotting down expenses in a notebook. By monitoring your spending habits, you can identify patterns and areas where you can cut back.

Identifying and Cutting Unnecessary Expenses

Habits play a crucial role in determining our spending behavior. By identifying habits that lead to unnecessary expenses, such as impulse buying or dining out frequently, you can take steps to change these behaviors. Consider alternatives like meal prepping at home, shopping with a list, or waiting 24 hours before making a non-crucial purchase.

Cutting down on unnecessary expenses not only helps reduce debt but also promotes mindful spending habits. Be conscious of where your money is going and prioritize crucial expenses over non-crucial ones.

Smart Saving Strategies

Now, you may have read about various tips and tricks on managing your finances, such as the 8 Tips Atomic Habits Can Teach You About Managing Your Finances. Regarding debt reduction, it’s vital to implement smart saving strategies that can help you reach your financial goals sooner rather than later.

Tips for Incremental Saving

Not sure where to start with your saving journey? Consider implementing these incremental saving strategies in your daily routine:

- Set a budget: Creating a budget can help you track your expenses and identify areas where you can cut back.

- Automate your savings: Set up automatic transfers from your checking account to your savings account to ensure you save consistently each month.

- Avoid impulse buying: Before making a purchase, ask yourself if it’s a need or a want to prevent unnecessary spending.

Recall, small changes in your daily habits can lead to significant savings over time. Thou, consistency is key in building a healthy saving habit.

Factors That Affect Your Saving Habits

Even the most disciplined savers can face challenges that impact their saving habits. Below are some factors that can affect your saving habits:

- Income level: Your income plays a significant role in how much you can save each month.

- Debt obligations: High levels of debt can limit your ability to save for the future.

- Lifestyle choices: Your spending habits and lifestyle choices can either support or hinder your saving goals.

The key is to identify these factors and make necessary adjustments to improve your saving habits. The sooner you address these challenges, the closer you’ll be to achieving your financial goals. The road to financial freedom is paved with smart saving strategies and consistent efforts towards debt reduction.

Increasing Your Income to Accelerate Debt Payoff

Many people facing debt find that one of the most effective ways to speed up the debt payoff process is by increasing their income. By supplementing your regular income with side hustles or passive income streams, you can allocate more money towards paying off your debts each month.

How to Find Side Hustles or Passive Income Streams

An excellent way to find side hustles or passive income streams is by assessing your skills and interests. You can look for freelance opportunities in your field, offer services such as tutoring or pet sitting, or explore online platforms that allow you to monetize hobbies like crafting or graphic design. Additionally, investing in rental properties or starting a small online business can generate passive income over time. Researching different options and trying out various income streams can help you find the best fit for your lifestyle and financial goals.

Tips for Negotiating a Raise or Improving Job Prospects

Streams Income is a crucial factor in accelerating debt payoff. Negotiating a raise or seeking better job prospects can significantly increase your earning potential. Here are some tips to help you navigate this process:

- Do your research: Understand your market value and be prepared to present solid evidence of your contributions to the company.

- Highlight your achievements: Showcase your accomplishments and the value you bring to the organization during performance reviews or when seeking a promotion.

- Consider upskilling: Investing in further education or certifications can make you a more valuable asset in the job market and increase your chances of securing a higher-paying position.

- Seek mentorship: Building relationships with mentors or industry experts can provide guidance on advancing in your career and negotiating better compensation.

Any raise or job change should be approached strategically, keeping your long-term financial goals in mind.

Increasing your income through side hustles, passive income streams, or career advancements can not only help you pay off debt faster but also provide more financial security in the long run. By diversifying your income sources and continuously seeking opportunities for growth, you can pave the way for a more stable and debt-free future.

Managing Debt Responsibly

For individuals looking to minimize their debt, managing debt responsibly is crucial. By developing daily habits that focus on responsible debt management, it becomes easier to reduce debt over time. One key aspect of managing debt responsibly is learning how to prioritize different types of debt effectively.

How to Prioritize Different Types of Debt

- High-Interest Debt: Credit card debt and payday loans typically have high-interest rates, making them costly in the long run.

- Secured Debt: Mortgages and auto loans are secured by collateral, so failing to pay them can result in losing your home or car.

- Unsecured Debt: Personal loans and medical bills fall into this category and although they may have lower interest rates, they can still impact your credit score significantly.

- Utility Bills: While not traditional debt, unpaid utility bills can lead to service disconnection and additional fees.

- Private Student Loans: These often come with fewer repayment options and higher interest rates compared to federal student loans.

Recognizing the differences between various types of debt can help you prioritize which debts to pay off first and allocate your resources effectively.

| Credit card debt | High-interest rates |

| Personal loans | Impact credit score |

| Utility bills | Service disconnection |

| Private student loans | Higher interest rates |

| Mortgages | Secured by collateral |

Negotiating with Creditors: Do’s and Don’ts

On the journey towards debt reduction, negotiating with creditors can be a useful strategy. Being aware of the do’s and don’ts of creditor negotiations can help you navigate this process more effectively.

To negotiate successfully with creditors, do communicate openly about your financial situation and do ask for lower interest rates or extended payment terms. However, don’t ignore calls or letters from creditors and don’t make promises you can’t keep.

Investment in Debt Reduction Tools and Resources

Digital Tools for Tracking Debt and Spending

Unlike traditional pen-and-paper methods, digital tools offer convenience and precision when it comes to tracking your debt and spending habits. By using apps and online platforms designed for managing finances, you can easily monitor your debt balances, set up payment reminders, and analyze your spending patterns in real-time. These tools provide a user-friendly interface that can help you stay organized and motivated on your debt reduction journey.

Books, Courses, and Workshops to Help You Stay on Track

One way to deepen your understanding of debt reduction strategies is by investing in books, courses, and workshops that are tailored to help you stay on track. These resources often provide valuable insights, practical tips, and motivational guidance to keep you focused on your financial goals. Whether you prefer reading a book at your own pace or participating in an interactive course, these resources can equip you with the knowledge and tools needed to successfully reduce your debt.

Debt reduction requires commitment and consistent effort, but investing in the right tools and resources can make the journey more manageable and rewarding. Consider exploring a mix of digital tools, educational resources, and expert guidance to create a personalized debt reduction plan that suits your unique financial situation. Note, every small step you take towards minimizing your debt brings you closer to financial freedom.

Staying Debt-Free: Long-Term Habit Development

Creating a Sustainable Financial Plan

Clearly defining your financial goals is important to staying debt-free in the long term. Start by listing all your debts, including amounts and interest rates. Next, create a budget that outlines your monthly income and expenses, allocating a portion to pay off debts. Consider setting up automatic payments to ensure you never miss a deadline. Regularly reviewing your plan and making adjustments as needed will help you stay on track towards financial freedom.

Reinforcing Good Financial Habits Daily

Staying mindful of your spending habits is crucial to reinforcing good financial habits daily. Track your expenses and identify areas where you can cut back to allocate more funds towards debt repayment. Consider using cash instead of credit cards to prevent impulse purchases. Celebrate small victories along the way to keep yourself motivated on your debt-free journey.

The key to long-term debt reduction lies in consistently practicing good financial habits. By staying committed to your goals, regularly reviewing your progress, and making adjustments as needed, you can create a sustainable plan that leads to lasting financial stability.

Conclusion

Drawing together daily habits to minimize debt through the principles of Atomic Habits can be a powerful tool for financial success. By breaking down debt reduction into small, manageable steps and consistently working towards our debt-reduction goals, we can create lasting change in our financial habits.

With a focus on building positive habits and making small improvements every day, anyone can work towards a debt-free future. By implementing the strategies outlined in Atomic Habits, we can take control of our finances, minimize debt, and ultimately achieve our financial goals.

FAQ

Q: What are Atomic Habits?

A: Atomic Habits are small, incremental changes or habits that can lead to remarkable results over time. In the context of debt reduction, these are daily habits that help minimize debt slowly but consistently.

Q: How can Atomic Habits help with debt reduction?

A: Atomic Habits can help with debt reduction by focusing on small, achievable changes in your daily life that can eventually lead to significant progress in paying off debt.

Q: What are some examples of Atomic Habits for debt reduction?

A: Atomic Habits for debt reduction can include tracking your expenses, setting a budget, paying more than the minimum amount due on your debts, and avoiding unnecessary purchases.

Q: Why are daily habits important for minimizing debt?

A: Daily habits are important for minimizing debt because they help create consistency and discipline in your financial choices, making it easier to stay on track with your debt reduction goals.

Q: How long does it take to see results from Atomic Habits for debt reduction?

A: The timeline for seeing results from Atomic Habits for debt reduction can vary depending on individual circumstances, but the key is to stay consistent and patient as small changes accumulate over time.

Q: How can I stay motivated to maintain Atomic Habits for debt reduction?

A: To stay motivated, try setting specific and achievable goals, tracking your progress, celebrating small victories along the way, and seeking support from friends or family members.

Q: Can Atomic Habits be applied to other areas of personal finance?

A: Yes, Atomic Habits can be applied to various aspects of personal finance, such as saving money, investing, building an emergency fund, and developing healthy spending habits.