Integrating happy money habits into your daily routine can significantly improve your overall well-being and happiness. According to social psychology, certain habits can help turn money into joy and fulfillment. By incorporating these positive practices, you can enhance your relationship with money and create a more fulfilling life. Learn more about these habits in the article “7 Simple Habits That Turn Money Into Happiness, …” here.

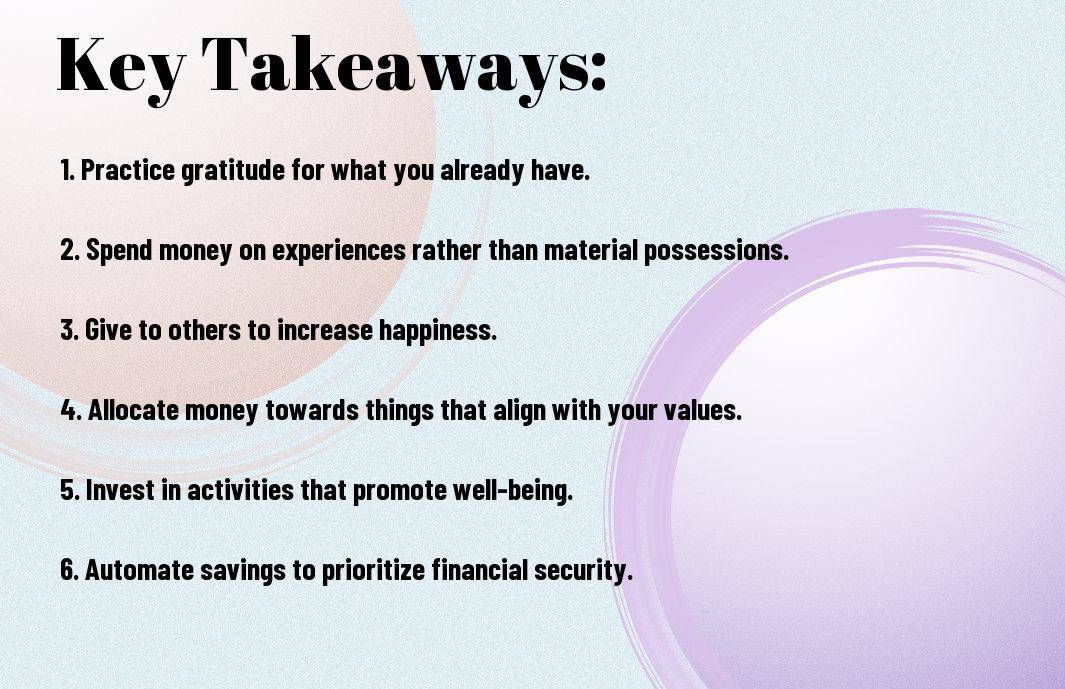

Key Takeaways:

- Be intentional with your spending: Focus on allocating your money towards experiences and purchases that bring genuine happiness and fulfillment.

- Practice gratitude: Take time each day to reflect on the things you are grateful for, whether big or small, to cultivate a positive relationship with money.

- Create a happy money mantra: Develop a positive affirmation related to money that reminds you to prioritize happiness and well-being over material possessions.

Understanding Happy Money

Clearly, integrating happy money into your daily routine can have a profound impact on your overall well-being. According to The Five Principles Of Happy Money, it is important to understand the principles behind this concept to fully embrace its benefits.

What is Happy Money?

Money can be a source of joy and fulfillment when spent wisely and consciously. Happy Money emphasizes that the way we spend our money can directly impact our happiness and satisfaction levels. It is not just about the amount of money we have but how we use it that makes a difference. By applying the principles of happy money, you can enhance your overall well-being and quality of life.

The Psychology Behind Spending Joyfully

One key aspect of happy money is understanding the psychology behind spending joyfully. Research shows that when we spend money on experiences rather than material possessions, it leads to greater long-term happiness. The joy derived from experiences tends to last longer, creating lasting memories and positive emotions. By focusing on experiences that bring joy, you can cultivate a more fulfilling and meaningful life.

With happy money, it is important to prioritize experiences that align with your values and bring you genuine happiness. Be mindful of your spending habits and make conscious choices that prioritize experiences over material possessions. By shifting your mindset towards joyful spending, you can create a more fulfilling and satisfying relationship with money.

Strategies for Integrating Happy Money

Unlike traditional budgeting where the focus is solely on cutting expenses, integrating happy money into your daily routine involves a more holistic approach to managing your finances. By prioritizing happiness and well-being, you can create a more fulfilling and sustainable relationship with money.

Mindful Budgeting for Happiness

Mindful budgeting for happiness involves conscious decision-making when it comes to your finances. Rather than restricting yourself and feeling deprived, this approach encourages you to align your spending with your values and goals.

Finding Your Happy Expenses

With this approach, you identify expenses that bring you joy and fulfillment. These expenses may include activities, experiences, or purchases that nourish your soul and enhance your overall well-being.

The key is to strike a balance between necessary expenses and happy expenses. While it’s important to meet your basic needs and save for the future, allocating some of your budget towards things that bring you happiness can significantly improve your quality of life.

Daily Practices

Despite the hustle and bustle of daily life, incorporating happy money practices into your routine can significantly impact your overall well-being and financial health.

Turning Routine into Ritual

Daily activities such as budgeting, tracking expenses, and setting financial goals may seem mundane, but by infusing them with intention and gratitude, you can transform these tasks into meaningful rituals. Start your day by acknowledging the value of the money you have and the ways it can enhance your life. Whether it’s through a morning meditation on financial wellness or a simple thank you to your wallet, these small acts can shift your money mindset.

Happy Money in Action: Daily tips and tricks

Tips for incorporating happy money into your daily routine include practicing conscious spending by aligning your purchases with your values. Set aside a designated time each day to review your finances and express gratitude for the resources you have. Another useful tip is to create a vision board or financial manifestation journal to keep your goals at the forefront of your mind.

- Conscious spending

- Gratitude

- Resources

Tricks to enhance your happy money practices include setting up automated savings to ensure you consistently contribute to your financial goals. Visualize your desired outcomes and the feeling of achieving them to motivate yourself. Recall, the way you perceive your relationship with money can greatly impact how it manifests in your life.

- Automated savings

- Visualize

- Perceive

Overcoming Obstacles

After incorporating How to Create a Healthy Money Mindset into your daily routine, you may encounter some obstacles along the way. Overcoming these challenges is an vital part of embracing the concept of Happy Money and reaping its benefits.

Common Challenges in Pursuing Happy Money

To fully embrace the principles of Happy Money, one common challenge that individuals face is overcoming negative money mindsets. These mindsets can be deeply rooted in our upbringing or past experiences with money, making it challenging to adopt a more positive outlook. Another challenge is the temptation to overspend or indulge in instant gratification, which can derail your financial goals and hinder your journey towards Happy Money.

Techniques to Stay Motivated and Positive

Common techniques to stay motivated and positive in your pursuit of Happy Money include practicing gratitude for what you have, setting realistic financial goals, and regularly reviewing your progress. By focusing on the positive aspects of your financial journey and celebrating small victories along the way, you can stay motivated and on track towards achieving long-term financial well-being.

Positive visualization techniques, such as creating vision boards or affirmations related to your financial goals, can also help you maintain a positive mindset and attract abundance into your life. Surrounding yourself with like-minded individuals who support your financial goals and seeking guidance from financial advisors or mentors can also provide the motivation and encouragement needed to overcome obstacles and continue on your path towards Happy Money.

Conclusion

With these considerations in mind, integrating the concept of happy money into your daily routine can bring about a positive shift in your financial well-being and overall happiness. By focusing on spending money on experiences and things that truly bring you joy, practicing gratitude for the abundance in your life, and being mindful of your financial decisions, you can create a more fulfilling and satisfying relationship with money. So go ahead, start incorporating these practices into your daily life and watch how your money and happiness grow in harmony!

FAQ

Q: What is the concept of integrating happy money into your daily routine?

A: Integrating happy money into your daily routine involves prioritizing spending on experiences and things that bring joy and fulfillment rather than material possessions.

Q: How can integrating happy money benefit your overall well-being?

A: By focusing on experiences that bring happiness, integrating happy money into your daily routine can lead to increased satisfaction, fulfillment, and overall well-being.

Q: What are some examples of happy money purchases?

A: Examples of happy money purchases include travel experiences, quality time with loved ones, cultural events, hobbies, wellness activities, and personal development courses.

Q: How can I start integrating happy money into my daily routine?

A: Start by budgeting for experiences that bring you joy, reflecting on what truly matters to you, and making conscious spending choices aligned with your values and happiness.

Q: Can integrating happy money lead to more meaningful relationships?

A: Yes, prioritizing experiences over material possessions can lead to more meaningful relationships as you invest in shared moments and connections with others.

Q: What are the potential long-term benefits of integrating happy money into daily life?

A: Long-term benefits may include increased gratitude, a deeper sense of purpose, enhanced life satisfaction, and a greater focus on what brings true happiness.

Q: How can I make integrating happy money a consistent habit in my daily routine?

A: Practice mindfulness in your spending decisions, regularly assess if purchases align with your values, create a happiness budget, and surround yourself with reminders of what truly brings you joy.