Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

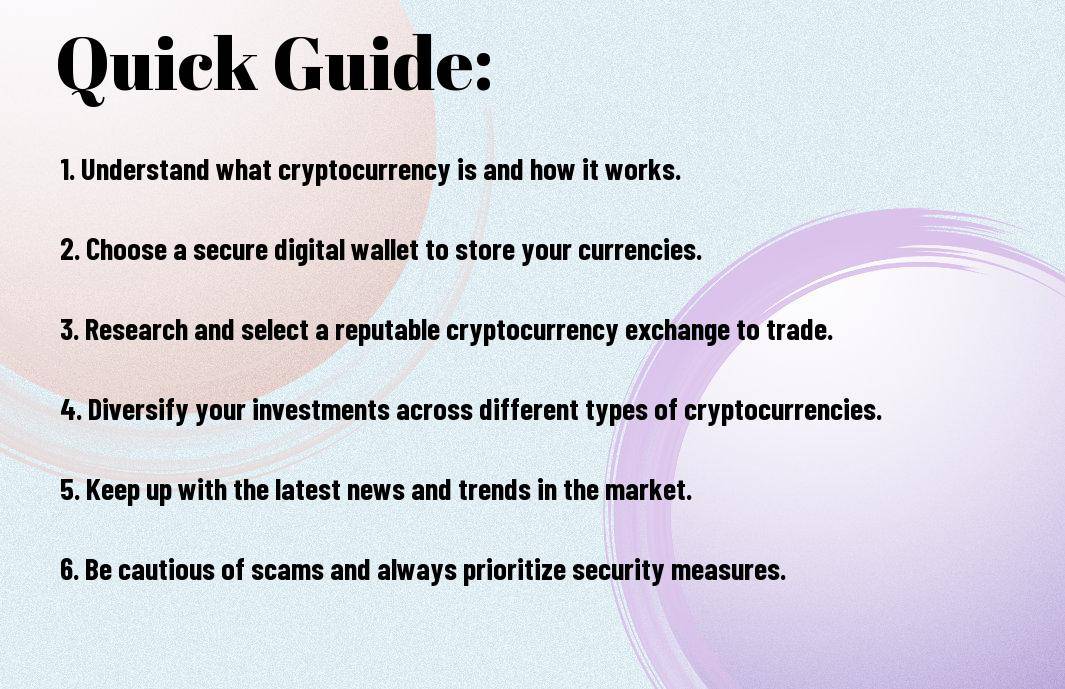

There’s a vast and rapidly evolving world of cryptocurrency out there, and for beginners, it can be overwhelming to navigate. Whether you’re intrigued by the potential for high returns or simply curious about the technology, it’s crucial to have a solid understanding of the basics before diving in. This guide aims to provide you with everything you need to know to start your journey into the world of cryptocurrency.

Now, How To Start Investing In Cryptocurrency: A Guide For… Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. It operates independently of a central bank and is decentralized. This digital form of currency allows for secure, peer-to-peer transactions to take place over the internet.

Assuming you are new to the world of cryptocurrency, it’s necessary to understand the underlying technology that powers it – blockchain. A blockchain is a decentralized, distributed ledger that records all transactions across a network of computers. Each transaction is stored in a “block,” which is then linked to the previous block, forming a chain. This technology ensures transparency, security, and immutability of transactions.

A blockchain serves as a digital ledger that cannot be altered, making it a tamper-proof and reliable system. This technology eliminates the need for intermediaries like banks, reducing transaction costs and increasing the efficiency of transactions. Blockchain technology is the backbone of cryptocurrencies like Bitcoin and Ethereum, revolutionizing the way financial transactions are conducted.

While there are thousands of cryptocurrencies in the market, some of the most popular ones include:

| Bitcoin (BTC) | Ethereum (ETH) |

| Ripple (XRP) | Litecoin (LTC) |

| Cardano (ADA) | Polkadot (DOT) |

| Bitcoin Cash (BCH) | Stellar (XLM) |

| Chainlink (LINK) | Monero (XMR) |

Unlike traditional forms of currency, purchasing cryptocurrency involves a few specific steps that can seem complex to beginners. In this chapter, we will break down the process into manageable steps to help you navigate through acquiring your first digital assets.

| Setting Up a Crypto Wallet | Choosing a Cryptocurrency Exchange |

|---|---|

Setting Up a Crypto WalletWhile setting up a crypto wallet may seem daunting at first, it is an vital step in securing your digital assets. A crypto wallet is a secure digital wallet used to store, send, and receive cryptocurrencies. There are different types of wallets, such as hardware wallets, software wallets, and online wallets. It is crucial to choose a wallet that suits your needs and offers a high level of security. |

Choosing a Cryptocurrency ExchangeWallet selection is critical as it determines the security and accessibility of your funds. Researching reputable cryptocurrency exchanges is crucial before making a decision. Consider factors such as fees, security measures, user interface, and available cryptocurrencies. It is recommended to use exchanges that offer two-factor authentication (2FA) to add an extra layer of security to your account. |

Another important factor to consider when choosing a cryptocurrency exchange is its reputation in the market. Look for exchanges that have a good track record of security and reliability. Reading reviews and seeking recommendations from experienced traders can help you make an informed decision.

Choosing the right cryptocurrency for your first purchase can be overwhelming due to the vast number of options available. Research is key in this step to understand the purpose, technology, and potential growth of the cryptocurrency you are interested in. Consider factors such as market capitalization, trading volume, and community support before investing your money in a particular cryptocurrency.

To ensure a smooth transaction when making your first purchase, it is vital to familiarize yourself with the buying process on your chosen exchange. Each platform may have slightly different procedures, so be sure to read and follow their guidelines carefully to avoid any mistakes or delays.

Despite the convenience and accessibility of cryptocurrencies, keeping your digital assets safe is paramount in the ever-evolving landscape of cybersecurity threats. Storing your cryptocurrency securely is crucial to protect your investments from hacks and theft.

With cryptocurrency gaining popularity, numerous types of wallets have emerged to store digital assets securely. The main categories include hardware wallets, software wallets, and paper wallets. Each option offers its own level of security and ease of use.

Any investor should carefully research and choose a wallet that aligns with their security needs and preferences.

Wallets play a crucial role in securing your cryptocurrency investments. It is important to follow best practices to safeguard your assets effectively. Avoid storing large amounts of cryptocurrency on exchanges for an extended period. Utilize hardware wallets for long-term storage of your digital assets.

Storing your cryptocurrency securely also involves backing up your wallet and private keys in multiple safe locations, enabling two-factor authentication, and keeping your devices and software up to date. By implementing these best practices, you can enhance the security of your cryptocurrency holdings and mitigate potential risks.

Keep in mind that sending and receiving cryptocurrency involves the use of digital wallets. When you want to send crypto to someone, you need to have their digital wallet address. You can send the cryptocurrency from your wallet to theirs by entering their wallet address and the amount you wish to send. On the other hand, when someone wants to send crypto to you, they will need your digital wallet address. It’s imperative to double-check the address before making any transactions, as sending crypto to the wrong address can result in irreversible losses.

Little do people realize that every time a cryptocurrency transaction is made, there is a fee associated with it. This fee contributes to the network’s security and helps prioritize transactions. The fee amount can vary depending on the cryptocurrency, network congestion, and the speed at which you want the transaction to be processed. It’s crucial to understand that the transaction fees can fluctuate, so it’s imperative to stay informed about the current fee rates to avoid overpaying.

With this in mind, it’s important to remember that higher fees typically result in faster transaction processing, while lower fees may take longer. Understanding transaction fees can help you optimize your transactions and avoid unnecessary costs. Be sure to consider the fee structure of the cryptocurrency you are using and adjust your transaction fees accordingly based on your priorities – speed or cost-effectiveness.

Many individuals are drawn to the world of cryptocurrency due to the potential for high returns on investment. However, the volatile nature of the market requires careful consideration and strategic planning. Here are some investment strategies and tips to help navigate the world of cryptocurrency:

Even before dipping your toes into the cryptocurrency market, it is crucial to conduct thorough research. Understanding the technology behind different cryptocurrencies, their use cases, and the teams driving their development is crucial. Researching market trends, historical data, and experts’ opinions can provide valuable insights that will inform your investment decisions.

Strategies such as diversification can help mitigate risks associated with investing in cryptocurrency. Diversifying your portfolio across different coins and tokens can help spread risk and minimize potential losses. Additionally, conducting a thorough risk assessment before investing can help you evaluate the potential risks and rewards of each investment.

Identifying fraudulent schemes in the cryptocurrency space is crucial to safeguarding your investments. Be wary of projects promising guaranteed returns or using high-pressure tactics to push you into investing. Conduct due diligence on the team behind the project, read reviews from reputable sources, and be cautious of projects with limited information or transparency.

Recognizing the signs of a potential scam can protect your investments and ensure that you are participating in legitimate and promising projects.

Stay informed: Keeping up to date with the latest news and developments in the cryptocurrency space can help you make informed investment decisions.

After entering into the world of cryptocurrency investing, it’s important to weigh the pros and cons before making any financial decisions. Here’s a breakdown of the advantages and disadvantages of investing in digital currencies:

| Pros of Cryptocurrency Investing | Cons of Cryptocurrency Investing |

| 1. Potential for high returns | 1. Volatility and price fluctuations |

| 2. Diversification of investment portfolio | 2. Regulatory uncertainty |

| 3. Accessibility to global markets | 3. Security risks and hacking concerns |

| 4. Innovation and technological advancements | 4. Lack of consumer protection |

| 5. Decentralization and potential for financial inclusion | 5. Limited acceptance in traditional markets |

Any newcomer to the cryptocurrency space may be enticed by the potential for high returns on their investment. For those willing to take on the risk, digital currencies have shown the ability to deliver significant profits. Additionally, investing in cryptocurrency offers a unique way to diversify one’s investment portfolio and access global markets with ease. For beginners looking to learn more about how to get started with cryptocurrency investing, check out How to Invest in Cryptocurrency: A Beginner’s Guide.

There’s a flip side to the coin when it comes to investing in cryptocurrency. The volatility and price fluctuations in the market can lead to significant financial losses if not managed properly. Additionally, the regulatory landscape surrounding digital currencies is still evolving, leading to uncertainty and potential legal challenges. Security risks and hacking concerns also pose a threat to investors, as the decentralized nature of cryptocurrencies can make them vulnerable to cyber attacks.

Cons: It’s crucial to be aware of the risks involved in cryptocurrency investing, as the lack of consumer protection and limited acceptance in traditional markets could leave investors exposed to fraud or market manipulation.

All signs point to a bright future for cryptocurrency. With global adoption on the rise and major institutions investing in blockchain technology, the potential for growth in this space is immense. In this chapter, we will explore the emerging trends and technologies that are shaping the future of cryptocurrency, as well as the factors influencing its adoption and value.

Blockchain technology continues to evolve, with advancements such as smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs) gaining traction in the crypto space. These innovations are revolutionizing the way transactions are conducted, assets are managed, and contracts are executed. Additionally, the integration of artificial intelligence (AI) and Internet of Things (IoT) with blockchain is opening up new possibilities for the future of cryptocurrency.

Regulatory developments, institutional investments, and mainstream acceptance are key factors driving the adoption and value of cryptocurrency. As regulations become clearer and more favorable, institutional investors are gaining confidence in the market, leading to increased capital inflows. Moreover, the acceptance of cryptocurrency by major companies and retailers is boosting its utility and value in the mainstream economy.

While these factors are propelling the growth of cryptocurrency, challenges such as security vulnerabilities, market volatility, and potential misuse remain. It is important for investors and users to stay informed and exercise caution when navigating this rapidly evolving landscape. Note, with great potential comes great responsibility in the world of cryptocurrency.

To wrap up, cryptocurrency is a rapidly evolving technology that has the potential to revolutionize the way we think about money and finance. As a beginner’s guide, it’s important to start with the basics – understanding what cryptocurrency is, how it works, and the different types available. By familiarizing yourself with key concepts such as blockchain technology, wallets, exchanges, and security measures, you can make informed decisions when it comes to buying, selling, or using cryptocurrencies.

Remember that the cryptocurrency market is highly volatile and comes with its own set of risks. It’s imperative to do your own research, stay informed about the latest developments, and be cautious when investing in or trading cryptocurrencies. By taking the time to learn and understand the fundamentals, you can navigate this exciting and complex world with confidence and make the most of the opportunities it presents.

A: Cryptocurrency is a digital or virtual form of currency that uses cryptography for security, making it difficult to counterfeit. It operates independently of a central authority, such as a government or financial institution.

A: Cryptocurrency transactions are recorded on a public ledger called a blockchain. When someone initiates a transaction, it is verified by a network of computers through a process called mining. Once verified, the transaction is added to the blockchain, making it secure and irreversible.

A: Blockchain is the technology that underpins cryptocurrencies. It is a decentralized and distributed ledger that records transactions across a network of computers. Each block in the chain contains a number of transactions, and once recorded, the data in any given block cannot be altered without the alteration of all subsequent blocks, which makes the blockchain secure.

A: You can buy cryptocurrency through online exchanges using traditional currency or by earning it through a process called mining. It’s important to research and choose a reputable exchange platform, set up a secure wallet to store your digital assets, and be cautious of potential scams.

A: The legality of cryptocurrency varies by country. While some countries have embraced it as a legitimate form of payment, others have banned or restricted its use. It’s important to understand the regulations in your country regarding cryptocurrency to avoid legal issues.

A: Investing in cryptocurrency carries risks such as price volatility, hacking attacks on exchanges, regulatory changes, and scams. It’s crucial to only invest what you can afford to lose and to do thorough research before making investment decisions.

A: To store your cryptocurrency safely, consider using hardware wallets or cold storage options rather than keeping large amounts of cryptocurrency on online exchanges. Implement strong security measures such as two-factor authentication and private key protection to safeguard your digital assets.