Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

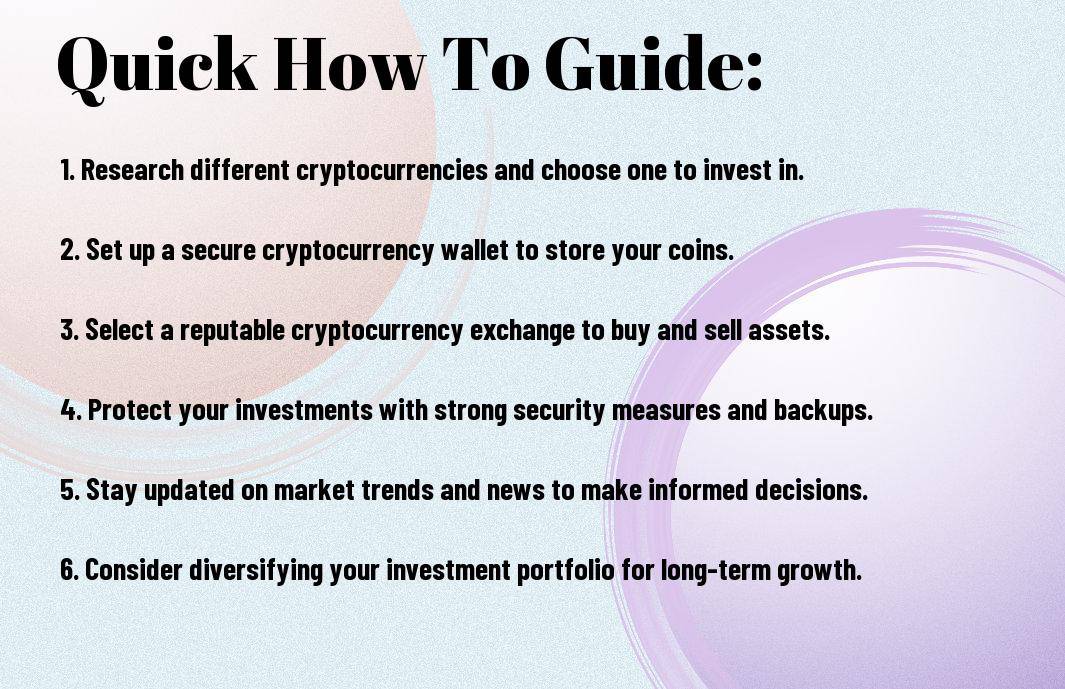

Most aspiring investors are intrigued by the allure of cryptocurrency and its potential for high returns. However, navigating the world of digital investing can be intimidating and fraught with risks. This comprehensive guide will decrypt the complexities of cryptocurrency and provide you with important steps to kickstart your journey as a digital investor.

From understanding the basics of blockchain technology to choosing the right cryptocurrency exchange, this step-by-step guide will equip you with the knowledge and tools needed to confidently enter the world of digital investing. Stay informed, stay cautious, and get ready to initiate on a thrilling adventure into cryptocurrency!

If you’re new to the world of cryptocurrency, it can seem complex and confusing at first. Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. These digital assets can be used for online transactions or investments.

While cryptocurrency is the digital currency itself, blockchain technology is the underlying technology that enables cryptocurrencies to function. Blockchain is a decentralized and distributed ledger that records all transactions across a network of computers. Each block in the chain contains a list of transactions, and once added, it cannot be altered. This immutable nature of blockchain ensures transparency and security in cryptocurrency transactions.

A key feature of blockchain is its decentralized nature, meaning there is no central authority governing the network. Transactions are verified by network participants through consensus mechanisms like Proof of Work or Proof of Stake. This eliminates the need for intermediaries such as banks or governments, reducing transaction costs and increasing efficiency.

Once again, you’ve decided to take the plunge into the world of cryptocurrency investing. Before you start buying coins or tokens, there are some vital steps you need to take to prepare for your crypto investment journey.

Little is known about cryptocurrency investment without understanding the importance of a digital wallet. Your digital wallet is where you store your cryptocurrencies securely. Choose a trustworthy wallet that supports the currencies you plan to invest in. Be sure to write down and safely store your private keys – these are the keys to accessing and managing your funds. Treat your wallet like you would a physical wallet, with utmost care and security.

Setting up security measures is vital when entering the world of cryptocurrency. Setting up two-factor authentication (2FA) and using strong, unique passwords for all your accounts can help prevent unauthorized access. Consider using a hardware wallet for an added layer of security. Additionally, be cautious of phishing attempts and only trust information from verified sources. Note, your investments are only as safe as the measures you put in place to protect them.

After deciding to venture into the world of cryptocurrency investing, it’s crucial to understand how to evaluate cryptocurrencies effectively before making any investment decisions. Here are some key factors to consider when evaluating a digital asset:

Any seasoned cryptocurrency investor will tell you that analyzing market trends is crucial to making informed investment decisions. By studying historical price movements and volume patterns, you can gain insights into the market sentiment and make more accurate predictions about future price movements. Pay attention to both short-term fluctuations and long-term trends to get a comprehensive view of the market.

Any aspiring crypto investor must have a solid understanding of the various factors that can impact the value of a cryptocurrency. From technological advancements and regulatory updates to market demand and competition, several elements can influence the price of digital assets. Here are some key factors to consider:

After gaining a deeper understanding of these crucial factors, you will be better equipped to evaluate cryptocurrencies and make informed investment choices in the digital asset space.

Many individuals are curious about entering the world of cryptocurrency investing but may feel overwhelmed by the process. To help you navigate this exciting journey, I recommend checking out the book Making More Money for You! Decrypting Cryptocurrency for comprehensive insights. Let’s break down the steps to make your first purchase in the cryptocurrency market.

Choosing the Right Exchange

Purchasing cryptocurrencies requires using a cryptocurrency exchange platform. When choosing an exchange, consider factors like reputation, security features, fees, and the variety of cryptocurrencies available. Some popular exchanges include Coinbase, Binance, and Kraken. Research each platform to find the one that best suits your needs.

How-to: Buying Your First Cryptocurrency

For your first cryptocurrency purchase, you’ll need to create an account on your chosen exchange. Once your account is set up and verified, deposit funds into your account using a bank transfer or debit/credit card. Next, select the cryptocurrency you want to buy, enter the amount, and complete the transaction. Remember to store your cryptocurrency in a secure wallet for added protection.

Choosing the right exchange and following secure practices are necessary steps when buying your first cryptocurrency. Ensure you research thoroughly, double-check all transaction details, and never share your private keys with anyone to protect your investment. With these steps in mind, you can confidently begin your journey into the world of digital investing.

To effectively manage your cryptocurrency portfolio, you need to follow some necessary tips. These tips will help you navigate the volatile market and make informed decisions about your investments. Here are some key strategies to consider:

You should aim to diversify your cryptocurrency holdings across different asset classes, such as major cryptocurrencies, DeFi tokens, and stablecoins. This will help you mitigate risk and maximize potential returns over time. Do not put all your eggs in one basket when it comes to investing in cryptocurrencies.

On your journey in digital investing, tracking your cryptocurrency investments is critical for making well-informed decisions. By using portfolio management tools, you can track your portfolio performance, set goals, and manage risks effectively. Stay vigilant in monitoring the market trends and adjusting your investment strategy accordingly.

Assume that you are the captain of your own ship, and navigating through the waters of the cryptocurrency market requires careful planning and constant attention. By following these tips for managing your cryptocurrency portfolio, you can increase your chances of success and profitability in the digital asset space.

All investors should strive to continuously learn and grow in their knowledge of the crypto market. This chapter will focus on advanced strategies that can help you navigate the complexities of digital investing and maximize your returns.

| Altcoins | ICOs and Tokens |

| Altcoins are alternative cryptocurrencies to Bitcoin, offering unique features and use cases. They can provide diversification to your portfolio but come with higher risk. | ICOs (Initial Coin Offerings) and tokens are ways for blockchain projects to raise funds. Investors should conduct thorough research before participating in these offerings to avoid scams. |

Little understood fact is that investing in altcoins, ICOs, and tokens require a deep understanding of the project, team, and technology behind them. It’s crucial to conduct due diligence and assess the potential risks before allocating your funds.

Passive income in the crypto industry can be achieved through staking and mining. Staking involves holding funds in a cryptocurrency wallet to support the network’s operations and earn rewards. On the other hand, mining is the process of validating transactions on a blockchain by solving complex mathematical puzzles.

Investing in staking and mining can provide a steady income stream, but it requires technical knowledge and a significant initial investment in hardware or staked tokens. It’s important to carefully consider the risks involved, such as hardware maintenance costs and market volatility.

Mining in cryptocurrencies is a competitive and resource-intensive process that requires specialized hardware and a good understanding of the underlying technology. While mining can be lucrative, it also comes with risks such as electricity costs, hardware depreciation, and increased difficulty levels. It’s necessary to stay informed about market trends and regularly evaluate the profitability of your mining operations.

Despite the volatility and ever-changing landscape of the cryptocurrency market, there are ways to stay informed and updated on the latest trends, news, and developments in the digital investing space.

Education is key when it comes to navigating the world of cryptocurrency. There are a plethora of online platforms, forums, and websites dedicated to providing reliable and up-to-date information on all things crypto. Some reputable sources include CoinDesk, Cointelegraph, and CryptoSlate. These platforms offer a wealth of resources, from market analysis and news updates to educational articles and guides for beginners.

Informed investors understand the importance of continuously learning and adapting in the fast-paced world of cryptocurrency. To stay ahead of the curve, consider joining online communities and forums such as Reddit’s r/CryptoCurrency and Bitcointalk. Engaging with like-minded individuals and experts can provide valuable insights and help you adapt to the ever-evolving landscape of digital investing.

Crypto investing requires a proactive approach to education and adaptation. By staying informed through reliable sources and actively participating in online communities, you can develop a deeper understanding of the market and make informed investment decisions.

Your journey into digital investing can be exciting and profitable, but it comes with its own set of risks and safety considerations. It’s crucial to navigate this landscape carefully to protect your investments and yourself. For a comprehensive guide on how to get started in digital investing, you can check out Decrypting Crypto: Crypto Investing for Beginners (Audible.

Identifying and avoiding scams is paramount in the world of digital investing. As the industry is still relatively young and largely unregulated, it has become a breeding ground for scams and fraudulent schemes. Be cautious of promises of guaranteed returns or schemes that sound too good to be true. Always do your due diligence before investing in any project or platform. Look for red flags such as lack of transparency, unverified team members, and unrealistic promises.

To ensure regulatory compliance in your digital investments, it is vital to familiarize yourself with the laws and regulations governing the cryptocurrency and digital asset space. Regulations vary by country, and it is crucial to understand the legal implications of your investments. Complying with regulations can help protect your investments and ensure that you are operating within the boundaries of the law. Stay informed about regulatory updates and seek legal advice if needed to ensure compliance with relevant laws.

Hence, initiateing on your journey into the world of cryptocurrency investing requires a solid understanding of the basics, such as choosing a reputable exchange, securing your investments through wallets or hardware solutions, and conducting thorough research before making any investment decisions. By following these steps and gradually expanding your knowledge and experience, you can navigate the complexities of the digital investing landscape with confidence.

Recall, the key to success in cryptocurrency investing lies in staying informed, being cautious and adaptive, and continuously learning as the market evolves. With patience and a meticulous approach, you can unlock the potential of digital assets and chart a path towards financial growth and success in this exciting and rapidly expanding field.

A: Cryptocurrency is a digital or virtual form of currency that uses cryptography for security and operates independently of a central authority, such as a government or financial institution.

A: Cryptocurrency works through a technology called blockchain, which is a decentralized and distributed ledger that records all transactions across a network of computers.

A: Investing in cryptocurrency can be lucrative, but it also carries risks due to its volatile nature. It is vital to do thorough research and understand the market before investing.

A: To start investing in cryptocurrency, you need to open an account on a cryptocurrency exchange, verify your identity, deposit funds, and then you can start buying and trading various digital assets.

A: Some popular cryptocurrencies to consider for investment include Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and more. Each cryptocurrency has its unique features and use cases.

A: It is crucial to store your cryptocurrency in secure wallets, such as hardware wallets or cold storage, to protect them from hacking or theft. Additionally, using two-factor authentication and keeping your private keys secure is also important.

A: Some common mistakes to avoid in cryptocurrency investing include investing more money than you can afford to lose, falling for scams or Ponzi schemes, not diversifying your investment portfolio, and not staying updated on market trends.